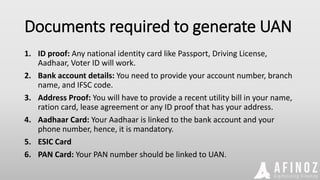

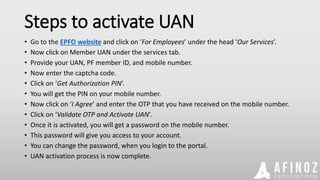

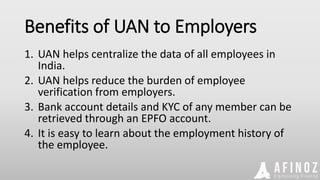

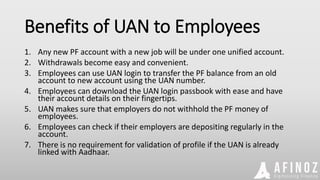

The Universal Account Number (UAN) is a 12-digit identifier assigned to every employee contributing to the Employee Provident Fund (EPF), remaining constant through job changes. It streamlines the process of EPF transfers and withdrawals, providing benefits for both employers and employees, including centralized data management and ease of accessing account details. Employees can generate and activate their UAN online using various documents, ensuring a more secure and convenient experience.