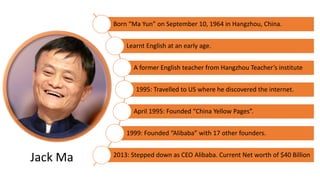

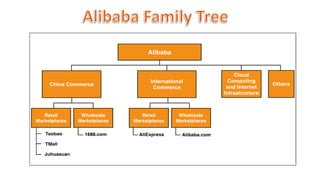

The document compares traditional commerce and e-commerce, noting key differences in areas like product inspection, reach, and accessibility. It then profiles Jack Ma, founder of Alibaba, covering his background and the company's evolution from 1999 to present day. Finally, it analyzes Alibaba's strengths, weaknesses, opportunities, and threats through a SWOT analysis.