Akzo Nobel India Ltd.

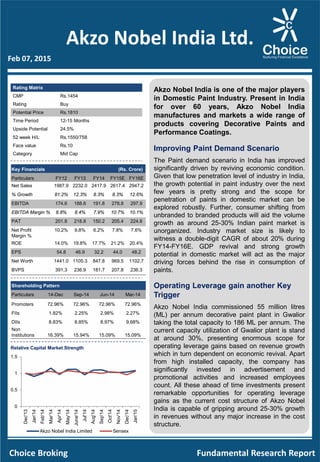

- 1. Akzo Nobel India Ltd. Akzo Nobel India is one of the major players in Domestic Paint Industry. Present in India for over 60 years, Akzo Nobel India manufactures and markets a wide range of products covering Decorative Paints and Performance Coatings. Improving Paint Demand Scenario The Paint demand scenario in India has improved significantly driven by reviving economic condition. Given that low penetration level of industry in India, the growth potential in paint industry over the next few years is pretty strong and the scope for penetration of paints in domestic market can be explored robustly. Further, consumer shifting from unbranded to branded products will aid the volume growth as around 25-30% Indian paint market is unorganized. Industry market size is likely to witness a double-digit CAGR of about 20% during FY14-FY16E. GDP revival and strong growth potential in domestic market will act as the major driving forces behind the rise in consumption of paints. Operating Leverage gain another Key Trigger Akzo Nobel India commissioned 55 million litres (ML) per annum decorative paint plant in Gwalior taking the total capacity to 186 ML per annum. The current capacity utilization of Gwalior plant is stand at around 30%, presenting enormous scope for operating leverage gains based on revenue growth which in turn dependent on economic revival. Apart from high installed capacity, the company has significantly invested in advertisement and promotional activities and increased employees count. All these ahead of time investments present remarkable opportunities for operating leverage gains as the current cost structure of Akzo Nobel India is capable of gripping around 25‐30% growth in revenues without any major increase in the cost structure. Choice Broking Fundamental Research Report Feb 07, 2015 Rating Matrix CMP Rs.1454 Rating Buy Potential Price Rs.1810 Time Period 12-15 Months Upside Potential 24.5% 52 week H/L Rs.1550/758 Face value Rs.10 Category Mid Cap Key Financials (Rs. Crore) Particulars FY12 FY13 FY14 FY15E FY16E Net Sales 1987.9 2232.0 2417.9 2617.4 2947.2 % Growth 81.2% 12.3% 8.3% 8.3% 12.6% EBITDA 174.6 188.6 191.8 278.8 297.9 EBITDA Margin % 8.8% 8.4% 7.9% 10.7% 10.1% PAT 201.8 218.8 150.2 205.4 224.8 Net Profit Margin % 10.2% 9.8% 6.2% 7.8% 7.6% ROE 14.0% 19.8% 17.7% 21.2% 20.4% EPS 54.8 46.9 32.2 44.0 48.2 Net Worth 1441.0 1105.3 847.8 969.5 1102.7 BVPS 391.3 236.9 181.7 207.8 236.3 Shareholding Pattern Particulars 14-Dec Sep-14 Jun-14 Mar-14 Promoters 72.96% 72.96% 72.96% 72.96% FIIs 1.82% 2.25% 2.98% 2.27% DIIs 8.83% 8.85% 8.97% 9.68% Non Institutions 16.39% 15.94% 15.09% 15.09% Relative Capital Market Strength 0 0.5 1 1.5 Dec'13 Jan'14 Feb'14 Mar'14 Apr'14 May'14 June'14 Jul'14 Aug'14 Sep'14 Oct'14 Nov'14 Dec'14 Jan'15 Akzo Nobel India Limited Sensex

- 2. Akzo Nobel India Ltd. Akzo Nobel India to remain Beneficiary of Acceleration in Demand Growth Akzo Noble India has an unmatched advantage in terms of best brands and cutting-edge technology. Akzo’s has been witnessing a pick-up in urban demand over the last six months largely driven by improved consumers sentiments in urban markets as company’s products are more skewed towards the premium category. Though Akzo’s reliance more on urban markets, it is also taking initiatives to enhance presence in rural and small towns like launching around 4 products each year and expanding distribution network. Q3FY15 Financial Performance reveals Company’s Strong Growth Potential Akzo Noble India witnessed 88% YoY increase in net profit to Rs.50.7 crore in Q3FY15. Net sales also grew by 4.7% YoY to 687 crore in Q3FY15. Strong performance during quarter led by a robust growth in sales of high-performance products as well as a continued focus on cost management, supplemented by soft input prices, especially the crude-linked materials. We expect a strong growth in sales as well as margins going forward. Valuation To value the Akzo Nobel India stock, we conducted fundamental analysis using the Economic-Industry-Company (E-I-C) framework. At CMP of Rs.1454 the stock is trading at 30.2x its FY16E EPS of Rs. 48.2. We recommend ‘BUY’ on the stock with a potential price of Rs.1810, arrived at 37.5x FY16E EPS which implies upside of 24.5% for long term (12-15 months) perspective. Choice Broking Fundamental Research Report Asian Paints Berger Paints Kansai Nerolac Akzo India Market Cap. ( Rs.Crore) 58,894.9 10,914.8 8,586.3 5,151.0 Net Worth ( Rs.Crore) 4,039.2 1,120.7 1,425.7 847.8 P/E (Trailing) 48.3 43.8 41.3 34.3 P/BV 14.6 9.7 6.0 6.1 P/Sales 4.6 2.8 2.7 2.1 EBIDTA Margin % 15.7% 11.1% 11.5% 7.9% EPS 12.7 7.2 38.6 32.2 Return on Net Worth 30.2% 22.3% 14.6% 17.7% Peer Group Analysis (As on March 31, 2014, TTM Share Price)

- 3. Akzo Nobel India Ltd. Revival in Economic Growth to provide Impetus to Sector Paint industry is highly correlated to economic scenario as industry demand largely depends upon disposable income and growing industrial sectors such as automobiles. Indian Paint industry volumes grow 1.5‐2.0x India’s GDP. After registering an average growth rate of 8% during FY08-FY12, Indian economic growth had slowed down to below 5% (with 2004-05 base year) during the past two financial years. Prevailing high interest rate, stubborn inflation, low investments and slow execution of infrastructure projects were the leading factors, impacted country’s economy growth. However, Indian economy has shown signs of nascent recovery and grew by 5.5% during the first half (April-September) of FY15 as compared to 4.9% in the same period in FY14. Besides, key macro-economic indicators such as inflation, CAD are also reviving, putting positive influence on economic growth. Indian economic growth is likely to improve to 5.5% in FY15 and further enhanced to 6-7% in FY16 and FY17. Improved consumers sentiments, the renewed policy thrust by new government and a pickup in consumer demand are likely to provide impetus to economic growth in coming future. With the gradually growing domestic economy, per capita income of people in India grew by a CAGR of 10% to $1570 in 2013 from $740 in 2005. Household income in the top 20 boom cities in India is expected to grow at around 10% annually over the next ten years, which is likely to increase consumer spending. 740 820 960 1050 1170 1290 1450 1550 1570 0 200 400 600 800 1000 1200 1400 1600 1800 2005 2006 2007 2008 2009 2010 2011 2012 2013 Choice Broking Fundamental Research Report India's GNI per Capita (US$) World Bank Data

- 4. Akzo Nobel India Ltd. Industry Revenue likely to increase by CAGR of 20% during FY15-FY16E India is the second largest consumer of paints in Asia. Paint industry is divided into decorative and industrial segments. Decorative paints accounts for around 73% of the domestic market revenue, while industrial paints segment represents the remaining share. Both segments are further divided into various valuables products. Interiors paints among the decorative paints segment are largely used and categories in premium, medium and economy groups. Furthermore, water based decorative paints have an edge and are growing at a higher rate on the back of increasing demand for water based coatings from housing and real estates. Industrial paints segment, comprising highly technological products, is more profitable and highly organized sub-sector. Demand for industrial paints is relatively price inelastic, but is more inclined to business cycles and thus depends on economic as well as industrial growth. Major end user industries include automobile, shipping, capital goods, white goods and heavy industries. With the progressively growing economy, the sector has witnessed a gradual shift in the preferences of people from the traditional whitewash to higher quality paints like emulsions and enamel paints. The outlook for decorative paint segment is looking very promising due to increasing demand from retail consumers, rapid urbanization, increasing awareness of paints benefits and easy availability of financing for housing loans. Rural market, which has a major share of the decorative paints segment, grew by 20% in FY14. Rural India’s consumption expenditure is growing well and any benefit to the rural sector’s disposable income is directly correlated to the paint industry’s growth. Present market size of the Indian paint industry stands at around Rs.40,500 crore and is likely to increase to Rs.62,000 crore by 2016 with a CAGR of around 20%. Choice Broking Fundamental Research Report Products Decorative Wood Wall Interiors Solvent Based Water Based Exteriors Cement Paints Emulsion Ancillary Metal Industrial Automotive Non- automotive Proactive Coatings Powder Coatings

- 5. Akzo Nobel India Ltd. Falling Crude Oil Prices bring Cheer to Industry Crude prices have declined significantly in past six months and are hovering at around a six -year low level due to ample global supplies from the US shale oil boom and a decision by OPEC to keep its production quotas unchanged despite low global demand. Prevailing low oil prices have been dragging down the operating costs for the industry as raw materials like titanium dioxide, additives, pigments, resins and solvents, which accounts for 25-30% of the total purchase basket of a paint company, are derivatives of crude oil. On an average, a 10% fall in global crude oil prices will increase gross margins by 2-3%, however, the actual benefit can vary across companies, depending on their product mix. Global research firm, Barclays has slashed its forecast average price of Brent crude for this year to $44 a barrel. Industry players are likely to witness a major margin boost in coming future on the back of low crude oil prices. 97.5 102.6 101.6 99.7 102.7 105.4 98.2 96.0 91.2 80.5 66.2 53.7 48.6 0 20 40 60 80 100 120 Jan'14 Feb'14 Mar'14 Apr'14 May'14 Jun'14 Jul'14 Aug'14 Sep'14 Oct'14 Nov'14 Dec'14 Jan'14 $/perbarrel Choice Broking Fundamental Research Report Brent Crude Oil Prices

- 6. Akzo Nobel India Ltd. Key Financial Projections (Akzo Nobel India Ltd.) • We expect net sales of the company to grow at a CAGR of 10.4% between FY14-FY16E mainly led by volume improvement on the back growing economy. • EBIDTA margin is expected to improve to 10.1% by FY16E, given the company ongoing initiatives to improve operation efficiencies of the company. • We expect net profits to grow at a CAGR of 22% between FY14-FY16E as we believe that growth going forward is likely to be led by volume as well as strong cost management. Company Analysis Akzo Nobel India is one of major players in domestic paint industry accounting for around 12% of Indian market revenue. Present in India for over 60 years, the company is a significant player in paint industry and manufactures and markets a wide range of products covering decorative paints and performance coatings. Besides the company has also significant presence in specialty chemicals segment. The company was incorporated as Indian Explosives Limited, co- promoted by Govt of India and Imperial Chemical Industries PLC, UK. However, the company became a member of the Akzo Nobel Group in 2008, the Dutch based international coating giant. Subsequently, the name of the company changed to Akzo Nobel India Ltd. Akzo Nobel India has six manufacturing facilities and present installed capacity stands at around 186 million litres per annum. Products and Services Akzo Nobel India provides a host of products ranging from coatings to chemicals. After the Kansai Nerolac, Akzo Nobel India is the only the major domestic player which has almost a balanced revenue mix to the tune of 60% and 40% contributed by the decorative and industrial divisions respectively. The company is a global leader in decorative paints and Dulux is its most popular brand in this segment used for interior and exterior decoration and protection. The company is also the largest manufacturer of performance coatings providing solutions to many industries and sectors including automotive, consumer electronics, power, aviation, shipping and construction among others. Key innovative industrial coatings products include coil and extrusion coatings for commercial and residential metal building products, home appliances and automotive components. Akzo Nobel India is technology leader in marine coatings providing valuable products in chemical & impact-resistant coatings for vessels being built repaired or maintained. Akzo Nobel India also makes a variety of specialty chemicals such as pulp & performance chemicals, functional chemicals and surface chemistry. Functional Chemicals are used in paints, detergents, automotive parts, agricultural products, building materials, adhesives, plastics, pharmaceuticals, foods, and cosmetics. Pulp and performance chemicals are used for the production of paper pulp, while surface chemistry finds a heavy demand in the personal care segment. Choice Broking Fundamental Research Report

- 7. Akzo Nobel India Ltd. Superior Product Quality, Continued Focus on New Technology adding value to Firm Being a part of the world’s leading coatings and chemicals group, AKZO Noble India has an unmatched advantage in terms of best brands and cutting-edge technology. The company offers superior quality products which delivers high performance in terms of longevity, washability, stain resistance, anti-colour fading, water proofing and faster drying times. Company’s emphasis to produce quality, innovate and standardize products, strategy to constantly introducing new products to stay ahead of the general marketplace, operational and internal efficiencies and aggressive advertisement campaigns are the core capabilities of the firm, driving the company growth. To bring new products with improved performance features and products for special applications, the company has sustained focus on research and development (R&D) and innovation. Some of key R&D projects recently undertaken by the AKZO Nobel India include development of Water-in-Oil, technology to reduce VOC in Trim Paints and development Color formula for solid colours. Major benefits derived from R&D initiatives are launch of new and innovative products, operating efficiency improvement through rationalization and indigenization of raw materials. Dulux Superclean was voted as the ‘Product of the year 2014’ in the paints category, showing the superior technological capability of the company. Going forward, the company will continue to use innovation and R&D strengths to lessen costs through process improvements, import substitution, and improving material usage efficiency. Moreover, continued R&D efforts will help the firm to give better response to changing customer needs and to leverage the Akzo Nobel’s global expertise to develop products for domestic market. Choice Broking Fundamental Research Report

- 8. Akzo Nobel India Ltd. Aggressive Capacity Expansion to lead to Volume Growth for Company Akzo Nobel India has production bases strategically located throughout the country. The company has six manufacturing plants located in different parts of India to cater to the domestic demands. Management also intends to grow the firm through organic route and has set up new green field project and expanded the capacity of existing brown field projects. Akzo has doubled its manufacturing capacity in last three years from 93 million litres/annum in FY11 to 186 million litres/annum in FY14 by setting up two manufacturing facility in Hyderabad (30 million litres/ annum) and Gwalior (55 million litres/annum). The company spent Rs.140 crore on its Gwalior plant which has been built on an area of 9000 square meters. The Gwalior plant capacity utilization is around 30% and presents immense scope for operating leverage gains based on volume growth. With this expansion, the company has also expanded its presence in North and Central India. The company has sufficient infrastructure for further expansion in the future and will remain among the prime beneficiaries of acceleration in demand growth in Indian economy. Therefore, we expect that additional capacity will provide boost to revenue growth as the company will be able to penetrate the market more aggressively. Choice Broking Fundamental Research Report Plant Location Processes Year of commencement Mohali Decorative, automotive refinishes 1998 Hyderabad Decorative, A&A coatings 1971, expanded in 2011 Mahad Polymer Chemicals 1991 Thane Decorative Paints 1996 Bangalore Functional Chemicals, Surface Chemistry 1996, expanded in 2011 Gwalior Waterborne decorative paints 2013 Nationwide Plant Locations

- 9. Akzo Nobel India Ltd. Akzo taking Measures to Enhance Penetration in Rural, Small Towns Akzo has a very strong premium portfolio (Dulux Velvet), where it enjoys 20% plus market share and is the second largest player after Asian Paints in decorative paint segment. However, unlike the peer members such as Asian Paints and Berger Paints, the company presence in Tier 3 & 4 cities and rural regions is limited with a share below 10%. Taking a view that tier 3 & 4 cities, rural regions and mass market categories could be a major trigger for volume growth in near future, the company is addressing this issue by launching around 4 products each year and expanding distribution network to new and small towns. The company has national wide distribution network with 14 offices, 75 warehouses and 9,000 dealers network. The firm’s product offering has been backed by years of research and innovative products will remain the main driver for it. This reflects an opportunity for the company to demonstrate its technological prowess in market. Meanwhile, in order to increase the penetration levels and grab a larger pie of the market share, Akzo is expanding its dealer network across the metro cities as well as tier-II towns. The company has setup warehousing facilities and delivery points to make sure that the supply side remains uninterrupted and functions in an efficient manner. Customer service has also been prioritized though these measures as it will ultimately lead in creating high levels of brand loyalty. Business Analysis Sales volume likely to witness firm recovery during FY15,FY16E Akzo Nobel India operates in two segments coatings and paintings. Though, around 96% of revenue generated from the paints (coatings). Coatings segment recorded a total revenue of Rs.2324 crore during FY14 compared to the previous year’s Rs.2142.6 crore, a growth of 8.5%. On the other hand, chemical segment revenue grew by 5% YoY to around Rs.93 crore. In FY14, Akzo’s net sales growth declined to 8.3% as comparison to double digit growth in the past few years. Furthermore, the company’s profit declined by 31% YoY to Rs.150 crore in FY15 due to the high operating expenditure and low demand due the prevailing economic slowdown. Moreover, high imported cost of raw materials due to the rupee depreciation also put pressure on margins. Choice Broking Fundamental Research Report

- 10. Akzo Nobel India Ltd. However, the situation is improving and the recent quarter (Q3FY15) financial result revealed company’s growth potential. Akzo Noble India witnessed 88% increase in net profit to Rs.50.7 crore in Q3FY15 as compared to 27 crore in the same quarter of previous fiscal. Net sales also grew by 4.7% YoY to 687 crore in Q3FY15. Strong performance during quarter led by a robust growth in sales of high-performance products as well as a continued focus on cost management, supplemented by soft input prices, especially the crude-linked materials. Overall expenses during the quarter stood at Rs.619.5 crore as against Rs.626.29 crore in the corresponding period a year ago. Improving fundamentals of economy are providing impetus to domestic demand. We expect a strong recovery in sales volume at CAGR of 10% to Rs.2,947.2 crore in FY16E from Rs.2417.9 crore recorded in FY14. Choice Broking Fundamental Research Report 1987.9 2232.0 2417.9 2617.4 2947.2 FY12 FY13 FY14 FY15E FY16E 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 0 10 20 30 40 50 60 Q1FY14 Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 RsCrore Net Profit EBIDTA Margin NPM Net Profit Growth (Up 88% YoY) Robust during Q3FY15 Expect growth at CAGR of 10% in net sales during projected period (Rs.Crore)

- 11. Akzo Nobel India Ltd. Softening Input prices to Boost Margins Among total operating expenditure, raw material expenditure accounts for around 53% of the total operating expenditure. Although EBIDTA margin of the firm stands below the peer members like Asian Paint and Berger Paints, the management has been taking measures to improve the operation excellence of the firm through process improvements and energy savings. Apart from that, prevailing low input prices such as crude oil and titanium dioxide (TiO2) are likely to improve Akzo Nobel India margins. Advertisement cost in the decorative paint segment is generally higher as companies scurry to grab market share by creating a strong brand and high levels of awareness among people. Since decorative paint is the major segment of firm, Akzo noble India has been beefing up its marketing activities and indulging in aggressive advertisement campaigns to promote the Dulux brand. Other expenses (including advertisement spending) are expected to increase by a CAGR of 9.14% to Rs.778 crore in FY16E from Rs.653 crore in FY14. The cost of raw material increased by 8% YoY to Rs.1,172 crore in FY14. During the first nine month of this fiscal, cost of raw material consumed increased by 5% YoY to Rs.915 crore. However, the prevailing low input prices in market has started showing positive result as Akzo Nobel India raw material cost declined significantly to Rs.269 crore during Q3FY15 as compared to Rs.337 crore in Q2FY15 and Rs.292 crore in Q3FY15. We expect that raw material cost is likely to increase at a CAGR of 9.3% to Rs.1399 crore during FY14-16E and EBIDTA margin to improve to 10.1% in FY16E from 7.9% recorded in FY14. Choice Broking Fundamental Research Report Consumption of raw materials 53% Purchase of stock in trade 10% Employee cost 9% Other expenses 28% 8.8% 8.4% 7.9% 10.7% 10.1% FY12 FY13 FY14 FY15E FY16E Cost Break-up EBIDTA Margin to improve in Coming Years

- 12. Akzo Nobel India Ltd. PAT likely to Grow to Rs.224 Crore in FY16E Net profit of Akzo Nobel India profit declined to Rs.150 crore during FY14, a decline in growth at 31% on YoY basis. With the recovery in economic situation, the financial condition of company has improved and during first three quarter of FY15, PAT grew significantly by 48% to Rs.41.6 crore as against 95.5 crore in the corresponding period of previous fiscal. Company’s PAT is expected to increase to Rs.205 crore in FY15E and Rs.224.8 crore in FY16E. Accordingly, Return on Equity (ROE) is likely to improve to 20.4% in FY16E from 17.7% in FY14. Choice Broking Fundamental Research Report Valuation We believe that India’s low per capita consumption of paints, likely revival in economic growth, increasing urbanization & changing life style, easy availability of credit and reviving growth in construction, automobiles and consumer durables segments will continue to act as the driving forces behind the rise in consumption of paints. To value the Akzo Nobel India stock, we conducted fundamental analysis using the Economic-Industry-Company (E-I-C) framework. At CMP of Rs. 1454 the stock is trading at 30.2x its FY16E EPS of Rs. 48.2. We recommend ‘BUY’ on the stock with a potential price of Rs. 1810, arrived at 37.5x FY16E EPS which implies upside of 24.5% for long term (12-15 months) perspective. 201.8 218.8 150.2 205.4 224.8 10.2% 9.8% 6.2% 7.8% 7.6% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 0.0 50.0 100.0 150.0 200.0 250.0 FY12 FY13 FY14 FY15E FY16E PAT NPM 14.0% 19.8% 17.7% 21.2% 20.4% FY12 FY13 FY14 FY15E FY16E ROE Profitability Trend of Akzo Nobel India Rs.Crore

- 13. Akzo Nobel India Ltd. Key Risks Economic Uncertainties : Demand of paints in India is cyclical and grows entirely in tandem with the economic growth. Akzo Nobel India derives around 96% of revenue from paints, which are closely linked to overall economy’s growth. Though, domestic economy growth is reviving, prevailing high interest rates in order to contain the inflation can impact the paint demand from housing and industrial sectors. Insufficient Reach to Rural and Small towns: Decorative paints segment is major revenue driver sub-sector of the company. The presence of Akzo Nobel India in rural region and tier 3 & 4 cities regions is limited and much less as comparison to industry leader Asian Paints and Berger paints. Rural India, which has a major share of the decorative paints segment, is growing at rapid pace. It reflects the need for company to enhance the presence as soon as possible to significantly leverage growth opportunities rising in rural area. Reversal in Crude Oil Prices: Crude prices have declined significantly in past six months and are hovering at around a six -year low level due to the prevailing unfavorable demand supply situation in global market. Low oil prices have been dragging down the operating costs for the industry as most of raw materials used for paints production are the derivatives of crude oil. In future, any reversal in crude oil prices can adversely impact the industry as well as Akzo Nobel India margins. Growing Presence of Small Players in Mid and Lower End Segments: Akzo has a very strong premium portfolio, however, it is taking measures to build presence in the mid-end and lower-end segments. These segments are marked by the presence of a large number of players from unorganized sector. Furthermore, competition is also rising in decorative paints segment which can affect the company’s margins. Choice Broking Fundamental Research Report

- 14. Akzo Nobel India Ltd. Choice Broking Fundamental Research Report Profit And Loss Statement (Rs. Crore) Particulars FY12 FY13 FY14 FY15E FY16E Net Sales 1987.9 2232.0 2417.9 2617.4 2947.2 % Grow th 81.2% 12.28% 8.33% 8.25% 12.60% Total Revenue 2100.2 2370.1 2474.6 2669.6 3009.0 % Grow th 77.6% 12.9% 4.4% 7.9% 12.7% Staff Costs 147.3 175.2 193.9 193.9 206.3 % of Net Sales 7.4% 7.9% 8.0% 7.4% 7.0% Other Operating costs 1139.1 1295.5 1378.5 1451.1 1664.2 % of Net Sales 57.3% 58.0% 57.0% 55.4% 56.5% Other Expenses 526.9 572.6 653.8 693.6 778.8 % of Net Sales 26.5% 25.7% 27.0% 26.5% 26.4% Total Operating Expenditures 1813.3 2043.4 2226.1 2338.6 2649.3 % of Net Sales 91.2% 91.6% 92.1% 89.3% 89.9% EBITDA 174.6 188.6 191.8 278.8 297.9 EBITDA Margin % 8.8% 8.4% 7.9% 10.7% 10.1% Grow th % 32.0% 8.0% 1.7% 45.3% 6.8% Depreciation & Amortisation 36.6 38.7 43.7 52.6 54.9 EBIT 137.9 149.9 148.2 226.2 243.0 Financial Charges 3.9 8.9 1.5 4.6 5.0 Other Income 112.4 138.1 56.7 52.2 61.8 PBT 246.4 279.1 203.4 273.8 299.7 Pre-tax Margin % 12.4% 12.5% 8.4% 10.5% 10.2% Tax 44.6 60.3 53.2 68.5 74.9 Effective Tax Rate % 18.1% 21.6% 26.1% 25.0% 25.0% Reported PAT 201.8 218.8 150.2 205.4 224.8 Net Profit Margin % 10.2% 9.8% 6.2% 7.8% 7.6% Grow th in Reported PAT % 14.7% 8.4% -31.4% 36.7% 9.5% Extrodinary Income 0.0 0.0 0.0 0.0 0.0 Adjusted PAT 201.8 218.8 150.2 205.4 224.8 Shares In Issue 3.68 4.67 4.67 4.67 4.67 Adjusted EPS 54.8 46.9 32.2 44.0 48.2 Balance Sheet (Rs. Crore) Particulars FY12 FY13 FY14 FY15E FY16E Gross Asset 697.4 731.0 904.9 970.1 1096.3 Accumulated Depriciation 341.1 376.2 402.4 455.0 509.9 Capital WIP 14.8 105.7 30.6 34.3 38.7 Net Fixed Asset 371.1 460.5 533.1 549.4 625.1 Investments & Deposits 1003.5 947.2 628.6 579.8 686.4 Current Asset 861.2 926.9 908.1 1048.1 1196.9 Cash 73.9 85.7 72.2 86.46 101.82 Inventories 333.4 314.9 324.2 380.91 433.09 Trade Debtors 226 251.6 307.6 272.98 339.05 Loans and Advances 227.9 274.7 204.1 307.73 322.98 Current Liabilities & Provisions 712.8 1,148.50 1,140.30 1,116.30 1,305.0 Net Current Asset Excluding Cash 74.5 -307.3 -304.4 -154.7 -209.9 Capital Deployed 1,523.0 1,186.1 929.5 1,061.0 1,203.4 Long-term Liabilities and Provisions 82.0 80.8 81.7 91.4 100.6 Total Liabilities 82.0 80.8 81.7 91.4 100.6 Share Capital 36.8 46.7 46.7 46.7 46.7 Reserve and Surplus 1,404.2 1,058.6 801.1 922.8 1,056.0 Total Stock Holder's Equity 1,441.0 1,105.3 847.8 969.5 1,102.7 Capital Employed 1,523.0 1,186.1 929.5 1,060.9 1,203.4 DIFF 0.0 0.0 0.0 0.1 0.0

- 15. Akzo Nobel India Ltd. Choice Broking Fundamental Research Report Cash Flow Statement (Rs. Crore) Particulars FY12 FY13 FY14 FY15E FY16E Profit before tax 246.4 279.1 203.4 273.8 299.7 Depreciation 108.1 35.1 26.2 52.6 54.9 Interest Expense 3.9 8.9 1.5 4.6 5.0 Operating Profit Before WC Changes 358.4 323.2 231.0 331.0 359.7 Changes In WC -86.4 381.8 -2.9 -149.7 55.3 Gross cash generated from Operations 272.0 705.0 228.1 181.3 414.9 Direct taxes paid 44.6 60.3 53.2 68.5 74.9 Cash Flow from Operations 227.4 644.7 175.0 112.8 340.0 Capital Expenditure (CAPEX) (322.8) (124.5) (98.8) (68.9) (130.6) Investments (18.5) 56.3 318.6 48.8 (106.6) Net Cash Used In Investing Activities (341.3) (68.2) 219.8 (20.1) (237.2) Change in Debt 13.8 (1.2) 0.9 9.7 9.2 Change in Equity 0.0 9.9 0.0 0.0 0.0 Dividends Paid (95.9) (370.7) (349.9) (83.7) (91.6) Interest Paid (3.9) (8.9) (1.5) (4.6) (5.0) Others 243.5 (193.7) (57.8) 0.0 0.0 Net Cash used in Financing Activities 157.5 (564.7) (408.3) (78.5) (87.4) Net Increase in Cash and Cash Equivalents 43.6 11.8 (13.5) 14.2 15.4 Cash and cash equivalents At the beginning 29.9 73.9 85.7 72.2 86.5 Net Increase in Cash and Cash Equivalents 43.6 11.8 (13.5) 14.2 15.4 Cash and cash equivalents At the end 73.5 85.7 72.2 86.4 101.9 Cash balance as per balance sheet 73.9 85.7 72.2 86.5 101.8 Difference (0.4) 0.0 0.0 (0.1) 0.0 Cash Flow from Operating Activities Cash Flow from Investing Activities Cash Flow from Financing Activities Financial Ratios (Rs. Crore) FY12 FY13 FY14 FY15E FY16E Return on Assets (ROA) 9.0% 9.4% 7.3% 9.4% 9.0% Return on Equity (ROE) 14.0% 19.8% 17.7% 21.2% 20.4% Return on Capital Employed (ROCE) 9.1% 12.6% 15.9% 21.3% 20.2% PAT/PBT (Tax Efficiency) 0.8 0.8 0.7 0.8 0.8 PBT/EBIT (Interest Burden) 1.8 1.9 1.4 1.2 1.2 EBIT/Sales (OPM) 0.1 0.1 0.1 0.1 0.1 Sales/Total Assets (Asset Turnover) 0.9 1.0 1.2 1.2 1.2 TA/NW (Financial Leverage) 1.6 2.1 2.4 2.2 2.3 ROE 14.0 19.8 17.7 21.2 20.4 Current Ratio 1.2 0.8 0.8 0.9 0.9 Acid Test Ratio 0.7 0.5 0.5 0.6 0.6 Assets Turnover Ratio 0.9 1.0 1.2 1.2 1.2 Working Capital Turnover Ratio 13.4 -10.1 -10.4 -38.4 -27.3 F.A. Turnover Ratio 5.4 4.8 4.5 4.8 4.7 C.A. Turnover Ratio 2.3 2.4 2.7 2.5 2.5 Debtors Velocity 41.5 41.1 46.4 38.1 42.0 EBITDA Margin 8.8% 8.4% 7.9% 10.7% 10.1% Pre-Tax Margin 12.4% 12.5% 8.4% 10.5% 10.2% Net Profit Margin 10.2% 9.8% 6.2% 7.8% 7.6% Net Sales 81.2% 12.3% 8.3% 8.3% 12.6% EBITDA 32.0% 8.0% 1.7% 45.3% 6.8% Adj.PAT 14.7% 8.4% -31.4% 36.7% 9.5% Adj.EPS 14.7% -14.4% -31.4% 36.7% 9.5% Inventory 61.2 51.5 48.9 53.1 53.6 Debtors 41.5 41.1 46.4 38.1 42.0 Net Working Capital Excluding Cash 74.5 -307.3 -304.4 -154.7 -209.9 Other Income/PBT 45.6% 49.5% 27.9% 19.1% 20.6% Enterprise Value 3536.4 4003.2 5142.1 8450.4 8444.3 FCF Margin (%) -14.0% 17.3% 1.5% -0.3% 5.0% Capex/Sales (%) 16.2% 5.6% 4.1% 2.6% 4.4% Adj.EPS 54.8 46.9 32.2 44.0 48.2 CEPS 64.7 55.2 41.6 55.3 59.9 DPS 26.0 79.4 75.0 17.9 19.6 BVPS 391.3 236.9 181.7 207.8 236.3 Cash Per Share 20.1 18.4 15.5 18.5 21.8 P/E 17.5 18.3 34.2 41.1 37.6 P/CEPS 14.8 15.6 26.5 32.7 30.2 P/BV 2.4 3.6 6.1 8.7 7.7 EV/EBIDTA 20.3 21.2 26.8 30.3 28.3 Market Share Price (TTM) 958 859 1100 1810 1810 Margin Ratios (%) Efficiency Ratios Liquidity Ratios Profitability Ratios Dupont Analysis-ROE Decomposition Valuation Parameters @ TTM Per Share (Rs) Other Ratios (%) Working Ratios (Days) Growth Ratios YoY (%)

- 16. Akzo Nobel India Ltd. Contact Us Satish Kumar Sharma Research Associate satish.kumar@choiceindia.com www.choiceindia.comcustomercare@choiceindia.com Disclaimer This is solely for information of clients of Choice Broking and does not construe to be an investment advice. It is also not intended as an offer or solicitation for the purchase and sale of any financial instruments. Any action taken by you on the basis of the information contained herein is your responsibility alone and Choice Broking its subsidiaries or its employees or associates will not be liable in any manner for the consequences of such action taken by you. We have exercised due diligence in checking the correctness and authenticity of the information contained in this recommendation, but Choice Broking or any of its subsidiaries or associates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this recommendation or any action taken on basis of this information. Technical analysis studies market psychology, price patterns and volume levels. It is used to forecast future price and market movements. Technical analysis is complementary to fundamental analysis and news sources. The recommendations issued herewith might be contrary to recommendations issued by Choice Broking in the company research undertaken as the recommendations stated in this report is derived purely from technical analysis. Choice Broking has based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Choice Broking makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. The opinions contained within the report are based upon publicly available information at the time of publication and are subject to change without notice. The information and any disclosures provided herein are in summary form and have been prepared for informational purposes. The recommendations and suggested price levels are intended purely for trading purposes. The recommendations are valid for the day of the report however trading trends and volumes might vary substantially on an intraday basis and the recommendations may be subject to change. The information and any disclosures provided herein may be considered confidential. Any use, distribution, modification, copying, forwarding or disclosure by any person is strictly prohibited. The information and any disclosures provided herein do not constitute a solicitation or offer to purchase or sell any security or other financial product or instrument. The current performance may be unaudited. Past performance does not guarantee future returns. There can be no assurance that investments will achieve any targeted rates of return, and there is no guarantee against the loss of your entire investment. POTENTIAL CONFLICT OF INTEREST DISCLOSURE (as on date of report) Disclosure of interest statement – • Analyst interest of the stock /Instrument(s): - No. • Firm interest of the stock / Instrument (s): - No. Choice Broking Fundamental Research Report