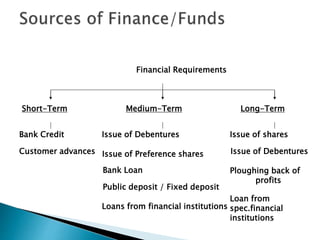

This document discusses financial management and its key functions. It outlines that financial management deals with planning and controlling a firm's financial resources and decisions. There are three main finance functions: investment decisions about what assets funds are invested in, financing decisions around obtaining funds, and dividend decisions regarding distributing profits to shareholders. The document focuses on investment decisions, outlining that capital budgeting is used for long-term assets while working capital management is for short-term assets. It also discusses financing decisions and the different sources of short, medium, and long-term funds for companies.