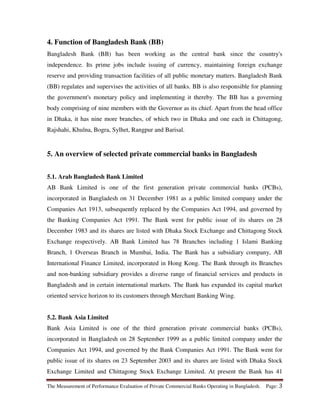

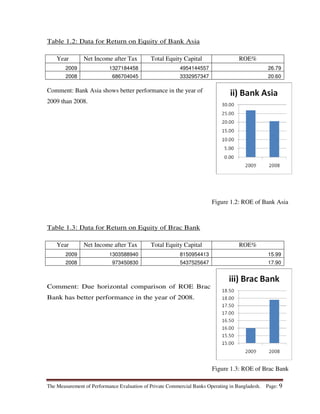

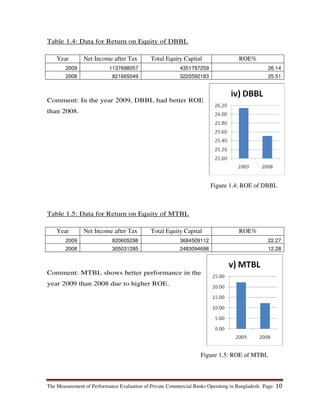

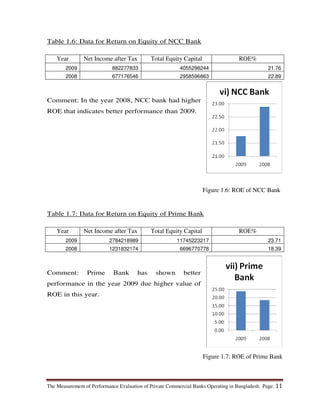

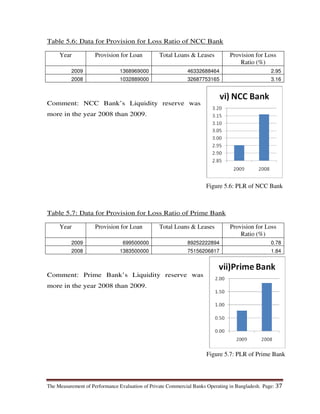

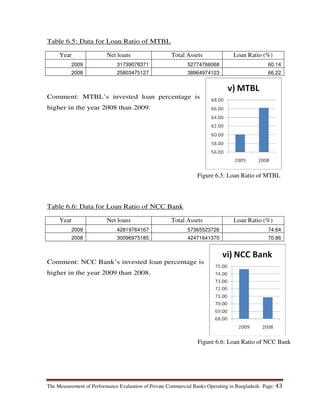

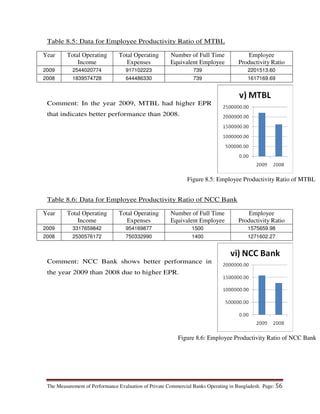

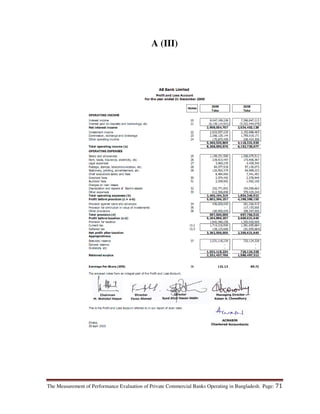

The document discusses performance evaluation of 10 private commercial banks in Bangladesh using various financial ratios. It provides background on the banking sector and objectives of the study. The study analyzes 2 years of data for profit ratios including return on equity (ROE), return on assets, net interest margin and earnings per share for banks like AB Bank, Bank Asia and Brac Bank. It finds that based on ROE, Bank Asia showed better performance in 2009 than 2008, while Brac Bank performed better in 2008. The document also provides details on the functions of Bangladesh Bank and overview of the selected private banks.