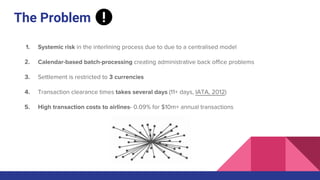

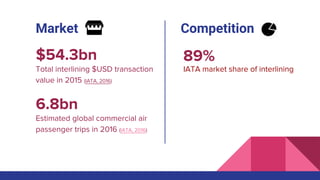

Interlining allows customers to fly on multiple airlines using a single ticket. This process currently relies on IATA as a central invoicing system, resulting in high transaction costs, clearance times of over 11 days, and currency restrictions. Implementing blockchain could reduce these costs and inefficiencies by allowing instantaneous settlement with no single point of failure, reducing fees by at least 0.01% and saving airlines $4.8 million annually. The proposed solution aims to streamline the interlining process and provide cost savings for airlines through blockchain technology.