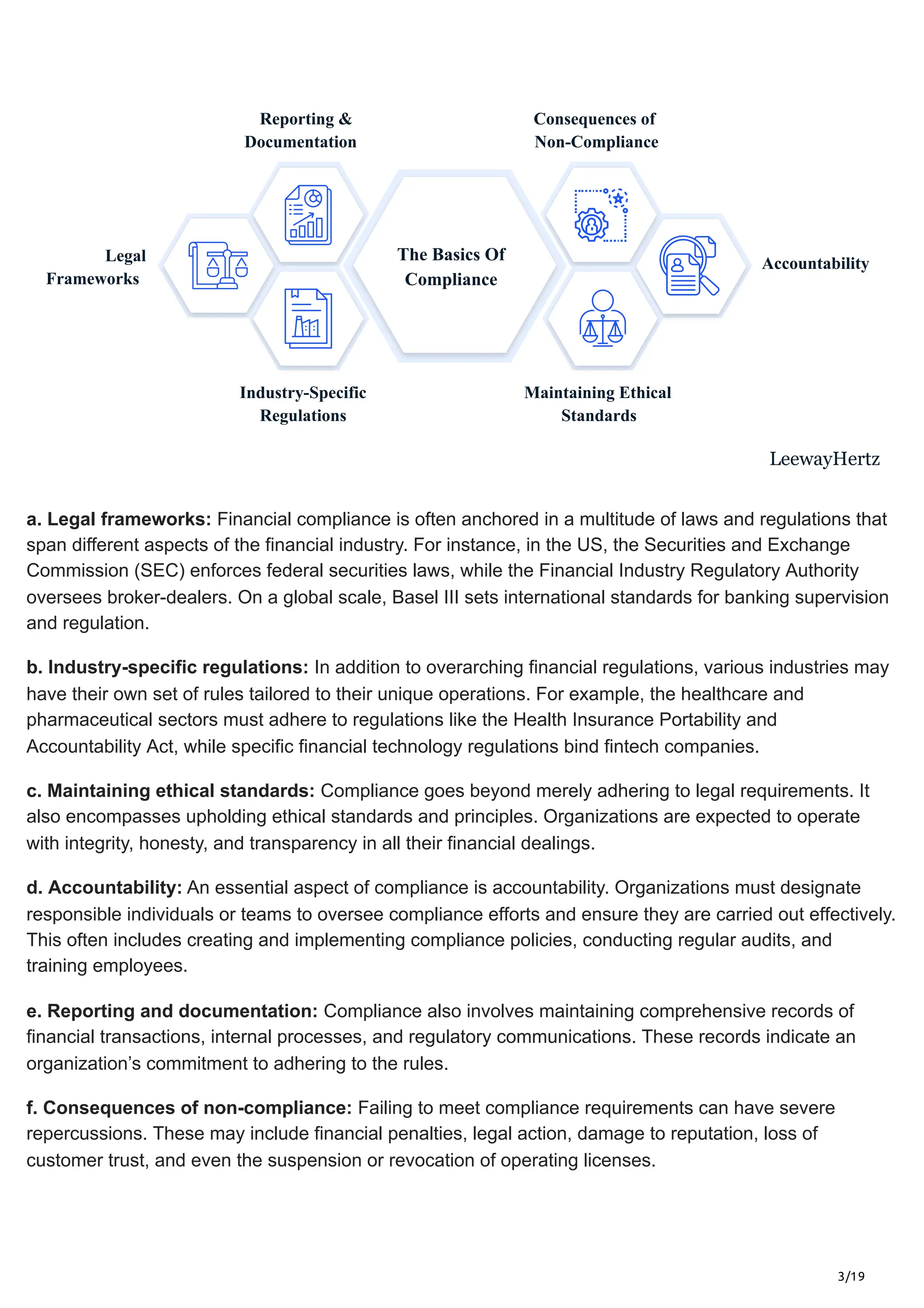

The document provides an overview of the critical need for AI in financial compliance due to the complex regulatory landscape and growing financial crimes, detailing how AI enhances accuracy, efficiency, and automation. It discusses AI applications such as KYC verification, fraud detection, and regulatory text analysis that streamline compliance workflows and reduce human error. Additionally, the document highlights the benefits of using AI technologies to mitigate risks and adapt to evolving regulations, emphasizing platforms like Leewayhertz's generative AI to optimize compliance processes.