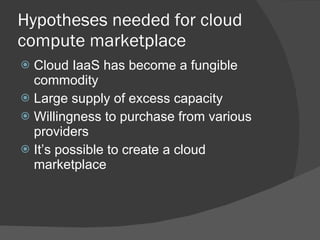

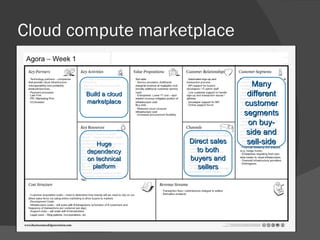

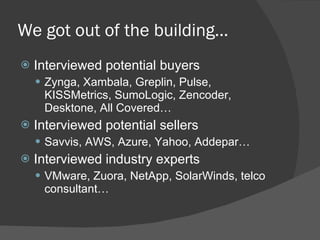

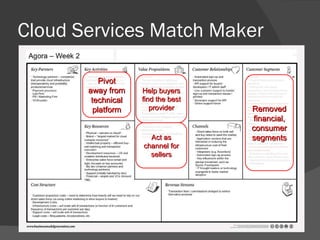

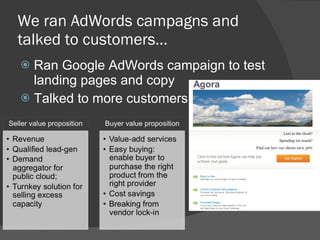

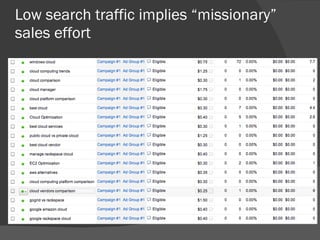

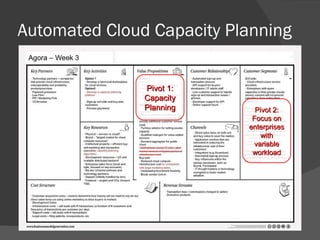

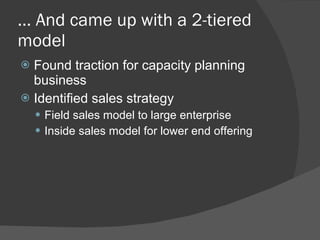

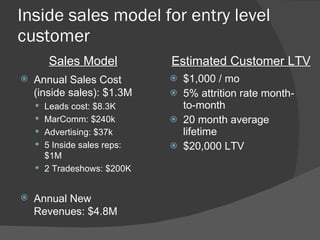

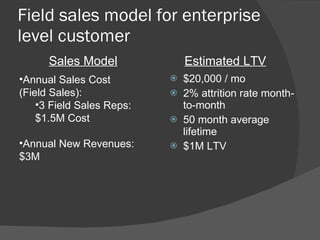

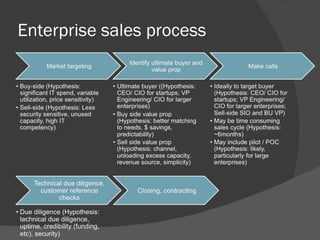

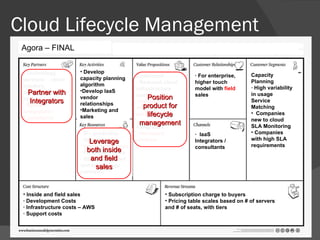

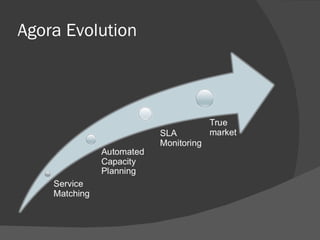

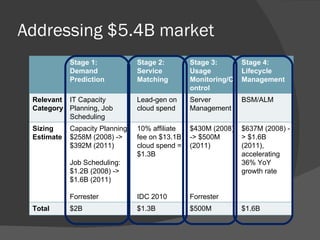

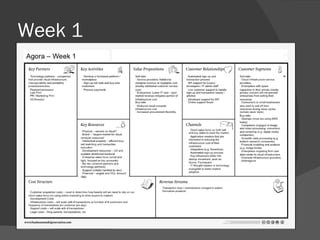

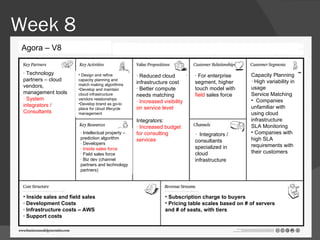

The document discusses the development of a business model for a cloud computing marketplace. It describes how the founders conducted customer interviews, analyzed the market, and pivoted their business model and product focus multiple times based on feedback. They ultimately developed a two-tiered sales model focusing on capacity planning and cloud lifecycle management, targeting enterprises through both inside and field sales with the help of cloud consulting partners.