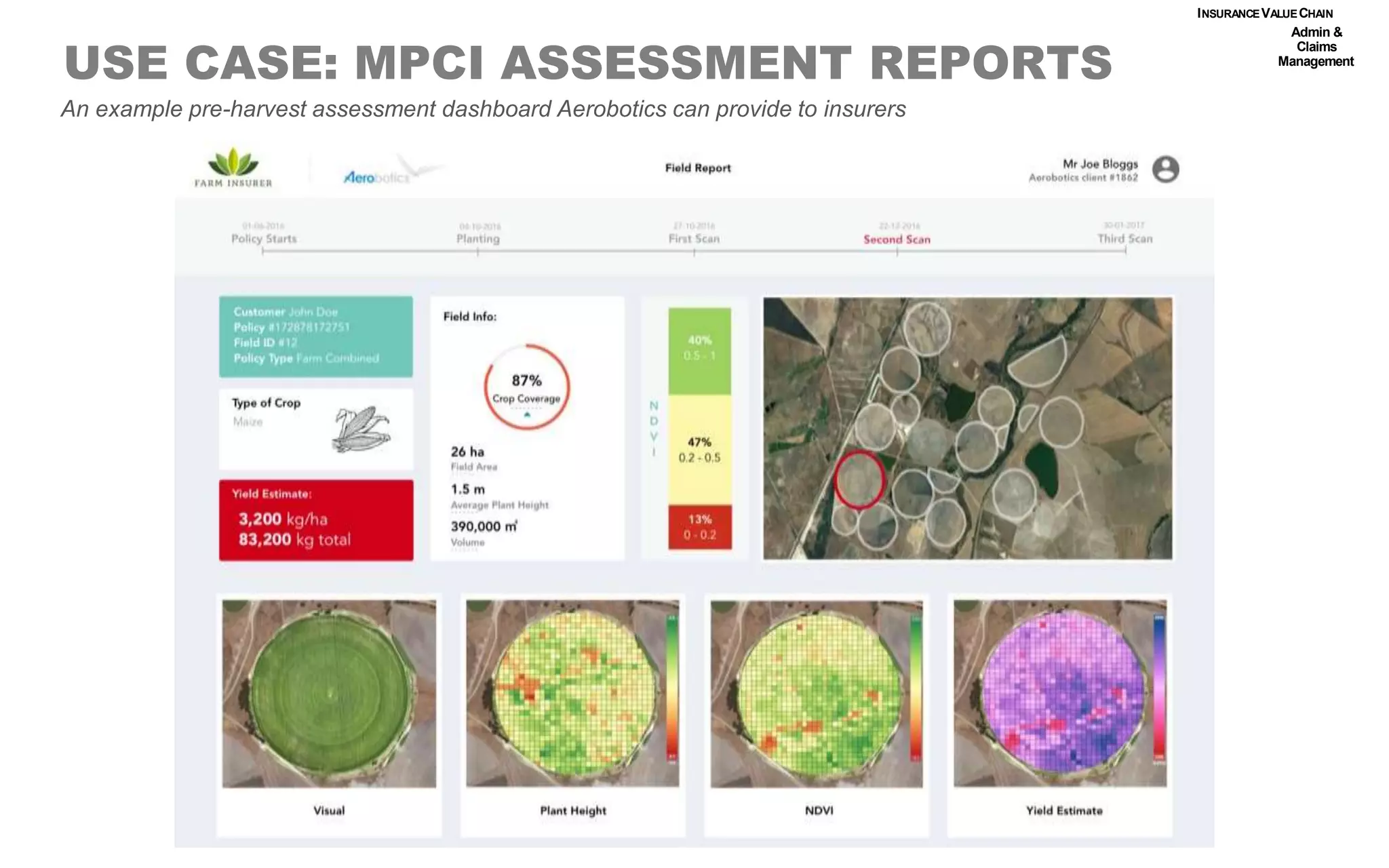

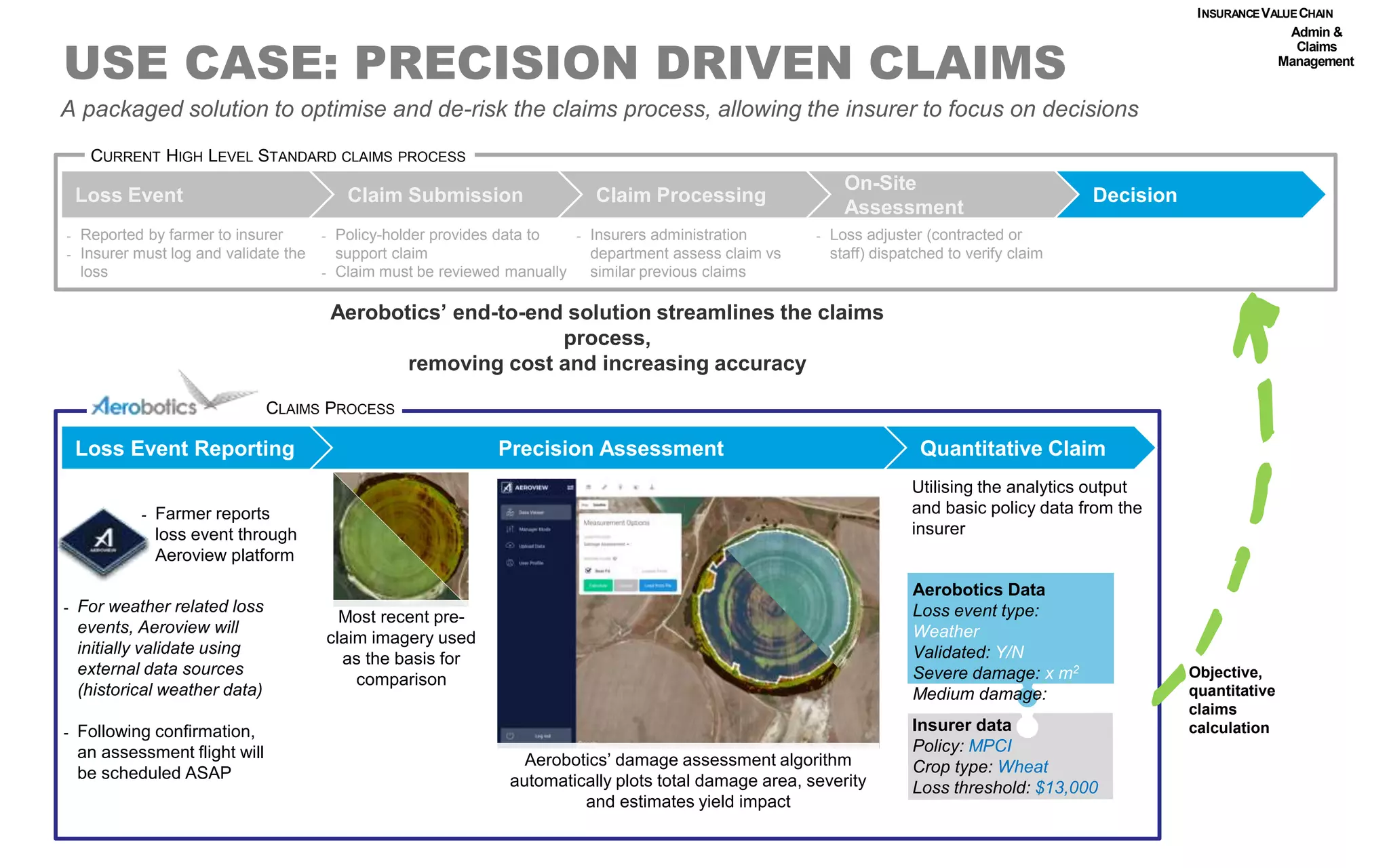

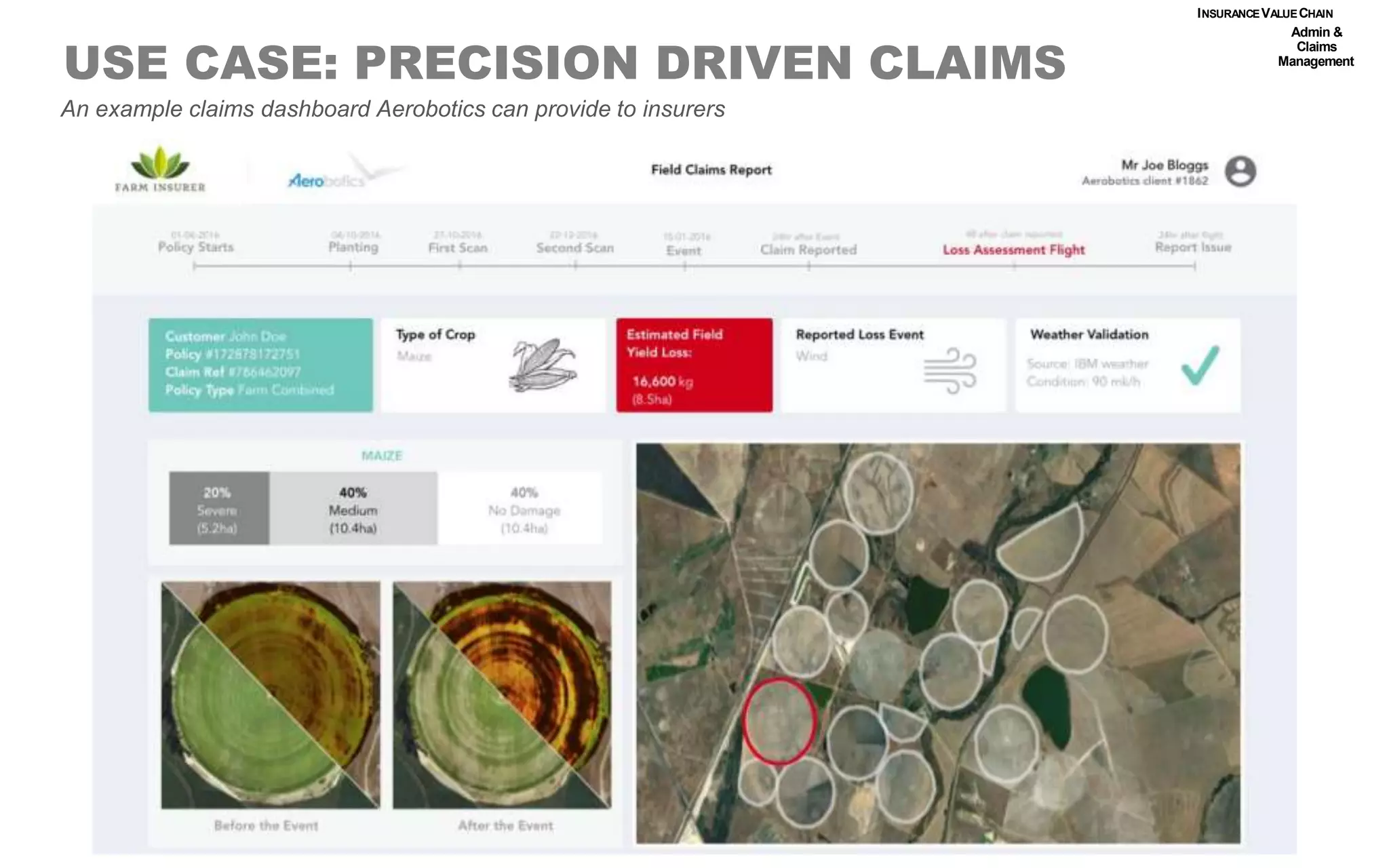

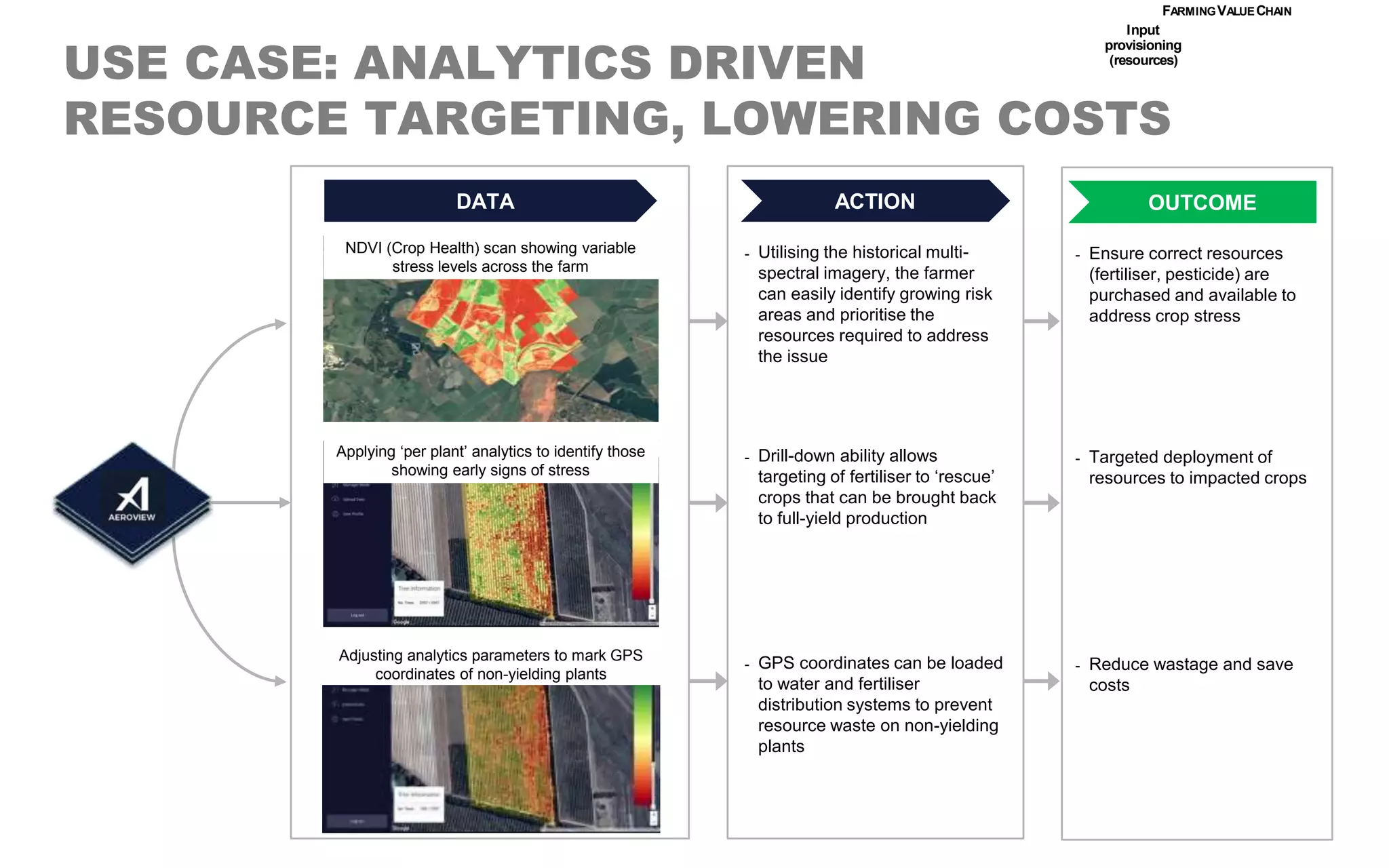

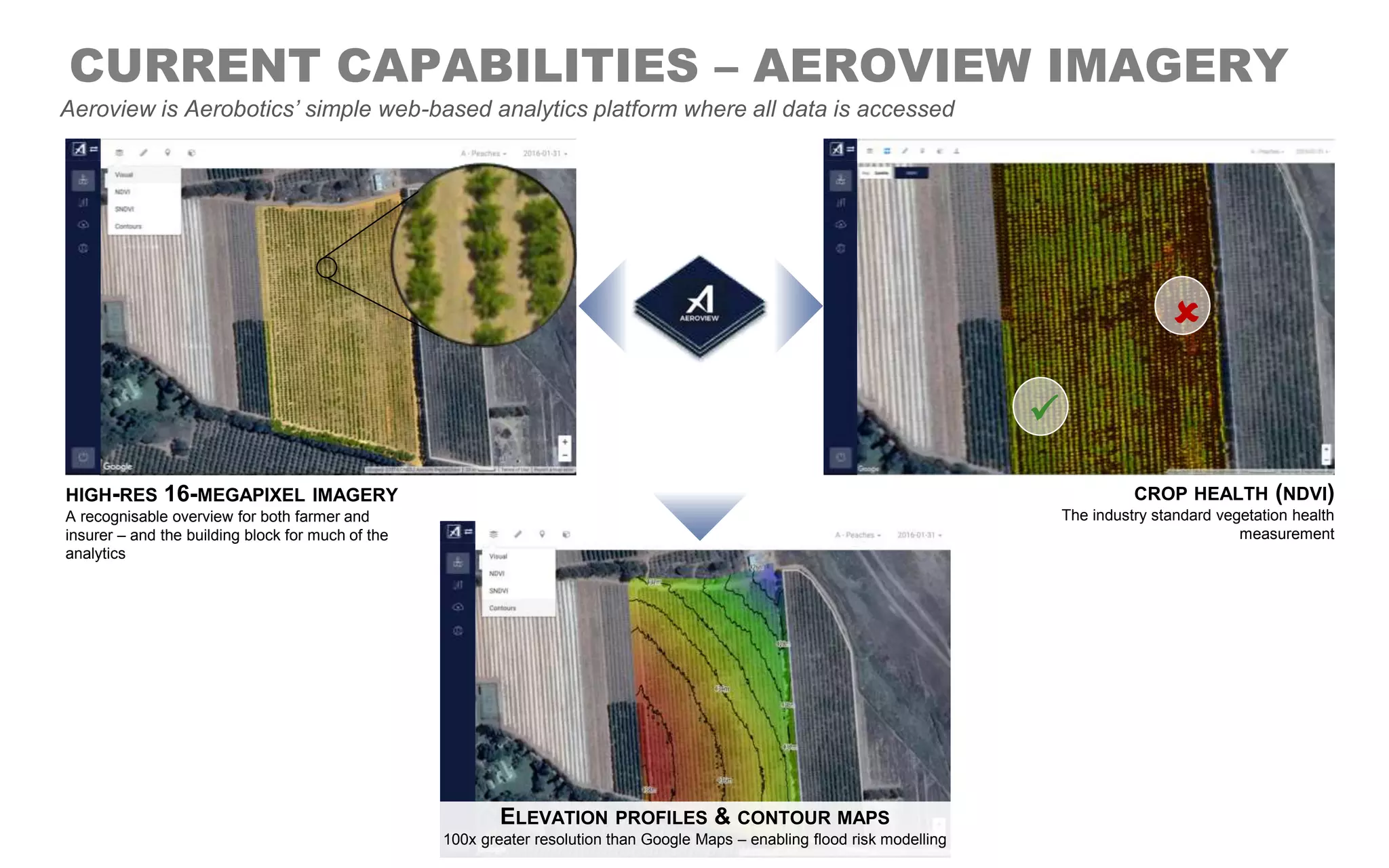

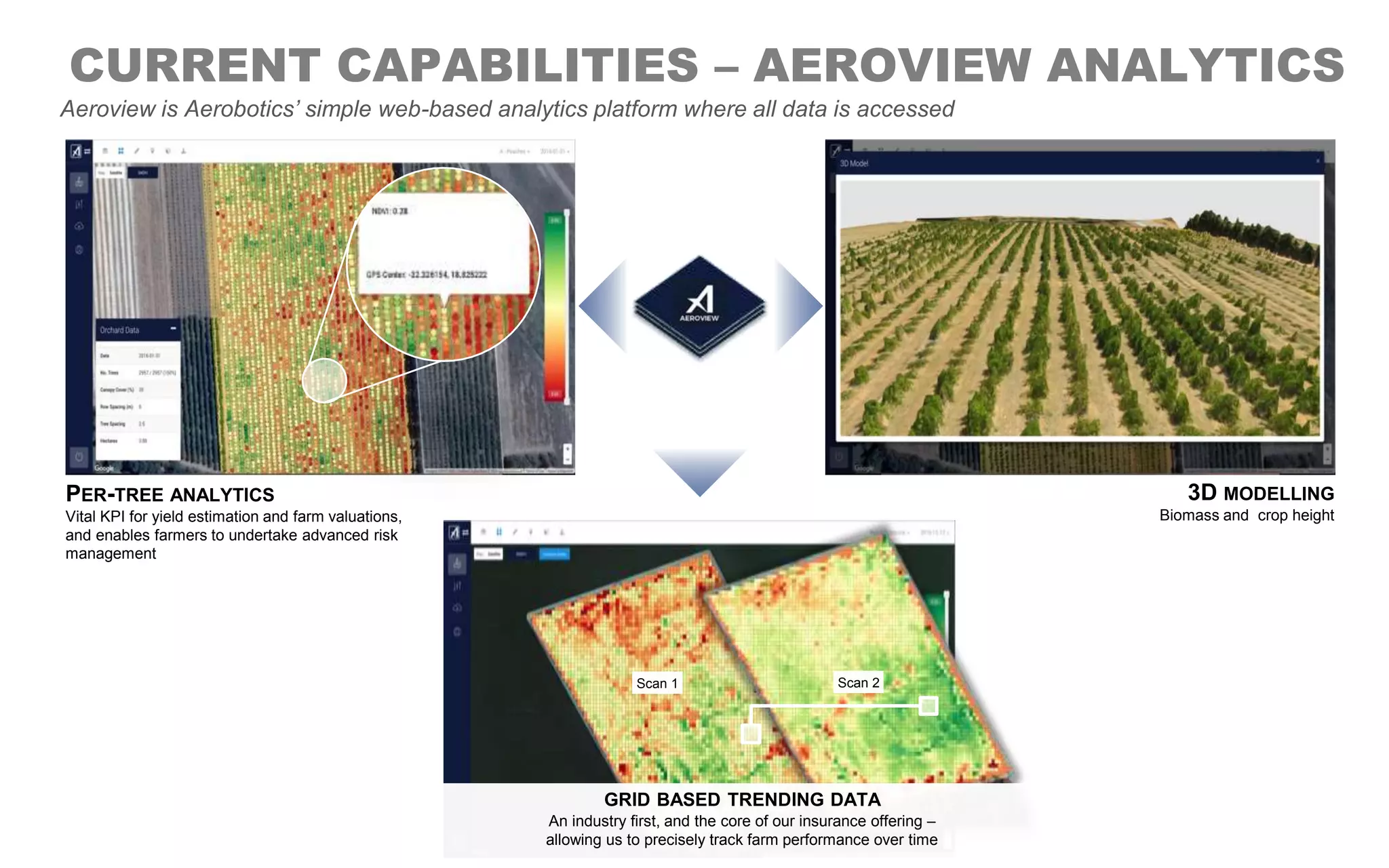

Aerobotics is an aerial data analytics company that uses machine learning on high-resolution drone imagery to provide insights to farmers. They now cover over 620,000 acres for clients in the UK, South Africa, and Australia. Their platform, Aeroview, provides 16-megapixel imagery, elevation profiles, crop health analytics, per-tree analytics, 3D modeling, and grid-based trending data. Aerobotics aims to improve crop insurance by providing accurate claims assessments and giving farmers tools to better manage their risks. This could benefit both farmers and insurers by increasing transparency and reducing costs. Aerobotics has made progress partnering with insurers and precision agriculture companies to expand their coverage and solutions.

![Low market penetration

“Only one third of global [farming] production is

currently insured”

SwissRe: Big Data Approaches To

Crop Insurance in Asia; Aug 2016

Negative customer sentiment

“For many in the agricultural sector, the prospect of an

attractive and affordable multi-peril insurance product

is nothing more than an 'old chestnut' rolled time and

time again.”

Australian Farmer; Jan 2017

Insurers are carrying excess risk and cost

Farmers remain unconvinced of

the value of insurance

Macro level assessment method for pricing

/

Difficult to quantify actual losses for claims

/

Risk of overpayment or payouts on inflated yields

/

Risk of adverse selection and moral hazard

/

Significant monitoring costs

/

Expensive annual cost, squeezing already

tight margins/

Mistrust and frustration with the claims

process/

Viewed as multiple payment, single benefit

/

CURRENT PROBLEMS IN CROP INSURANCE

Both farmer and insurer endure frustrations with the current process

The

outcomes?](https://image.slidesharecdn.com/aerobotics-dual-benefit-agricultural-insurance-v4-12-slide-version-170528165412/75/Europe-Start-Up-InsurTech-Award-2017-Aerobotics-5-2048.jpg)