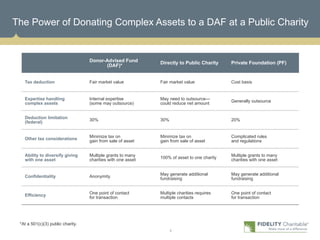

This document discusses the benefits of donating complex assets to charity. It notes that most wealth in the US is held in private businesses and other complex assets, and these assets provide an opportunity for tax-efficient charitable giving when donated. Donating complex assets allows donors to claim a fair market value tax deduction and provides immediate support to charities. The document provides examples of complex assets that can be donated and considerations for doing so, and outlines strategies for donating assets while still operating a business or in advance of exiting a business. It notes various parties benefit from these donations.