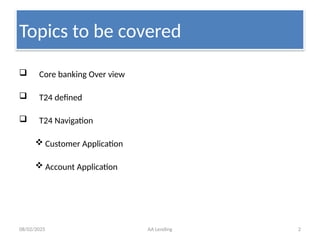

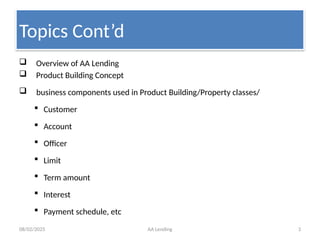

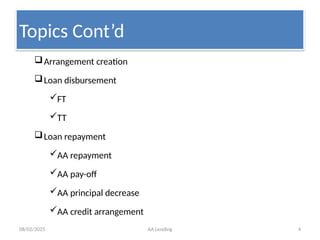

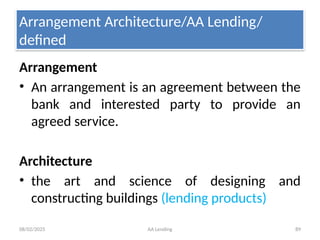

Overview of AA Lending, Product Building Concept

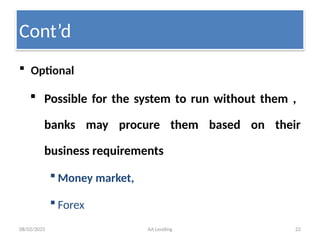

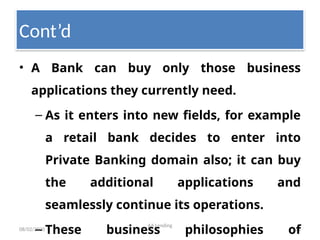

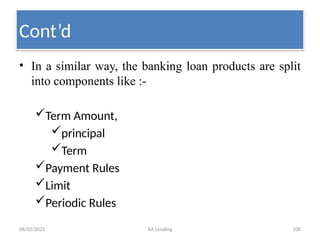

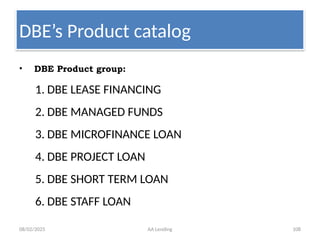

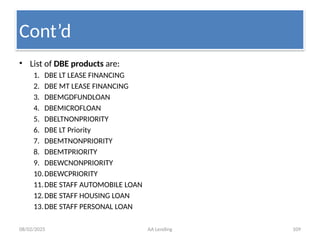

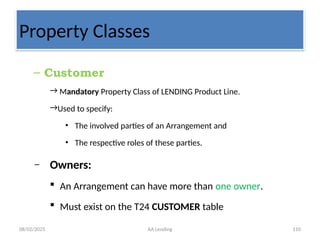

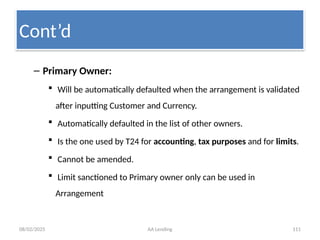

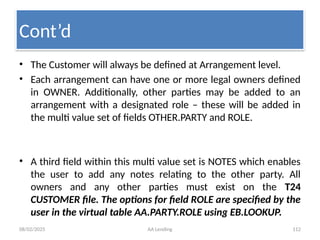

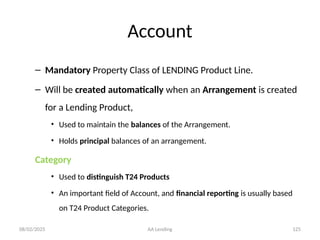

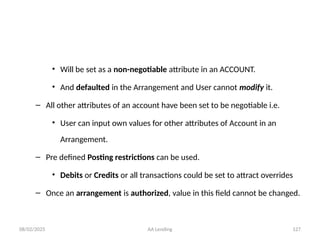

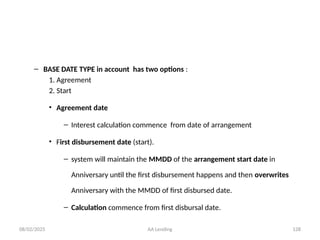

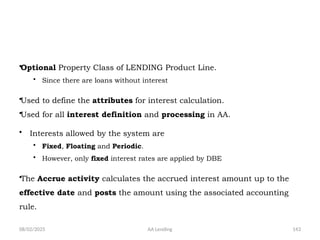

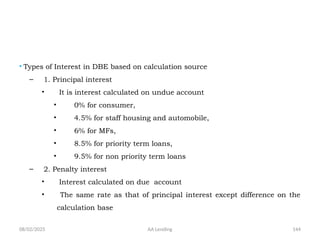

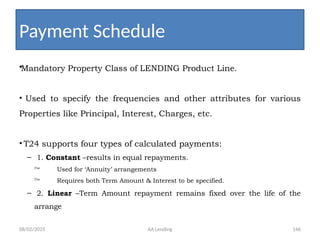

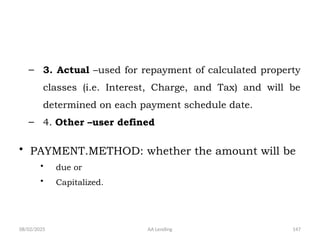

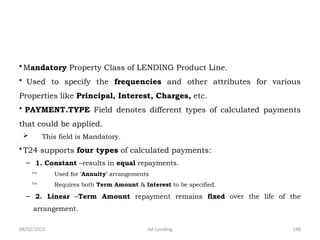

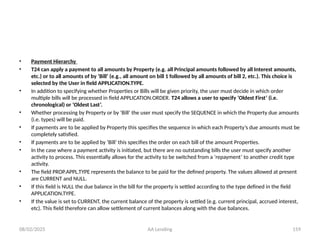

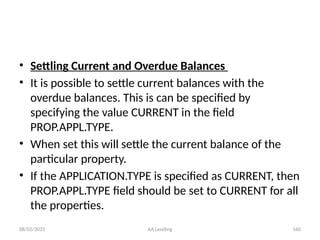

business components used in Product Building/Property classes/

Banks are increasingly adopting IT based solutions, for providing better services to their customers at a minimal cost

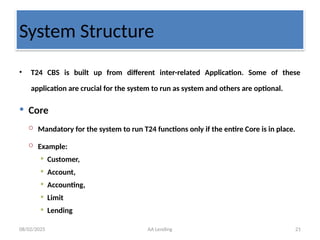

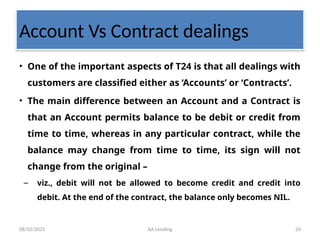

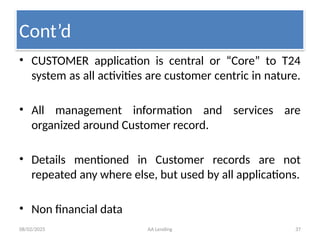

Core banking is a software based system that provides end to end functionalities for a bank’s main business process.