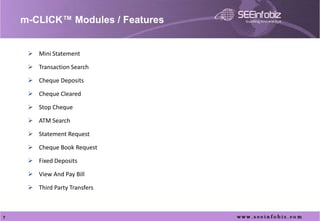

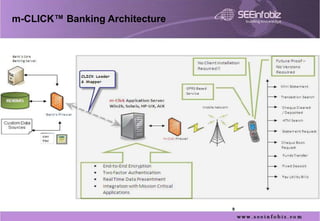

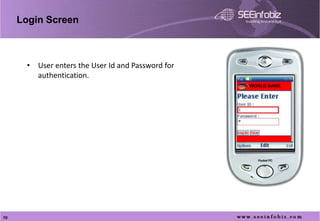

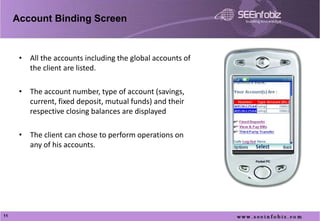

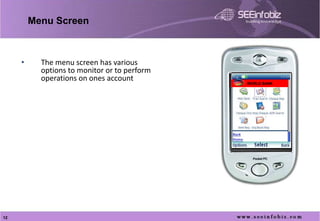

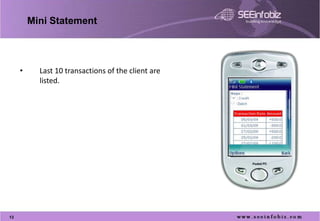

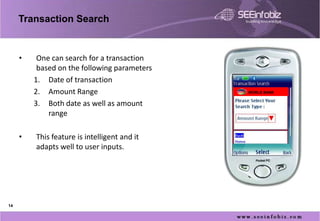

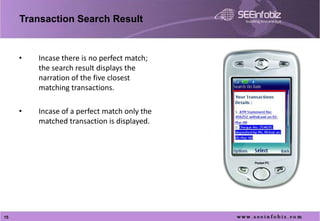

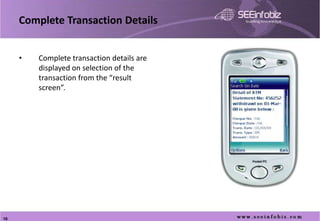

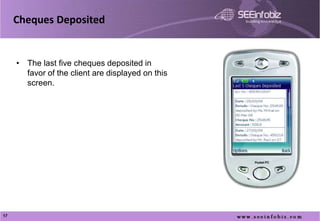

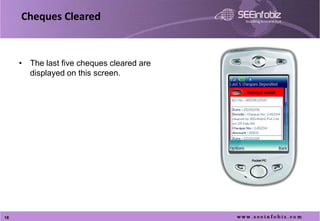

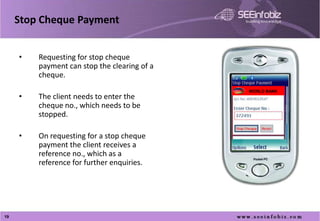

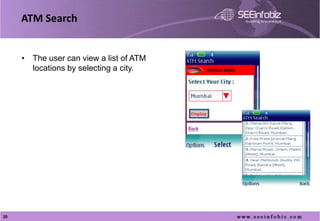

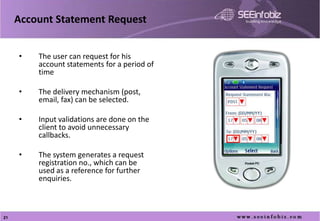

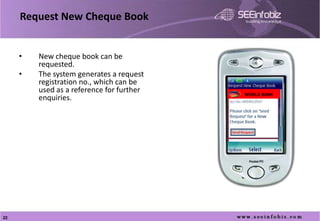

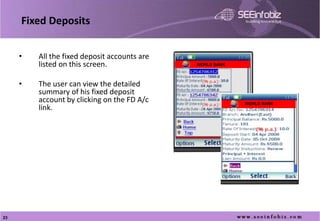

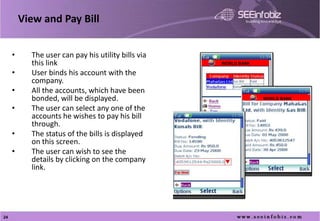

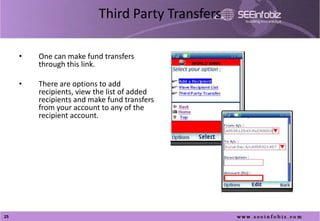

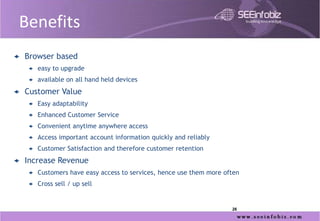

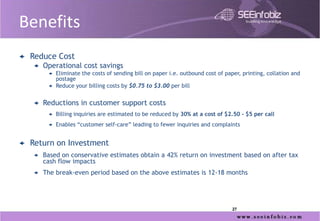

This document summarizes SEEinfobiz Pvt Ltd, an IT solutions company that provides mobile banking applications, customer relationship management, business intelligence, and outsourcing services from offices in India, the US, UK, Dubai, and other locations. The company's m-CLICK mobile banking product allows users to view account balances, search transactions, request statements, deposit checks, and transfer funds from their mobile devices. Benefits of m-CLICK include being browser-based, enhancing customer service, and increasing revenue through cross-selling while reducing costs through operational efficiencies and lower customer support needs.