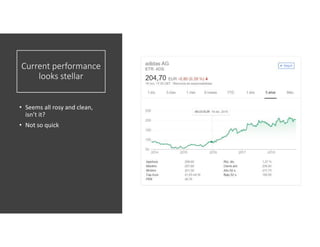

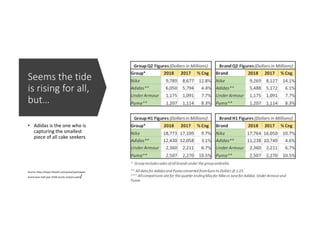

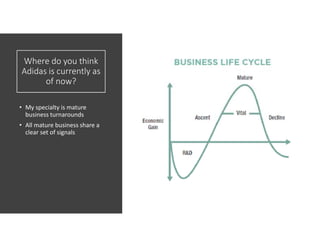

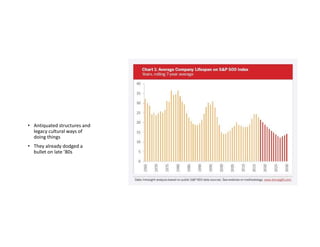

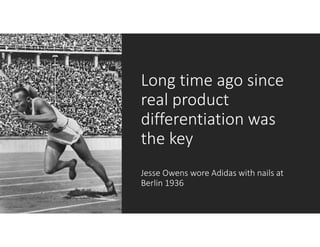

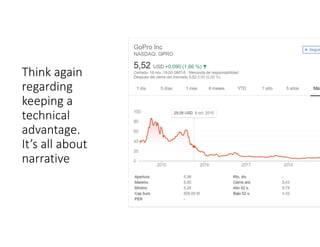

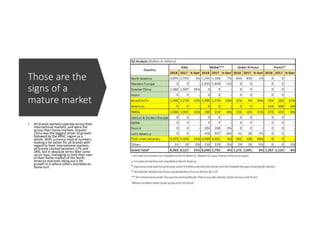

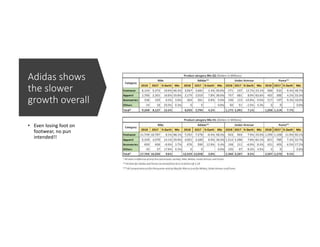

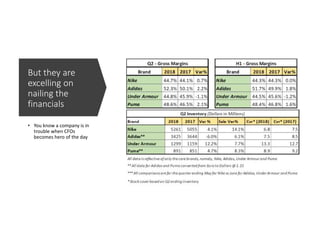

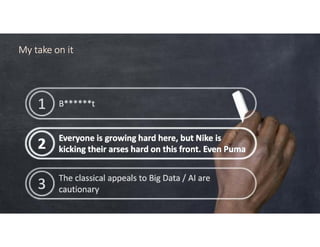

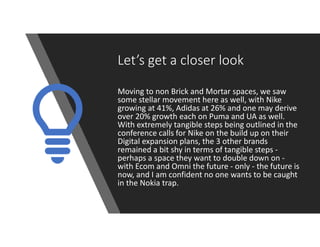

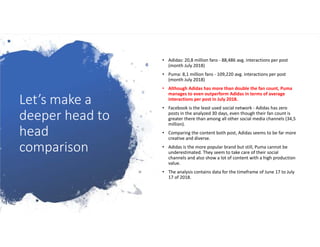

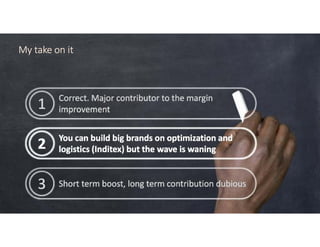

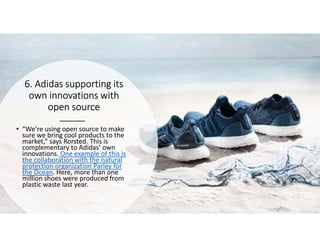

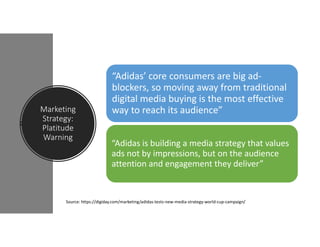

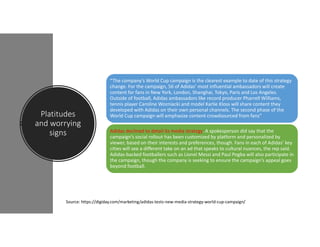

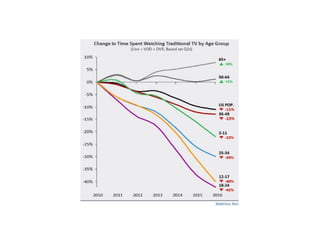

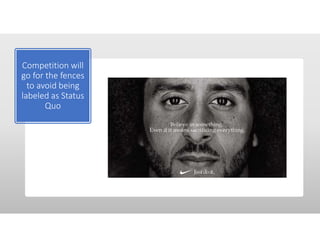

The document analyzes adidas's current market position and strategies, highlighting its recent financial performance and growth in e-commerce, while noting challenges with product excitement and competition from Nike. It discusses historical insights and shifts in branding strategies aimed at reconnecting with consumers, as well as a focus on digital transformation and key markets. Overall, the sportswear industry is projected to grow, but adidas faces pressures to innovate and maintain relevance amidst fierce competition.