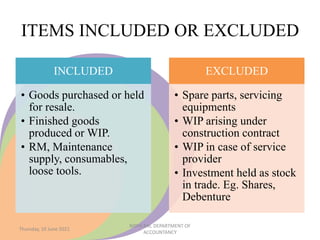

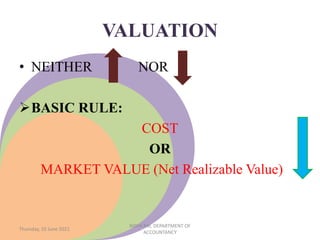

Accounting Standard 2 outlines the valuation of inventory. It defines inventory as assets held for sale, in production, or as materials to be consumed. Inventory includes goods for resale, finished goods, work in progress, and raw materials. It is valued at the lower of cost or net realizable value, with raw materials at cost. Cost includes purchase price, duties, freight, and conversion costs minus discounts. Net realizable value is estimated selling price minus completion and selling costs. Inventory must be valued at the financial year-end.