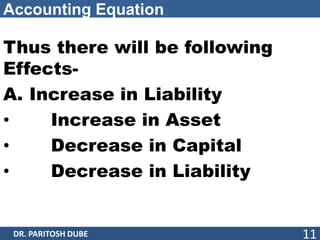

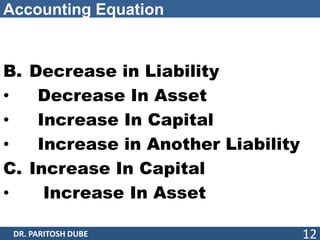

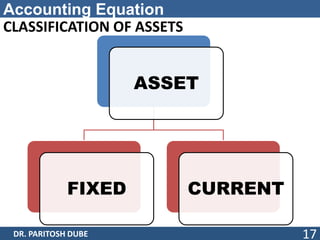

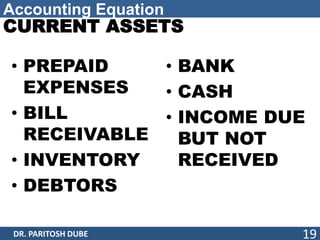

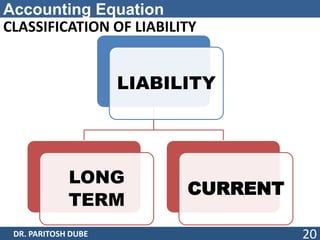

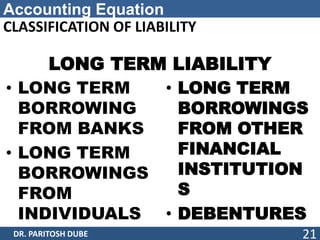

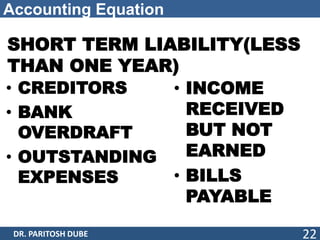

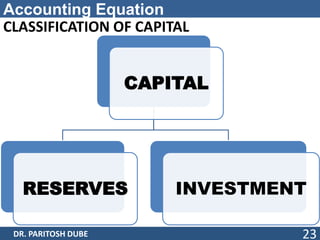

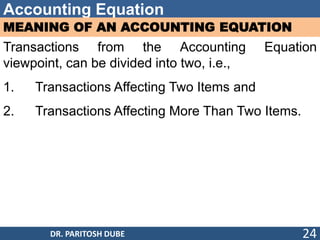

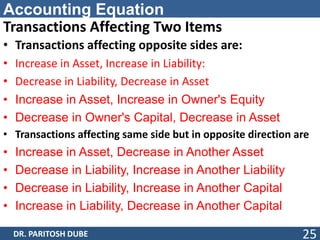

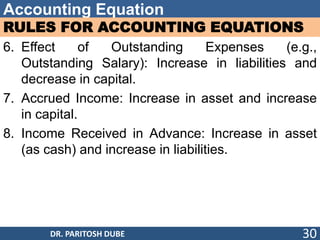

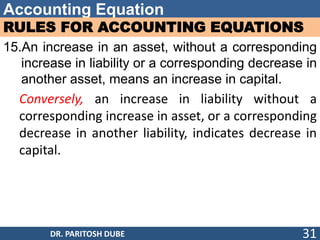

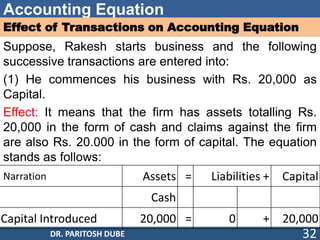

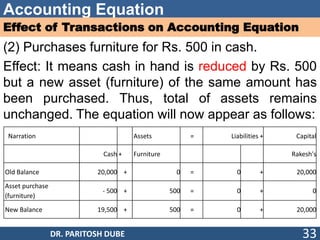

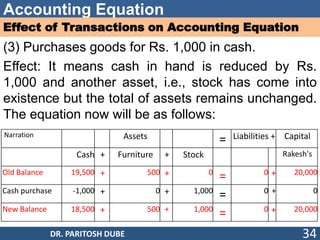

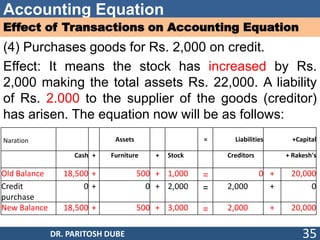

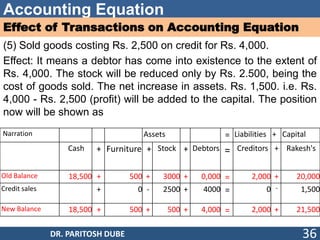

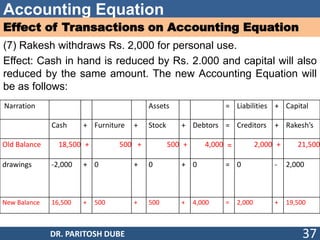

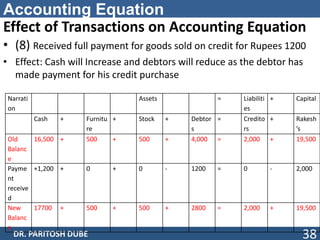

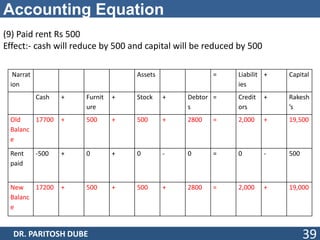

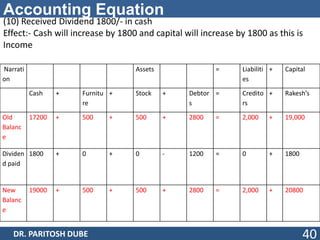

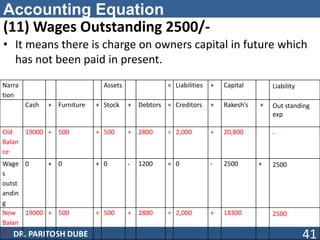

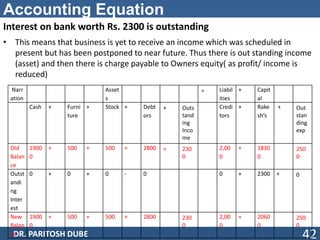

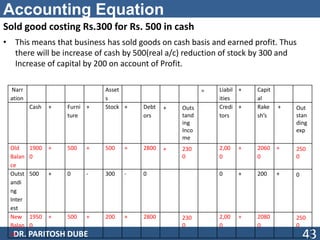

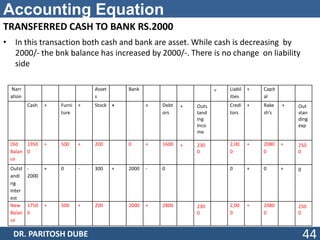

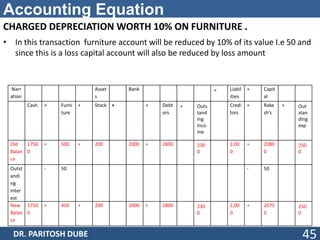

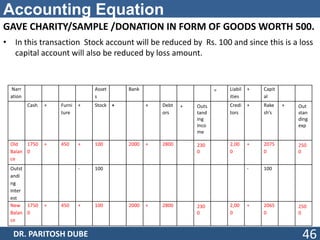

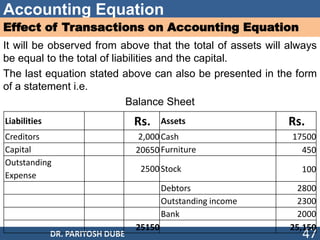

The document elaborates on the accounting equation, which asserts that a company's assets are always equal to its liabilities and equity. It explains the concepts of assets, liabilities, and capital along with the classification and effects of transactions on the accounting equation and presents rules for managing these entries. The text also covers practical examples demonstrating how different transactions influence the accounting equation.