- Accounting principles are the rules and guidelines that accountants follow when recording transactions, including usefulness, objectivity, and feasibility.

- Key accounting concepts include the business entity, going concern, money measurement, cost, dual aspect, accounting period, matching, and realization concepts.

- Accounting conventions guide financial statement preparation, such as disclosure, materiality, consistency, and conservatism.

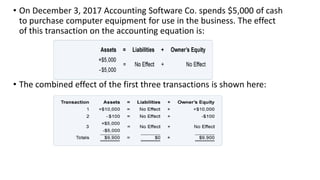

- The accounting equation states that assets must equal liabilities plus owner's equity at all times to remain in balance.