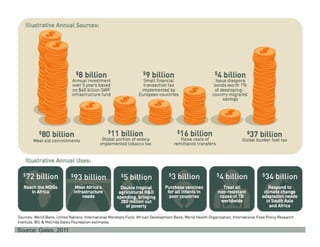

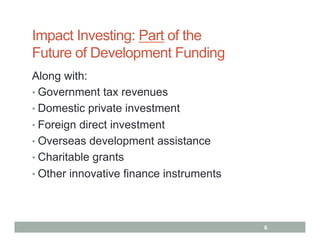

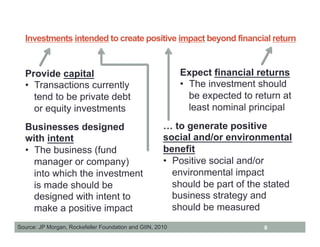

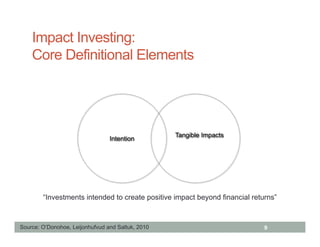

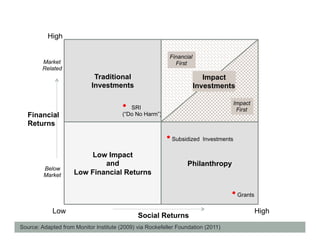

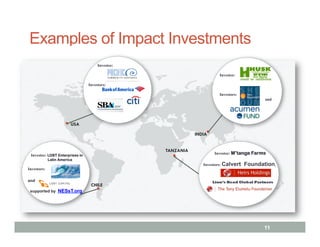

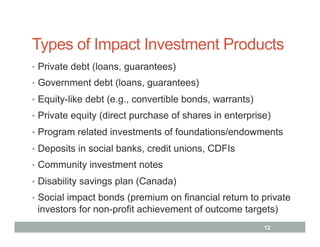

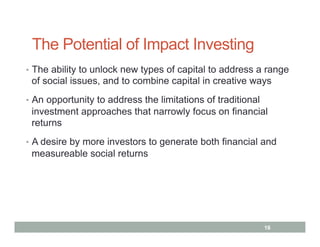

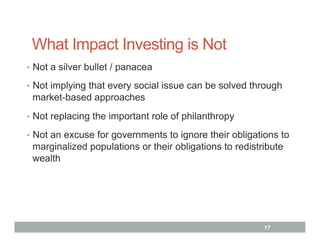

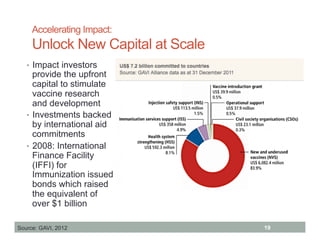

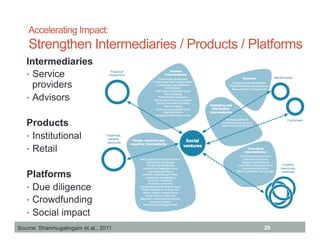

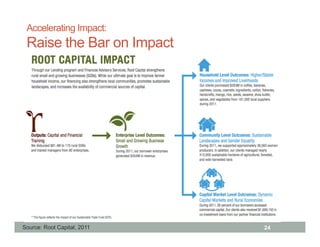

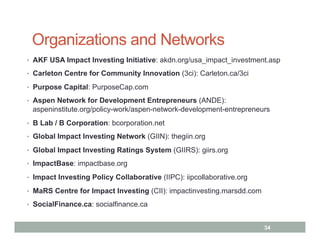

This document discusses the growth and potential of impact investing as a means to address social issues and leverage private capital, particularly in the context of slow economic growth and increasing inequality. It outlines various types of impact investments, the importance of accountability and measurement, and emphasizes the need for collaboration among governments, businesses, and the social sector to foster this evolving industry. The document also highlights challenges and opportunities, urging a focus on capacity development, innovative financing methods, and continuous learning in the impact investing space.