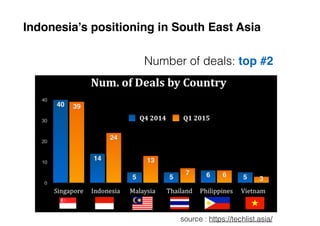

This document discusses the growth of startups in Indonesia from 2010 to the present. It notes that in 2010, Indonesia had 22 million internet users but small internet penetration, while today it has over 80 million users and mobile internet is fueling growth. The number of active startups in Indonesia has grown to over 890, with many diaspora and returnees starting companies. Venture capital investment in Indonesian tech startups has increased from just 3 deals in 2010 to over 99 deals in 2014. The document predicts that mobile/social will drive new distribution models and that software will continue "eating the world", including in industries like ad-tech, education, finance, and government in Indonesia. It argues Indonesia is well positioned to