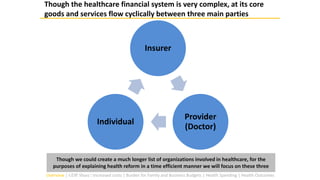

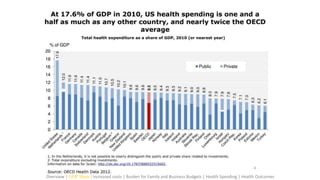

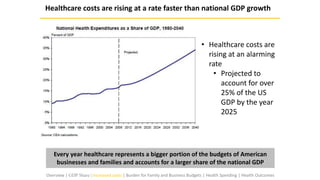

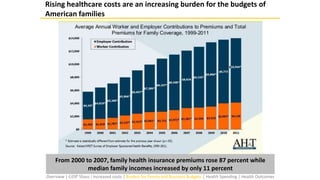

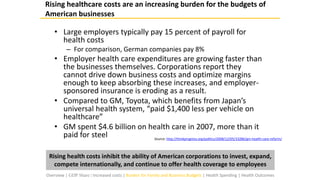

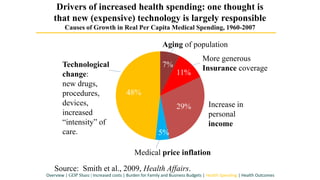

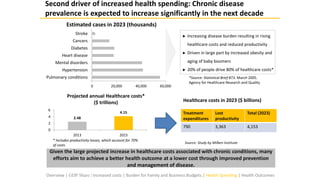

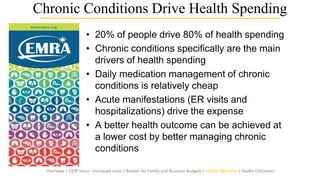

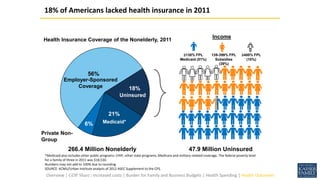

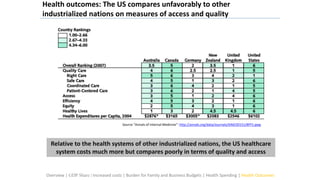

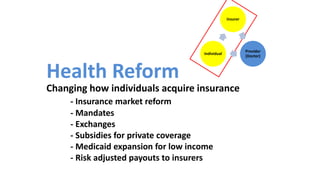

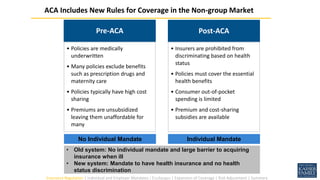

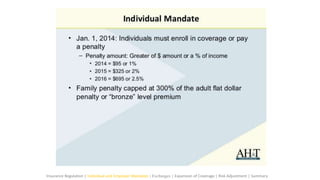

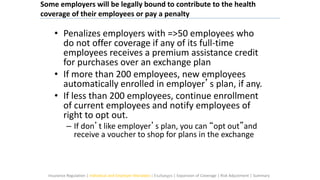

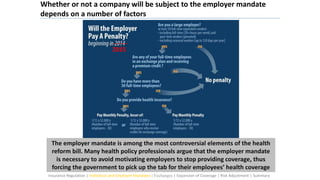

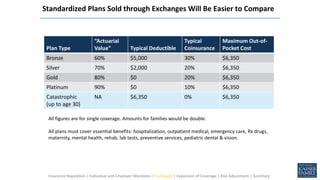

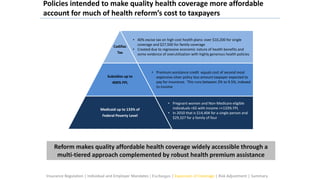

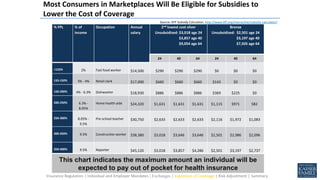

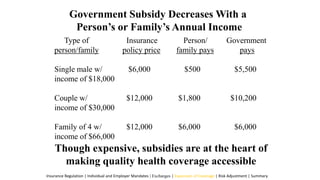

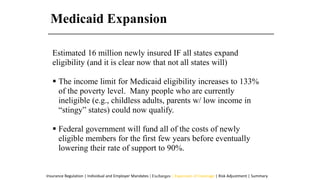

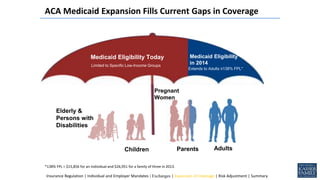

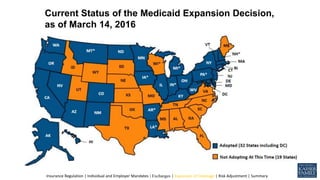

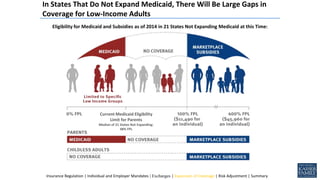

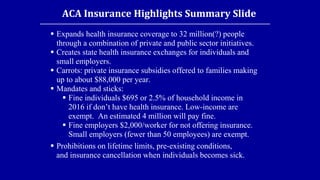

The document provides an overview of American health reform, including its rationale and key implications. It discusses three main parties in the healthcare system - individuals, insurers, and providers - and how their interactions were impacted by reform. Specifically, it summarizes changes to how individuals acquire insurance through the creation of state health insurance exchanges, expansion of Medicaid, and use of subsidies. It also reviews the new employer and individual mandates imposed by reform.