Ac516

•Download as DOCX, PDF•

0 likes•151 views

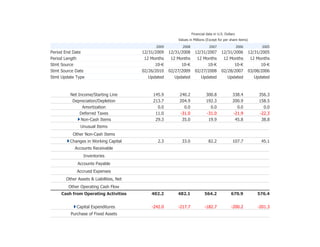

The document provides financial data for a company from 2009 to 2005 including income statements, balance sheets, and cash flow statements. It shows the company had net income of $145.9 million in 2009 with total revenue of $3.88 billion for the year. Assets as of the end of 2009 totaled $3.35 billion with current assets of $2.14 billion, and total equity was $1.01 billion with common stock of $0.9 million.

Report

Share

Report

Share

Recommended

dominion resources GAAP Reconciliations and Footnotes

This document reconciles operating earnings, return on equity, and return on invested capital to reported earnings, return on equity, and return on invested capital for the years 2003-2007 for a company. It shows adjustments made to operating earnings such as gains or losses from sales of business units, impairment charges, discontinued operations, and other one-time items to derive reported earnings according to GAAP. The reconciliation also calculates the impact of these adjustments on the company's return on equity and return on invested capital.

Conference Call 3Q17

This document provides an earnings review conference call transcript for Itaú Unibanco Holding S.A. for the third quarter of 2017. It includes:

1) An introduction and welcome from the President and CEO and other executive officers.

2) An explanation that historical pro forma financial data is presented to allow comparison prior to the merger between Itaú Chile and CorpBanca, which was completed in April 2016.

3) A discussion of Itaú Unibanco's main challenges, including focusing on clients, profitability, internationalization, people management, risk management, and digital transformation.

nationwide 1Q08 Statistical Supplement

This document provides quarterly financial highlights for Nationwide Financial Services for Q1 2008. Key points include:

- Total revenues for Q1 2008 were $916.3 million, down from $1,068.7 million in Q4 2007.

- Net operating earnings for Q1 2008 were $131.5 million, down from $161.7 million in Q4 2007.

- Total customer funds managed and administered as of Q1 2008 were $153.3 billion, down from $162.4 billion as of Q4 2007.

Nordnet Q3 2011 report

- Nordnet's profits increased significantly in the first three quarters of 2011, with operating income up 12% and profit after tax up 68%.

- Key metrics like earnings per share and number of active accounts also rose sharply compared to the same period last year.

- Nordnet maintained a strong cost control while launching new services in Norway and seeing continued strong customer inflows.

Big_Lots_AR2001FSO

This document is the 2001 annual report of Big Lots, Inc. that includes selected financial data from 1998-2002, such as net sales, costs, expenses, earnings, balance sheet information, and store counts. It also includes a management discussion and analysis section and notes regarding forward-looking statements and risk factors that could affect the company's projections.

nationwide 2Q07 Statistical Supplement

This document provides quarterly financial highlights and statistics for Nationwide Financial Services for the second quarter of 2007:

- Total operating revenues were $1.18 billion for the quarter, consistent with the prior year. Net income was $197 million.

- The Individual Investments segment reported pre-tax operating earnings of $109 million for the quarter driven by improved investment income and gains.

- Customer funds managed and administered by Nationwide grew to $164 billion, an increase of 5% from the prior year.

- Total assets were $121 billion and shareholders' equity was $5.45 billion at quarter end. Net operating return on average equity excluding accumulated other comprehensive income was 14.1% for

Example of ActiveDisclosure Linked Audit Committee Package

The document summarizes financial results for a company's December 2014 quarter and six months ended March 31, 2014 compared to the prior year periods. Some key highlights include:

- Net sales were in line with an "Upside Forecast" but gross margin improved significantly year-over-year due to cost reductions and improved product mix.

- Operating expenses decreased due to a one-time gain in the prior year but increased due to bonus accruals in the current year.

- The company reported a net loss that increased compared to the prior year periods.

- Cash flow from operations was positive due to changes in working capital but property/equipment purchases used cash.

danaher 05-2q-rel

Danaher Corporation announced record results for the second quarter and first half of 2005. Net earnings for the second quarter increased 25.5% compared to 2004, and sales increased 19%. For the first six months, net earnings increased 27.5% and sales increased 19%. The company's president stated that growth from existing businesses accounted for 5.5% sales growth in the quarter and that the company saw broad-based strength across its businesses.

Recommended

dominion resources GAAP Reconciliations and Footnotes

This document reconciles operating earnings, return on equity, and return on invested capital to reported earnings, return on equity, and return on invested capital for the years 2003-2007 for a company. It shows adjustments made to operating earnings such as gains or losses from sales of business units, impairment charges, discontinued operations, and other one-time items to derive reported earnings according to GAAP. The reconciliation also calculates the impact of these adjustments on the company's return on equity and return on invested capital.

Conference Call 3Q17

This document provides an earnings review conference call transcript for Itaú Unibanco Holding S.A. for the third quarter of 2017. It includes:

1) An introduction and welcome from the President and CEO and other executive officers.

2) An explanation that historical pro forma financial data is presented to allow comparison prior to the merger between Itaú Chile and CorpBanca, which was completed in April 2016.

3) A discussion of Itaú Unibanco's main challenges, including focusing on clients, profitability, internationalization, people management, risk management, and digital transformation.

nationwide 1Q08 Statistical Supplement

This document provides quarterly financial highlights for Nationwide Financial Services for Q1 2008. Key points include:

- Total revenues for Q1 2008 were $916.3 million, down from $1,068.7 million in Q4 2007.

- Net operating earnings for Q1 2008 were $131.5 million, down from $161.7 million in Q4 2007.

- Total customer funds managed and administered as of Q1 2008 were $153.3 billion, down from $162.4 billion as of Q4 2007.

Nordnet Q3 2011 report

- Nordnet's profits increased significantly in the first three quarters of 2011, with operating income up 12% and profit after tax up 68%.

- Key metrics like earnings per share and number of active accounts also rose sharply compared to the same period last year.

- Nordnet maintained a strong cost control while launching new services in Norway and seeing continued strong customer inflows.

Big_Lots_AR2001FSO

This document is the 2001 annual report of Big Lots, Inc. that includes selected financial data from 1998-2002, such as net sales, costs, expenses, earnings, balance sheet information, and store counts. It also includes a management discussion and analysis section and notes regarding forward-looking statements and risk factors that could affect the company's projections.

nationwide 2Q07 Statistical Supplement

This document provides quarterly financial highlights and statistics for Nationwide Financial Services for the second quarter of 2007:

- Total operating revenues were $1.18 billion for the quarter, consistent with the prior year. Net income was $197 million.

- The Individual Investments segment reported pre-tax operating earnings of $109 million for the quarter driven by improved investment income and gains.

- Customer funds managed and administered by Nationwide grew to $164 billion, an increase of 5% from the prior year.

- Total assets were $121 billion and shareholders' equity was $5.45 billion at quarter end. Net operating return on average equity excluding accumulated other comprehensive income was 14.1% for

Example of ActiveDisclosure Linked Audit Committee Package

The document summarizes financial results for a company's December 2014 quarter and six months ended March 31, 2014 compared to the prior year periods. Some key highlights include:

- Net sales were in line with an "Upside Forecast" but gross margin improved significantly year-over-year due to cost reductions and improved product mix.

- Operating expenses decreased due to a one-time gain in the prior year but increased due to bonus accruals in the current year.

- The company reported a net loss that increased compared to the prior year periods.

- Cash flow from operations was positive due to changes in working capital but property/equipment purchases used cash.

danaher 05-2q-rel

Danaher Corporation announced record results for the second quarter and first half of 2005. Net earnings for the second quarter increased 25.5% compared to 2004, and sales increased 19%. For the first six months, net earnings increased 27.5% and sales increased 19%. The company's president stated that growth from existing businesses accounted for 5.5% sales growth in the quarter and that the company saw broad-based strength across its businesses.

Verizon Reports Sustained Revenue Growth and Continued Strong Cash Flows fo...

This document summarizes Verizon Communications' consolidated statements of income for the fourth quarter and full year of 2008. Some key details:

- For Q4 2008, total operating revenues increased 3.4% to $24.6 billion and net income increased 15.2% to $1.24 billion compared to Q4 2007.

- For the full year 2008, total operating revenues increased 4.2% to $97.4 billion and net income increased 16.4% to $6.43 billion compared to 2007.

Third Quarter of Fiscal Year Ending March 2021 (FY2020) Financial Highlights

This document provides a summary of Ricoh Leasing Company's financial results for the third quarter of the 2021 fiscal year.

- Net sales and profits increased year-over-year for the 11th and 7th consecutive periods respectively, despite an allowance for doubtful accounts from COVID-19. Operating assets decreased due to securitization.

- Performance was generally positive across business segments. The investment business saw sales and profit increases from prior investments.

- Ricoh is monitoring the full-year forecast carefully due to uncertainty from the pandemic, but progress has been made towards the operating profit target so far.

Nordnet Q2 2011 report

The document provides an interim financial report for a company from January to June 2011. It summarizes key financial figures showing operating income increased 2% and profit after tax rose 25%. It also outlines goals to achieve 100% cost coverage from non-trading commissions by end of 2011 and double revenues within 2 years. The company aims to become the leading savings bank in Nordic countries by 2018 by expanding its existing customer base in Sweden, Norway, Denmark, and Finland.

itw_050127

This document summarizes ITW's fourth quarter 2004 conference call. It includes an agenda for the call, forward-looking statements, highlights and analysis of financial results, segment results for engineered products in North America and internationally, and key economic data. John Brooklier and Jon Kinney will provide introductions, a financial overview, and forecast for 2005. They will also take questions from attendees.

Nordnet Q4 2011 presentation

Presentation of Nordnet's year-end report 2011. For the full report and webcast, visit our corporate website at www.nordnetab.com.

Nordnet year-end report 2010

Nordnet reported increased operating income and profit after tax for 2010 compared to 2009. However, earnings per share were down slightly. For 2011, Nordnet plans cost reductions of 15% to secure goals and visions in light of decreased market activity. Measures include reducing consultants, marketing investments, and potentially reducing staff. Nordnet also reported highlights for 2010 such as successful integrations and new products, and goals to double revenues by 2013 while maintaining operating margins.

Uniliver's financial modeling

Presentation of Unilever link below:

https://www.slideshare.net/ToobaShafique2/presentation1-144714935

2008 04-02 Q2 & Half-Year 2007/2008 Results

The company reported strong financial results for the second quarter and first half of the fiscal year, with net sales increasing 4.0% and 4.5% respectively. Operating profit grew 13.5% in the second quarter excluding one-time items. Cash flow from operating activities was also up significantly. The company will continue its store expansion strategy and establish new markets to further boost sales and profits. Key to ongoing success is maintaining high gross margins while expanding the store base.

danaher 02-3qrel

Danaher Corporation announced its third quarter 2002 results, reporting a 32% increase in net earnings to $116.0 million compared to third quarter 2001. Diluted earnings per share increased 25% year-over-year to $0.74. Total sales for the quarter grew 28% to $1,151.7 million, driven primarily by acquisitions completed in the first quarter of 2002. For the first nine months of 2002, net earnings were $128.7 million which included a $173.8 million one-time non-cash charge related to goodwill impairment. Excluding this charge, nine month net earnings were up 14% to $302.4 million compared to the same period in 2001.

Nordnet Q1 2011 report

Presentation of Nordnet's interim report for January-March 2011. The report was published on 28 April 2011.

atmos enerrgy segmentinfo040408

The document provides revised quarterly segment income statements and balance sheets for a company during fiscal year 2007 based on new reporting segments. The new segments are natural gas distribution, regulated transmission and storage, natural gas marketing, and pipeline, storage and other. Summarized income statements are provided for the quarters ended December 31, 2006, March 31, 2007, June 30, 2007, and September 30, 2007 showing operating revenues, purchased gas costs, operating expenses, operating income, interest charges, income before taxes, and net income for each segment. Financial information is unaudited and should be read with the company's audited annual report.

nationwide 1Q07 Statistical Supplement

This document is Nationwide Financial Services' statistical supplement for the first quarter of 2007. It provides quarterly financial highlights and key metrics for Nationwide's business segments. Nationwide saw total operating revenues of $1.1 billion for Q1 2007, with the Individual Investments segment contributing $365 million and pre-tax operating earnings of $217.6 million. Total customer funds managed and administered were $156.1 billion. Nationwide also reported net income of $203.2 million or $1.38 per diluted share for the quarter.

alltel 4q05supplement

The document summarizes financial information for ALLTEL Corporation for quarterly periods in 2003, 2004, and 2005. It discusses two transactions - the sale of ALLTEL Information Services' financial services division in 2003 and ALLTEL's merger with Western Wireless in 2005. As a result of these transactions, certain operations were classified as discontinued operations. The document also provides consolidated quarterly statements of income for ALLTEL under GAAP and for its continuing/current businesses (non-GAAP), excluding effects of discontinued operations.

occidental petroleum Core Results and Reported Earnings Release

This document contains Occidental Petroleum Corporation's quarterly income statement for 2007 and 2008. It shows revenue, expenses, and earnings for the company's oil and gas, chemicals, and midstream segments. In 2007, the company reported total annual core earnings of $8.3 billion and total annual reported earnings of $5.4 billion. In 2008, total annual core earnings increased to $12.6 billion while total annual reported earnings increased to $6.9 billion. The document also notes that Occidental uses a measure called "core results" to exclude significant transactions and events that vary widely from period to period in order to provide useful information to investors for comparing earnings performance.

2014 Financial Report

This financial report summarizes Santander Group's consolidated financial results for 2014. Some key highlights include:

- Total assets increased 11.7% to €1,266 billion from 2013 to 2014. Net customer loans grew 7.3% and customer deposits increased 6.5% over this period.

- Gross income rose 1.7% to €42.6 billion in 2014. Attributable profit to the Group increased 39.3% to €5.8 billion.

- Capital ratios like CET1 fully-loaded and CET1 phase-in were above requirements at 9.7% and 12.2% respectively as of December 2014.

- Shares outstanding increased 11% to 12

Radio Shack Integrated Cash Flow Model_DCF

The document provides a financial model for Radio Shack with assumptions and projections for income statements, balance sheets, and cash flows from 2003 to 2010. Key assumptions include annual net sales growth of 4.5%, cost of goods sold as a percentage of net sales of 51.1%, and SG&A expenses as a percentage of net sales of 37.2%. The model projects increasing revenues but declining profits and cash flows over this period as operating expenses rise and the company repurchases stock.

Apple Financial Ratios 2014

Financial Management Presentation, Shows Financial Ratios classification and how to calculate those of Apple for fiscal year Oct-2013 to Sep-2014.

nationwide 4Q07 Statistical Supplement

This document is a statistical supplement from Nationwide Financial Services for the fourth quarter of 2007. It includes:

1) Consolidated income statements and balance sheets for Nationwide showing quarterly results. Pre-tax operating earnings were $216.6 million for Q4 2007.

2) Segment results for individual investments, retirement plans, individual protection, and corporate and other. Retirement plans pre-tax operating earnings were $75.9 million in Q4 2007.

3) Key metrics for individual segments such as account values, policy reserves, sales and earnings trends. Sales in Q4 2007 were $4.79 billion.

4) Other financial data like customer funds managed, separate account assets

Financial Statements

Microsoft Corporation reported financial results for the quarter and fiscal year ended June 30, 2004. Revenue increased 15% to $9.3 billion for the quarter and 14% to $36.8 billion for the fiscal year. Net income increased 82% to $2.7 billion for the quarter and 9% to $8.2 billion for the fiscal year. Earnings per share increased 79% to $0.25 for the quarter and 9% to $0.76 for the fiscal year. The company's largest segments by revenue were Client, Server and Tools, and Information Worker.

Press release Hera Group 3q 2008

The Hera Group Board of Directors approved financial results for the first nine months of 2008, showing growth across key metrics. Revenues increased 30.7% to €2,556.5 million, EBITDA rose 17.1% to €350.4 million, and EBIT grew 16.8% to €180 million. All business areas achieved increased profits, with the waste management area contributing most to EBITDA at 37.2% and revenues growing 13.5%. The company expects to meet full-year targets for growth and profitability.

dover Q307_10Q

This document is Dover Corporation's Form 10-Q quarterly report filed with the SEC for the quarter ended September 30, 2007. It includes Dover's condensed consolidated financial statements and notes for the periods presented. Some key details:

- Revenue for the quarter increased 15% to $1.84 billion compared to $1.61 billion in the prior year. Net earnings increased 5% to $174.6 million.

- Year-to-date revenue increased 16% to $5.37 billion and net earnings increased 7% to $475.7 million.

- Total assets increased to $7.95 billion at the end of the quarter from $7.63 billion at the end of 2006

dover 3Q06_Earnings

Dover Corporation reported financial results for the third quarter of 2006 with the following highlights:

- Earnings from continuing operations increased 27% to $156.3 million compared to $123 million in the prior year.

- Revenue for the quarter increased 21% to $1.651.9 billion.

- Net earnings were $167.5 million including discontinued operations, compared to $122.7 million the previous year.

- The company expects a solid fourth quarter but with results moderating from the third quarter.

More Related Content

What's hot

Verizon Reports Sustained Revenue Growth and Continued Strong Cash Flows fo...

This document summarizes Verizon Communications' consolidated statements of income for the fourth quarter and full year of 2008. Some key details:

- For Q4 2008, total operating revenues increased 3.4% to $24.6 billion and net income increased 15.2% to $1.24 billion compared to Q4 2007.

- For the full year 2008, total operating revenues increased 4.2% to $97.4 billion and net income increased 16.4% to $6.43 billion compared to 2007.

Third Quarter of Fiscal Year Ending March 2021 (FY2020) Financial Highlights

This document provides a summary of Ricoh Leasing Company's financial results for the third quarter of the 2021 fiscal year.

- Net sales and profits increased year-over-year for the 11th and 7th consecutive periods respectively, despite an allowance for doubtful accounts from COVID-19. Operating assets decreased due to securitization.

- Performance was generally positive across business segments. The investment business saw sales and profit increases from prior investments.

- Ricoh is monitoring the full-year forecast carefully due to uncertainty from the pandemic, but progress has been made towards the operating profit target so far.

Nordnet Q2 2011 report

The document provides an interim financial report for a company from January to June 2011. It summarizes key financial figures showing operating income increased 2% and profit after tax rose 25%. It also outlines goals to achieve 100% cost coverage from non-trading commissions by end of 2011 and double revenues within 2 years. The company aims to become the leading savings bank in Nordic countries by 2018 by expanding its existing customer base in Sweden, Norway, Denmark, and Finland.

itw_050127

This document summarizes ITW's fourth quarter 2004 conference call. It includes an agenda for the call, forward-looking statements, highlights and analysis of financial results, segment results for engineered products in North America and internationally, and key economic data. John Brooklier and Jon Kinney will provide introductions, a financial overview, and forecast for 2005. They will also take questions from attendees.

Nordnet Q4 2011 presentation

Presentation of Nordnet's year-end report 2011. For the full report and webcast, visit our corporate website at www.nordnetab.com.

Nordnet year-end report 2010

Nordnet reported increased operating income and profit after tax for 2010 compared to 2009. However, earnings per share were down slightly. For 2011, Nordnet plans cost reductions of 15% to secure goals and visions in light of decreased market activity. Measures include reducing consultants, marketing investments, and potentially reducing staff. Nordnet also reported highlights for 2010 such as successful integrations and new products, and goals to double revenues by 2013 while maintaining operating margins.

Uniliver's financial modeling

Presentation of Unilever link below:

https://www.slideshare.net/ToobaShafique2/presentation1-144714935

2008 04-02 Q2 & Half-Year 2007/2008 Results

The company reported strong financial results for the second quarter and first half of the fiscal year, with net sales increasing 4.0% and 4.5% respectively. Operating profit grew 13.5% in the second quarter excluding one-time items. Cash flow from operating activities was also up significantly. The company will continue its store expansion strategy and establish new markets to further boost sales and profits. Key to ongoing success is maintaining high gross margins while expanding the store base.

danaher 02-3qrel

Danaher Corporation announced its third quarter 2002 results, reporting a 32% increase in net earnings to $116.0 million compared to third quarter 2001. Diluted earnings per share increased 25% year-over-year to $0.74. Total sales for the quarter grew 28% to $1,151.7 million, driven primarily by acquisitions completed in the first quarter of 2002. For the first nine months of 2002, net earnings were $128.7 million which included a $173.8 million one-time non-cash charge related to goodwill impairment. Excluding this charge, nine month net earnings were up 14% to $302.4 million compared to the same period in 2001.

Nordnet Q1 2011 report

Presentation of Nordnet's interim report for January-March 2011. The report was published on 28 April 2011.

atmos enerrgy segmentinfo040408

The document provides revised quarterly segment income statements and balance sheets for a company during fiscal year 2007 based on new reporting segments. The new segments are natural gas distribution, regulated transmission and storage, natural gas marketing, and pipeline, storage and other. Summarized income statements are provided for the quarters ended December 31, 2006, March 31, 2007, June 30, 2007, and September 30, 2007 showing operating revenues, purchased gas costs, operating expenses, operating income, interest charges, income before taxes, and net income for each segment. Financial information is unaudited and should be read with the company's audited annual report.

nationwide 1Q07 Statistical Supplement

This document is Nationwide Financial Services' statistical supplement for the first quarter of 2007. It provides quarterly financial highlights and key metrics for Nationwide's business segments. Nationwide saw total operating revenues of $1.1 billion for Q1 2007, with the Individual Investments segment contributing $365 million and pre-tax operating earnings of $217.6 million. Total customer funds managed and administered were $156.1 billion. Nationwide also reported net income of $203.2 million or $1.38 per diluted share for the quarter.

alltel 4q05supplement

The document summarizes financial information for ALLTEL Corporation for quarterly periods in 2003, 2004, and 2005. It discusses two transactions - the sale of ALLTEL Information Services' financial services division in 2003 and ALLTEL's merger with Western Wireless in 2005. As a result of these transactions, certain operations were classified as discontinued operations. The document also provides consolidated quarterly statements of income for ALLTEL under GAAP and for its continuing/current businesses (non-GAAP), excluding effects of discontinued operations.

occidental petroleum Core Results and Reported Earnings Release

This document contains Occidental Petroleum Corporation's quarterly income statement for 2007 and 2008. It shows revenue, expenses, and earnings for the company's oil and gas, chemicals, and midstream segments. In 2007, the company reported total annual core earnings of $8.3 billion and total annual reported earnings of $5.4 billion. In 2008, total annual core earnings increased to $12.6 billion while total annual reported earnings increased to $6.9 billion. The document also notes that Occidental uses a measure called "core results" to exclude significant transactions and events that vary widely from period to period in order to provide useful information to investors for comparing earnings performance.

2014 Financial Report

This financial report summarizes Santander Group's consolidated financial results for 2014. Some key highlights include:

- Total assets increased 11.7% to €1,266 billion from 2013 to 2014. Net customer loans grew 7.3% and customer deposits increased 6.5% over this period.

- Gross income rose 1.7% to €42.6 billion in 2014. Attributable profit to the Group increased 39.3% to €5.8 billion.

- Capital ratios like CET1 fully-loaded and CET1 phase-in were above requirements at 9.7% and 12.2% respectively as of December 2014.

- Shares outstanding increased 11% to 12

Radio Shack Integrated Cash Flow Model_DCF

The document provides a financial model for Radio Shack with assumptions and projections for income statements, balance sheets, and cash flows from 2003 to 2010. Key assumptions include annual net sales growth of 4.5%, cost of goods sold as a percentage of net sales of 51.1%, and SG&A expenses as a percentage of net sales of 37.2%. The model projects increasing revenues but declining profits and cash flows over this period as operating expenses rise and the company repurchases stock.

Apple Financial Ratios 2014

Financial Management Presentation, Shows Financial Ratios classification and how to calculate those of Apple for fiscal year Oct-2013 to Sep-2014.

nationwide 4Q07 Statistical Supplement

This document is a statistical supplement from Nationwide Financial Services for the fourth quarter of 2007. It includes:

1) Consolidated income statements and balance sheets for Nationwide showing quarterly results. Pre-tax operating earnings were $216.6 million for Q4 2007.

2) Segment results for individual investments, retirement plans, individual protection, and corporate and other. Retirement plans pre-tax operating earnings were $75.9 million in Q4 2007.

3) Key metrics for individual segments such as account values, policy reserves, sales and earnings trends. Sales in Q4 2007 were $4.79 billion.

4) Other financial data like customer funds managed, separate account assets

Financial Statements

Microsoft Corporation reported financial results for the quarter and fiscal year ended June 30, 2004. Revenue increased 15% to $9.3 billion for the quarter and 14% to $36.8 billion for the fiscal year. Net income increased 82% to $2.7 billion for the quarter and 9% to $8.2 billion for the fiscal year. Earnings per share increased 79% to $0.25 for the quarter and 9% to $0.76 for the fiscal year. The company's largest segments by revenue were Client, Server and Tools, and Information Worker.

Press release Hera Group 3q 2008

The Hera Group Board of Directors approved financial results for the first nine months of 2008, showing growth across key metrics. Revenues increased 30.7% to €2,556.5 million, EBITDA rose 17.1% to €350.4 million, and EBIT grew 16.8% to €180 million. All business areas achieved increased profits, with the waste management area contributing most to EBITDA at 37.2% and revenues growing 13.5%. The company expects to meet full-year targets for growth and profitability.

What's hot (20)

Verizon Reports Sustained Revenue Growth and Continued Strong Cash Flows fo...

Verizon Reports Sustained Revenue Growth and Continued Strong Cash Flows fo...

Third Quarter of Fiscal Year Ending March 2021 (FY2020) Financial Highlights

Third Quarter of Fiscal Year Ending March 2021 (FY2020) Financial Highlights

occidental petroleum Core Results and Reported Earnings Release

occidental petroleum Core Results and Reported Earnings Release

Similar to Ac516

dover Q307_10Q

This document is Dover Corporation's Form 10-Q quarterly report filed with the SEC for the quarter ended September 30, 2007. It includes Dover's condensed consolidated financial statements and notes for the periods presented. Some key details:

- Revenue for the quarter increased 15% to $1.84 billion compared to $1.61 billion in the prior year. Net earnings increased 5% to $174.6 million.

- Year-to-date revenue increased 16% to $5.37 billion and net earnings increased 7% to $475.7 million.

- Total assets increased to $7.95 billion at the end of the quarter from $7.63 billion at the end of 2006

dover 3Q06_Earnings

Dover Corporation reported financial results for the third quarter of 2006 with the following highlights:

- Earnings from continuing operations increased 27% to $156.3 million compared to $123 million in the prior year.

- Revenue for the quarter increased 21% to $1.651.9 billion.

- Net earnings were $167.5 million including discontinued operations, compared to $122.7 million the previous year.

- The company expects a solid fourth quarter but with results moderating from the third quarter.

dover Q306_10Q

This document is Dover Corporation's Form 10-Q quarterly report filed with the SEC for the quarter ended September 30, 2006. It includes Dover's condensed consolidated financial statements and notes for the periods. Some key details:

- Revenue for the quarter was $1.65 billion, up 21% from the prior year. Net earnings were $167.5 million.

- Year-to-date revenue was $4.81 billion, up 23% from prior year. Net earnings were $443.3 million.

- Total assets increased to $7.32 billion from $6.58 billion at the end of 2005, driven primarily by acquisitions.

- Cash flow from operations was

dover Q308_Supplement

- Revenue for the third quarter of 2008 was $1.965 billion, up slightly from $1.865 billion in the third quarter of 2007.

- Net earnings for the quarter were $187.65 million, up 8% from $174.59 million in the third quarter of 2007.

- Earnings per share for the quarter were $1.01, up from $0.87 in the prior year period.

DT BSExhibit 5b Dollar Tree, Balance Sheet Data, Fiscal 2009–2014

DT BSExhibit 5b Dollar Tree, Balance Sheet Data, Fiscal 2009–2014 (in $ millions)Balance Sheet as of:Jan-31-2015Feb-01-2014Feb-02-2013Jan-28-2012Jan-29-2011Jan-30-2010ASSETSCash And Equivalents864.1267.7399.9288.3311.2571.6Short Term Investments0000174.827.8 Total Cash & ST Investments864.1267.7399.9288.3486.0599.4Accounts Receivable------ Total Receivables------Inventory1,035.71,035.3971.7867.4803.1679.8Prepaid Exp.66.556.679.427.527.920.2Deferred Tax Assets, Curr.28.318.922.526.216.36.2Other Current Assets------ Total Current Assets1,994.61,378.51,473.51,209.41,333.31,305.6Gross Property, Plant & Equipment2,970.22,710.12,433.92,155.81,945.41,794.8Accumulated Depreciation(1,759.7)(1,616.1)(1,473.2)(1,330.5)(1,204.3)(1,080.5) Net Property, Plant & Equipment1,210.51,094.0960.7825.3741.1714.3Goodwill164.6169.3173.3173.1173.1133.3Other Intangibles1.52.50000Deferred Tax Assets, LT30.624.128.316.838.035.0Deferred Charges, LT74.34.30000Other Long-Term Assets90.999.2116.2104.095.0101.5Total Assets3,567.02,771.92,752.02,328.62,380.52,289.7Assets excluding GW and intangibles3,400.92,600.12,578.72,155.52,207.42,156.4LIABILITIESAccounts Payable433.6393.9346.5286.7261.4219.9Accrued Exp.230.2157.8163.9146.0127.4125.4Curr. Port. of LT Debt012.814.315.516.517.5Curr. Income Taxes Payable42.747.379.663.364.448.6Other Current Liabilities155.174.571.969.563.164.5 Total Current Liabilities861.6686.3676.2581.0532.8475.9Long-Term Debt757.0757.0257.0250.0250.0250.0Other Non-Current Liabilities163.4157.9151.5153.0138.7134.6Total Liabilities1,782.01,601.21,084.7984.0921.5860.5Common Stock2.12.12.21.11.20.9Additional Paid In Capital43.010.70.3---Retained Earnings1,774.01,174.81,666.31,344.11,458.21,430.7Treasury Stock------Comprehensive Inc. and Other(34.1)(16.9)(1.5)(0.6)(0.4)(2.4) Total Common Equity1,785.01,170.71,667.31,344.61,459.01,429.2Total Equity1,785.01,170.71,667.31,344.61,459.01,429.2Total Liabilities And Equity3,567.02,771.92,752.02,328.62,380.52,289.7GW and Intangibles166.10171.80173.30173.10173.10133.30Equity - Unadjusted1,785.01,170.71,667.31,344.61,459.01,429.2Equity + Liabilities3,567.02,771.92,752.02,328.62,380.52,289.7 % Equity50.0%42.2%60.6%57.7%61.3%62.4%GW adj to equity 83.172.6105.0100.0106.183.2Equity excluding GW and intangibles 1,701.91,098.11,562.31,244.61,352.91,346.0Capital Structure:Liabilities1,782.01,601.21,084.7984.0921.5860.5Equity1,785.01,170.71,667.31,344.61,459.01,429.2Total3,567.002,771.902,752.002,328.602,380.502,289.70Capital Structure:Liabilities50.0%57.8%39.4%42.3%38.7%37.6%Equity50.0%42.2%60.6%57.7%61.3%62.4%Total100.0%100.0%100.0%100.0%100.0%100.0%Goodwill & Intangibles Funding:Liabilities83.099.268.373.167.050.1Equity83.172.6105.0100.0106.183.2Total Goodwill & Intangibles166.1171.8173.3173.1173.1133.3

DT ISExhibit 5a Dollar Tree, Income Statement Data, Fiscal 2009-2014 (in $ millions)Fiscal Period EndingJan-31-2015Feb-01-2014Feb-02-2013

Jan-28-2012

Jan-29-2011

Jan-30-2010Revenue8,602.27,840.37,394.56,630.55,882.4 ...

danaher 04-4Q-REL

Danaher Corporation reported record results for the fourth quarter and full year 2004 with net earnings increasing 26% and 36% respectively over the previous year. Fourth quarter sales increased 33% to $1.98 billion while full year sales grew 30% to $6.89 billion. The company also expanded its segment reporting to three segments: Professional Instrumentation, Industrial Technologies, and Tools and Components. The CEO stated they were pleased with the strong gains across all three segments and record cash flow of $1.03 billion, a 20% increase over 2003.

danaher 07_4Q_Release

Danaher Corporation reported financial results for the fourth quarter and full year of 2007. Net earnings for Q4 2007 were $320 million, or $0.97 per diluted share. For the full year 2007, net earnings were $1.37 billion, or $4.19 per diluted share. Sales for Q4 2007 were $3.14 billion, a 19.5% increase over Q4 2006. For the full year 2007, sales were $11.03 billion, a 16.5% increase over 2006. The company's president stated they were pleased with the record results and remain confident in their ability to deliver again in 2008 despite softness in some end markets.

danaher 06_4Q_Release

Danaher reported record results for the fourth quarter and full year of 2006. Net earnings for Q4 2006 increased 28.5% to $323.7 million compared to Q4 2005. For the full year, net earnings increased 25% to $1.122 billion compared to 2005. Sales for Q4 2006 increased 17.5% to $2.66 billion and increased 20% for the full year to $9.596 billion. Danaher also expanded its segment reporting to include Medical Technologies as its own segment.

dover Release_3Q07_18442

Dover Corporation reported a 16% increase in EPS to $0.88 for Q3 2007 compared to $0.76 for Q3 2006. Revenue increased 15% to $1.84 billion. For the first nine months of 2007, EPS increased 11% to $2.36 while revenue increased 15% to $5.37 billion. The company achieved organic growth of 3.3% and acquisition growth of 9.6% in Q3. Looking ahead, Dover expects continued solid business in Q4 but with moderating growth and restructuring charges of $0.02-0.03 per share.

dover news_72507_earnings

Dover Corporation reported record results for the second quarter of 2007, with earnings from continuing operations of $175.1 million (up 10% from 2006), revenue of $1.859 billion (up 12% from 2006), and record backlog of $1.6 billion. For the six months ended June 30, 2007, earnings from continuing operations were $314 million (up 8% from 2006) and revenue was $3.639 billion (up 15% from 2006). The company expects a record third quarter with moderate organic growth and contributions from acquisitions.

dover Q206_10Q

This document is Dover Corporation's Form 10-Q quarterly report filed with the SEC for the quarter ended June 30, 2006. It includes condensed consolidated financial statements such as statements of operations, balance sheets, cash flows, and notes to the financial statements. Some key details include total revenue for the quarter of $1.66 billion, net earnings of $71.9 million, total assets of $6.86 billion, and total stockholders' equity of $3.63 billion. The report provides the company's quarterly and year-to-date financial performance as well as additional disclosures regarding accounting policies, business acquisitions, and subsequent events.

danaher 08_4Q_Release

Danaher Corporation reported financial results for Q4 and full year 2008. Q4 net earnings were $305.7 million compared to $320.2 million in Q4 2007. For the full year, net earnings were $1.3 billion compared to $1.37 billion in 2007. Sales increased 1% in Q4 to $3.18 billion and increased 15% for the full year to $12.7 billion. The CEO stated that while 2009 will be difficult, Danaher's portfolio of businesses and strong balance sheet will allow it to outperform in a challenging market.

itw_10q3q03

The document is Illinois Tool Works Inc.'s quarterly report filed with the SEC for the quarter ending September 30, 2003. It includes the company's unaudited financial statements and notes. The financial statements show that for the quarter, ITW reported revenues of $2.5 billion, operating income of $426.7 million, net income of $268.9 million, and basic earnings per share of $0.88. For the nine months ending September 30, revenues were $7.4 billion, operating income was $1.2 billion, net income was $740.4 million, and basic EPS was $2.41.

itw_10q3q03

This document is Illinois Tool Works Inc.'s quarterly report filed with the SEC for the quarter ending September 30, 2003. It includes Illinois Tool Works' statement of income, balance sheet, cash flows statement, and notes to the financial statements. For the quarter, Illinois Tool Works reported net income of $268.9 million on revenues of $2.531 billion. Total assets as of September 30, 2003 were $10.795 billion, with total stockholders' equity of $7.399 billion. Cash provided by operating activities for the first nine months of 2003 was $888.5 million.

Intl Financial Highlights

This document provides financial highlights for a company over multiple years including revenue, operating income, net income, earnings per share, cash and short term investments, total assets, and stockholders' equity. The highlights are presented in British Pounds, Australian Dollars, Japanese Yen, Euros, and Canadian Dollars. Revenue increased most years as did operating income, net income, and total assets.

danaher 06-3Q-REL

Danaher Corporation announced record financial results for the third quarter and first nine months of 2006. Net earnings increased 17% for the quarter and 24% year-to-date compared to the same periods in 2005. Sales also increased substantially both for the quarter (24% higher) and year-to-date (21% higher). The CEO stated that core revenue growth remained strong and they expect to continue delivering positive results for the remainder of the year based on the strength of their businesses.

Q1 2009 Earning Report of Smith International, Inc.

Smith International, Inc. reported revenues of $2.41 billion for the first quarter of 2009, a slight increase from $2.37 billion in the first quarter of 2008. Net income was $144.2 million, down compared to $246.1 million in the prior year quarter. Earnings per share for the quarter were $0.44, the same as the previous quarter and down from $0.87 in the first quarter of 2008. Total current assets were $4.82 billion as of March 31, 2009, down from $5.09 billion as of December 31, 2008.

aon 10Q_110708

This document is Aon Corporation's quarterly report (Form 10-Q) filed with the SEC for the quarter ending September 30, 2008. It includes Aon's condensed consolidated financial statements and notes. The financial statements show that for the quarter, Aon's revenue was $1.8 billion, income from continuing operations was $153 million, and net income was $117 million. For the nine months ended September 30, 2008, revenue was $5.7 billion, income from continuing operations was $494 million, and net income was $1.5 billion. The report provides Aon's required quarterly disclosures to the SEC and investors including financial position, results of operations, cash flows, risks and legal proceedings

danaher 08_2Q_Release

Danaher Corporation announced record results for the second quarter of 2008, with net earnings from continuing operations of $363 million, an 18% increase over the second quarter of 2007. Sales increased 25% to $3.28 billion. The company also saw a 22% increase in adjusted net earnings from continuing operations, which excludes certain charges related to an acquisition. For the first six months of 2008, net earnings from continuing operations were $640 million, up 14.5% compared to the same period in 2007. The company's CEO stated that despite economic conditions, the company's businesses are well positioned for the rest of 2008.

danaher 06-1Q-Rel

Danaher Corporation announced record first quarter results for 2006, with net earnings of $216 million, a 15% increase from 2005. Total sales increased 17.5% to $2.14 billion due to 12.5% growth from acquisitions and 7.5% core revenue growth. Operating cash flow was also up 8% from the previous record set in 2005. The company's CEO stated that the broad-based strength across businesses reinforces confidence in delivering positive results for the rest of 2006.

Similar to Ac516 (20)

DT BSExhibit 5b Dollar Tree, Balance Sheet Data, Fiscal 2009–2014

DT BSExhibit 5b Dollar Tree, Balance Sheet Data, Fiscal 2009–2014

Q1 2009 Earning Report of Smith International, Inc.

Q1 2009 Earning Report of Smith International, Inc.

Recently uploaded

Your Skill Boost Masterclass: Strategies for Effective Upskilling

Your Skill Boost Masterclass: Strategies for Effective UpskillingExcellence Foundation for South Sudan

Strategies for Effective Upskilling is a presentation by Chinwendu Peace in a Your Skill Boost Masterclass organisation by the Excellence Foundation for South Sudan on 08th and 09th June 2024 from 1 PM to 3 PM on each day.BÀI TẬP DẠY THÊM TIẾNG ANH LỚP 7 CẢ NĂM FRIENDS PLUS SÁCH CHÂN TRỜI SÁNG TẠO ...

BÀI TẬP DẠY THÊM TIẾNG ANH LỚP 7 CẢ NĂM FRIENDS PLUS SÁCH CHÂN TRỜI SÁNG TẠO ...Nguyen Thanh Tu Collection

https://app.box.com/s/qhtvq32h4ybf9t49ku85x0n3xl4jhr15clinical examination of hip joint (1).pdf

described clinical examination all orthopeadic conditions .

Walmart Business+ and Spark Good for Nonprofits.pdf

"Learn about all the ways Walmart supports nonprofit organizations.

You will hear from Liz Willett, the Head of Nonprofits, and hear about what Walmart is doing to help nonprofits, including Walmart Business and Spark Good. Walmart Business+ is a new offer for nonprofits that offers discounts and also streamlines nonprofits order and expense tracking, saving time and money.

The webinar may also give some examples on how nonprofits can best leverage Walmart Business+.

The event will cover the following::

Walmart Business + (https://business.walmart.com/plus) is a new shopping experience for nonprofits, schools, and local business customers that connects an exclusive online shopping experience to stores. Benefits include free delivery and shipping, a 'Spend Analytics” feature, special discounts, deals and tax-exempt shopping.

Special TechSoup offer for a free 180 days membership, and up to $150 in discounts on eligible orders.

Spark Good (walmart.com/sparkgood) is a charitable platform that enables nonprofits to receive donations directly from customers and associates.

Answers about how you can do more with Walmart!"

How to Create a More Engaging and Human Online Learning Experience

How to Create a More Engaging and Human Online Learning Experience Wahiba Chair Training & Consulting

Wahiba Chair's Talk at the 2024 Learning Ideas Conference. PCOS corelations and management through Ayurveda.

This presentation includes basic of PCOS their pathology and treatment and also Ayurveda correlation of PCOS and Ayurvedic line of treatment mentioned in classics.

বাংলাদেশ অর্থনৈতিক সমীক্ষা (Economic Review) ২০২৪ UJS App.pdf

বাংলাদেশের অর্থনৈতিক সমীক্ষা ২০২৪ [Bangladesh Economic Review 2024 Bangla.pdf] কম্পিউটার , ট্যাব ও স্মার্ট ফোন ভার্সন সহ সম্পূর্ণ বাংলা ই-বুক বা pdf বই " সুচিপত্র ...বুকমার্ক মেনু 🔖 ও হাইপার লিংক মেনু 📝👆 যুক্ত ..

আমাদের সবার জন্য খুব খুব গুরুত্বপূর্ণ একটি বই ..বিসিএস, ব্যাংক, ইউনিভার্সিটি ভর্তি ও যে কোন প্রতিযোগিতা মূলক পরীক্ষার জন্য এর খুব ইম্পরট্যান্ট একটি বিষয় ...তাছাড়া বাংলাদেশের সাম্প্রতিক যে কোন ডাটা বা তথ্য এই বইতে পাবেন ...

তাই একজন নাগরিক হিসাবে এই তথ্য গুলো আপনার জানা প্রয়োজন ...।

বিসিএস ও ব্যাংক এর লিখিত পরীক্ষা ...+এছাড়া মাধ্যমিক ও উচ্চমাধ্যমিকের স্টুডেন্টদের জন্য অনেক কাজে আসবে ...

How to Manage Your Lost Opportunities in Odoo 17 CRM

Odoo 17 CRM allows us to track why we lose sales opportunities with "Lost Reasons." This helps analyze our sales process and identify areas for improvement. Here's how to configure lost reasons in Odoo 17 CRM

ANATOMY AND BIOMECHANICS OF HIP JOINT.pdf

it describes the bony anatomy including the femoral head , acetabulum, labrum . also discusses the capsule , ligaments . muscle that act on the hip joint and the range of motion are outlined. factors affecting hip joint stability and weight transmission through the joint are summarized.

Reimagining Your Library Space: How to Increase the Vibes in Your Library No ...

Librarians are leading the way in creating future-ready citizens – now we need to update our spaces to match. In this session, attendees will get inspiration for transforming their library spaces. You’ll learn how to survey students and patrons, create a focus group, and use design thinking to brainstorm ideas for your space. We’ll discuss budget friendly ways to change your space as well as how to find funding. No matter where you’re at, you’ll find ideas for reimagining your space in this session.

Advanced Java[Extra Concepts, Not Difficult].docx![Advanced Java[Extra Concepts, Not Difficult].docx](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Advanced Java[Extra Concepts, Not Difficult].docx](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

This is part 2 of my Java Learning Journey. This contains Hashing, ArrayList, LinkedList, Date and Time Classes, Calendar Class and more.

Main Java[All of the Base Concepts}.docx

This is part 1 of my Java Learning Journey. This Contains Custom methods, classes, constructors, packages, multithreading , try- catch block, finally block and more.

Beyond Degrees - Empowering the Workforce in the Context of Skills-First.pptx

Iván Bornacelly, Policy Analyst at the OECD Centre for Skills, OECD, presents at the webinar 'Tackling job market gaps with a skills-first approach' on 12 June 2024

South African Journal of Science: Writing with integrity workshop (2024)

South African Journal of Science: Writing with integrity workshop (2024)Academy of Science of South Africa

A workshop hosted by the South African Journal of Science aimed at postgraduate students and early career researchers with little or no experience in writing and publishing journal articles.BÀI TẬP BỔ TRỢ TIẾNG ANH 8 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2023-2024 (CÓ FI...

BÀI TẬP BỔ TRỢ TIẾNG ANH 8 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2023-2024 (CÓ FI...Nguyen Thanh Tu Collection

https://app.box.com/s/y977uz6bpd3af4qsebv7r9b7s21935vdHow to Make a Field Mandatory in Odoo 17

In Odoo, making a field required can be done through both Python code and XML views. When you set the required attribute to True in Python code, it makes the field required across all views where it's used. Conversely, when you set the required attribute in XML views, it makes the field required only in the context of that particular view.

Recently uploaded (20)

Your Skill Boost Masterclass: Strategies for Effective Upskilling

Your Skill Boost Masterclass: Strategies for Effective Upskilling

BÀI TẬP DẠY THÊM TIẾNG ANH LỚP 7 CẢ NĂM FRIENDS PLUS SÁCH CHÂN TRỜI SÁNG TẠO ...

BÀI TẬP DẠY THÊM TIẾNG ANH LỚP 7 CẢ NĂM FRIENDS PLUS SÁCH CHÂN TRỜI SÁNG TẠO ...

Walmart Business+ and Spark Good for Nonprofits.pdf

Walmart Business+ and Spark Good for Nonprofits.pdf

How to Create a More Engaging and Human Online Learning Experience

How to Create a More Engaging and Human Online Learning Experience

Film vocab for eal 3 students: Australia the movie

Film vocab for eal 3 students: Australia the movie

বাংলাদেশ অর্থনৈতিক সমীক্ষা (Economic Review) ২০২৪ UJS App.pdf

বাংলাদেশ অর্থনৈতিক সমীক্ষা (Economic Review) ২০২৪ UJS App.pdf

How to Manage Your Lost Opportunities in Odoo 17 CRM

How to Manage Your Lost Opportunities in Odoo 17 CRM

Reimagining Your Library Space: How to Increase the Vibes in Your Library No ...

Reimagining Your Library Space: How to Increase the Vibes in Your Library No ...

Beyond Degrees - Empowering the Workforce in the Context of Skills-First.pptx

Beyond Degrees - Empowering the Workforce in the Context of Skills-First.pptx

South African Journal of Science: Writing with integrity workshop (2024)

South African Journal of Science: Writing with integrity workshop (2024)

BÀI TẬP BỔ TRỢ TIẾNG ANH 8 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2023-2024 (CÓ FI...

BÀI TẬP BỔ TRỢ TIẾNG ANH 8 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2023-2024 (CÓ FI...

Ac516

- 1. Financial data in U.S. Dollars Values in Millions (Except for per share items) <br /> 20092008200720062005Period End Date12/31/200912/31/200812/31/200712/31/200612/31/2005Period Length12 Months12 Months12 Months12 Months12 MonthsStmt Source10-K10-K10-K10-K10-KStmt Source Date02/26/201002/27/200902/27/200802/28/200703/08/2006Stmt Update TypeUpdatedUpdatedUpdatedUpdatedUpdated Net Income/Starting Line145.9240.2300.8338.4356.3Depreciation/Depletion213.7204.9192.3200.9158.5Amortization0.00.00.00.00.0Deferred Taxes11.0-31.0-31.0-21.9-22.3Non-Cash Items29.335.019.945.838.8Unusual Items0.0-1.1-3.50.00.0Other Non-Cash Items29.336.123.445.838.8Changes in Working Capital2.333.082.2107.745.1Accounts Receivable2.3150.55.566.693.5Inventories81.226.1-6.6-48.655.7Accounts Payable-47.8-80.136.627.5-97.8Accrued Expenses-16.0-39.7-7.462.0-134.7Other Assets & Liabilities, Net-17.4-23.854.10.2112.6Other Operating Cash Flow0.00.00.00.015.8Cash from Operating Activities402.2482.1564.2670.9576.4 Capital Expenditures-242.0-217.7-182.7-200.2-201.3Purchase of Fixed Assets-242.0-217.7-182.7-200.2-201.3Other Investing Cash Flow Items, Total13.8-209.9-104.7312.9206.2Acquisition of Business-10.10.00.00.00.0Sale of Business0.04.68.10.00.0Sale/Maturity of Investment894.7533.8855.31,721.01,824.7Purchase of Investments-870.5-744.4-968.2-1,406.2-1,604.3Other Investing Cash Flow-0.3-3.90.1-1.9-14.2Cash from Investing Activities-228.2-427.6-287.4112.74.9 Financing Cash Flow Items10.4-0.12.39.0-3.0Other Financing Cash Flow10.4-0.12.39.0-3.0Total Cash Dividends Paid0.00.00.00.00.0Issuance (Retirement) of Stock, Net0.0-548.2-149.3-817.7-1,032.4Issuance (Retirement) of Debt, Net-6.6500.20.00.0-1.5Cash from Financing Activities3.8-48.1-147.0-808.7-1,036.9 Foreign Exchange Effects2.3-4.22.61.4-2.3Net Change in Cash180.12.2132.4-23.7-457.9 Net Cash - Beginning Balance279.2277.0144.6168.3626.2Net Cash - Ending Balance459.3279.2277.0144.6168.3<br />Income statement<br />Financial data in U.S. Dollars Values in Millions (Except for per share items) <br /> 20092008200720062005Period End Date12/31/200912/31/200812/31/200712/31/200612/31/2005Period Length12 Months12 Months12 Months12 Months12 MonthsStmt Source10-K10-K10-K10-K10-KStmt Source Date02/26/201002/26/201002/27/200802/28/200703/08/2006Stmt Update TypeUpdatedReclassifiedUpdatedUpdatedUpdated Revenue3,879.94,528.44,973.95,108.15,221.5Total Revenue3,879.94,528.44,973.95,108.15,221.5 Cost of Revenue, Total2,570.12,993.83,410.33,462.13,585.9Gross Profit1,309.81,534.61,563.61,646.01,635.6 Selling/General/Administrative Expenses, Total647.8807.3812.8761.8755.1Research & Development375.3423.3403.8370.5336.4Depreciation/Amortization0.00.00.00.00.0Interest Expense (Income), Net Operating0.00.00.00.00.0Unusual Expense (Income)73.726.825.771.210.4Other Operating Expenses, Total0.00.00.00.00.0Operating Income213.0277.2321.3442.5533.7 Interest Income (Expense), Net Non-Operating0.00.00.00.00.0Gain (Loss) on Sale of Assets0.00.00.00.00.0Other, Net-4.6-7.47.0-5.3-6.5Income Before Tax187.0275.9349.5459.3553.7 Income Tax - Total41.135.748.7120.9197.4Income After Tax145.9240.2300.8338.4356.3 Minority Interest0.00.00.00.00.0Equity In Affiliates0.00.00.00.00.0U.S. GAAP Adjustment0.00.00.00.00.0Net Income Before Extra. Items145.9240.2300.8338.4356.3 Total Extraordinary Items0.00.00.00.00.0Net Income145.9240.2300.8338.4356.3 Total Adjustments to Net Income0.00.00.00.00.0Preferred Dividends0.00.00.00.00.0General Partners' Distributions0.00.00.00.00.0 Basic Weighted Average Shares78.288.995.3102.8121.0Basic EPS Excluding Extraordinary Items1.872.73.163.292.94Basic EPS Including Extraordinary Items1.872.73.163.292.94 Diluted Weighted Average Shares78.689.295.8103.5122.3Diluted EPS Excluding Extrordinary Items1.862.693.143.272.91Diluted EPS Including Extraordinary Items1.862.693.143.272.91 Dividends per Share - Common Stock Primary Issue0.00.00.00.00.0Gross Dividends - Common Stock0.00.00.00.00.0Interest Expense, Supplemental39.328.913.012.111.2Depreciation, Supplemental209.1203.2191.0199.5157.1 Normalized EBITDA525.0537.8559.2713.2701.2Normalized EBIT315.9334.6368.2513.7544.1Normalized Income Before Tax289.9333.3396.4530.5564.1Normalized Income After Taxes226.18290.17341.16390.86362.99Normalized Income Available to Common226.18290.17341.16390.86362.99 Basic Normalized EPS2.893.263.583.83.0Diluted Normalized EPS2.883.253.563.782.97<br />blance sheet<br />Financial data in U.S. Dollars Values in Millions (Except for per share items) <br /> 20092008200720062005Period End Date12/31/200912/31/200812/31/200712/31/200612/31/2005Stmt Source10-K10-K10-K10-K10-KStmt Source Date02/26/201002/27/200902/27/200802/28/200703/08/2006Stmt Update TypeUpdatedUpdatedUpdatedUpdatedUpdated Assets Cash and Short Term Investments1,132.5973.3796.1550.9888.8Cash & Equivalents459.3279.2277.0144.6168.3Short Term Investments673.2694.1519.1406.3720.5Total Receivables, Net424.9427.3578.8584.3650.9Accounts Receivable - Trade, Net424.9427.3578.8584.3650.9Accounts Receivable - Trade, Gross458.6463.4615.3622.3688.3Provision for Doubtful Accounts-33.7-36.1-36.5-38.0-37.4Total Inventory357.3438.3464.4457.8409.2Prepaid Expenses226.0223.8227.5237.0220.7Other Current Assets, Total0.00.00.00.00.0Total Current Assets2,140.72,062.72,066.81,830.02,169.6 Property/Plant/Equipment, Total - Net914.9863.2869.0846.8832.2Goodwill, Net0.00.00.00.00.0Intangibles, Net0.00.00.00.00.0Long Term Investments22.024.70.00.00.0Note Receivable - Long Term0.00.00.00.00.0Other Long Term Assets, Total276.6314.8185.3172.2328.3Other Assets, Total0.00.00.00.00.0Total Assets3,354.23,265.43,121.12,849.03,330.1 Liabilities and Shareholders' Equity Accounts Payable510.1557.1636.9600.3572.8Payable/Accrued0.00.00.00.00.0Accrued Expenses251.5302.7295.6365.7316.7Notes Payable/Short Term Debt0.05.50.00.00.0Current Port. of LT Debt/Capital Leases0.00.0149.90.00.0Other Current Liabilities, Total430.2392.2414.9358.0344.2Total Current Liabilities1,191.81,257.51,497.31,324.01,233.7 Total Long Term Debt648.9648.70.0149.8149.6Long Term Debt648.9648.70.0149.8149.6Deferred Income Tax0.00.00.00.00.0Minority Interest0.00.00.00.00.0Other Liabilities, Total499.9547.1345.5340.0518.1Total Liabilities2,340.62,453.31,842.81,813.81,901.4 Redeemable Preferred Stock0.00.00.00.00.0Preferred Stock - Non Redeemable, Net0.00.00.00.00.0Common Stock0.90.91.11.11.2Additional Paid-In Capital820.0803.5887.8827.3832.5Retained Earnings (Accumulated Deficit)839.8692.5935.7627.5988.8Treasury Stock - Common-404.5-404.5-454.7-289.8-230.5Other Equity, Total-242.6-280.3-91.6-130.9-163.3Total Equity1,013.6812.11,278.31,035.21,428.7 Total Liabilities & Shareholders’ Equity3,354.23,265.43,121.12,849.03,330.1 Total Common Shares Outstanding78.177.794.797.0111.9Total Preferred Shares Outstanding0.00.00.00.00.0<br />