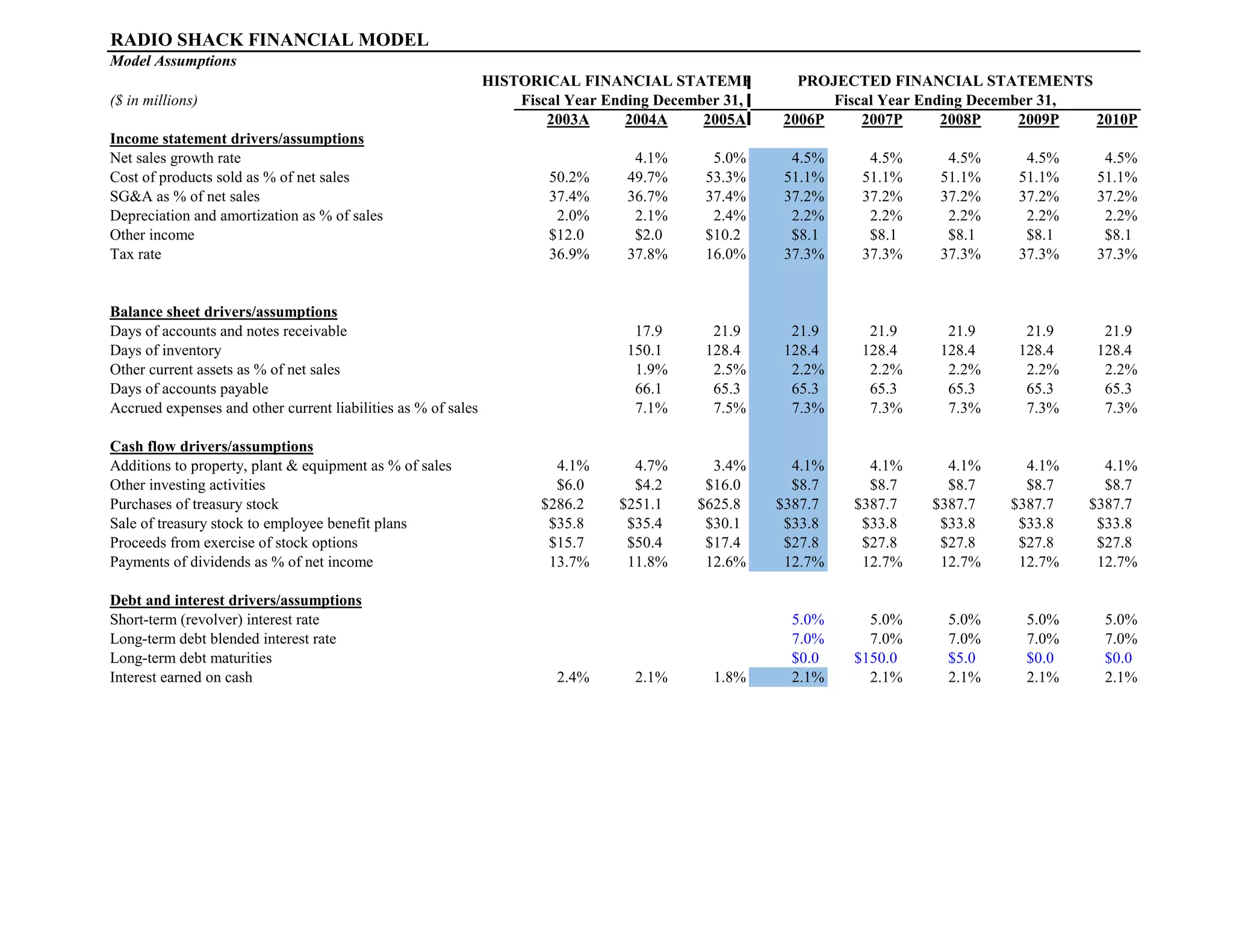

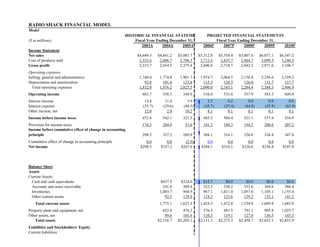

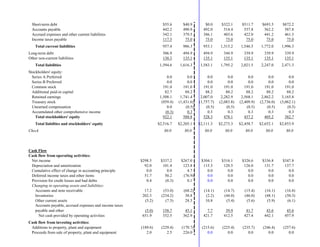

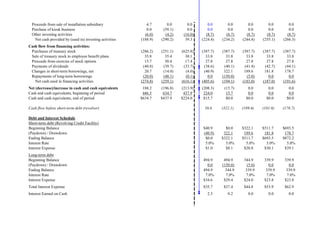

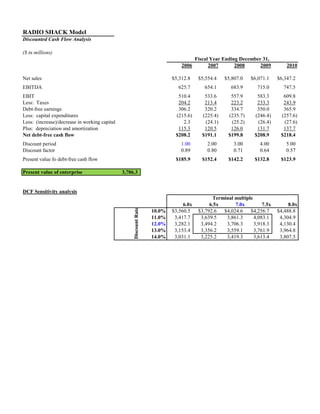

The document provides a financial model for Radio Shack with assumptions and projections for income statements, balance sheets, and cash flows from 2003 to 2010. Key assumptions include annual net sales growth of 4.5%, cost of goods sold as a percentage of net sales of 51.1%, and SG&A expenses as a percentage of net sales of 37.2%. The model projects increasing revenues but declining profits and cash flows over this period as operating expenses rise and the company repurchases stock.