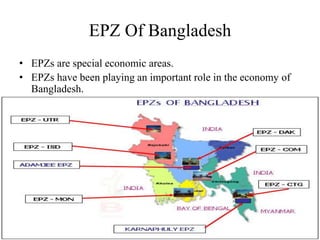

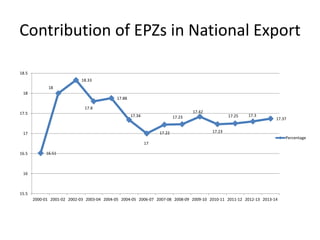

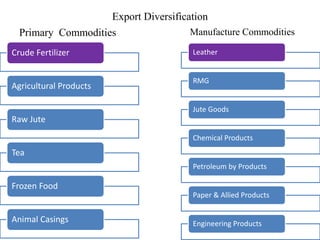

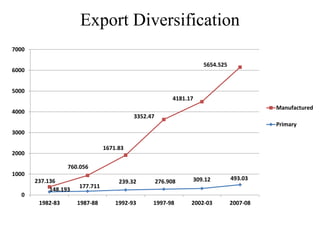

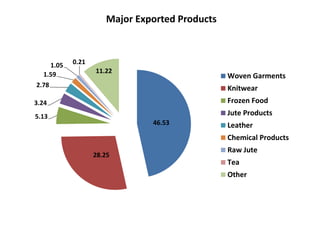

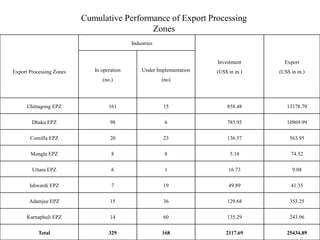

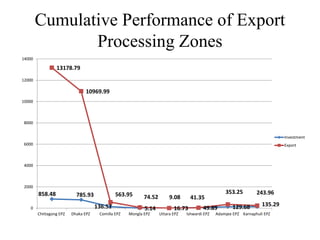

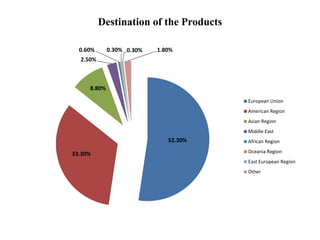

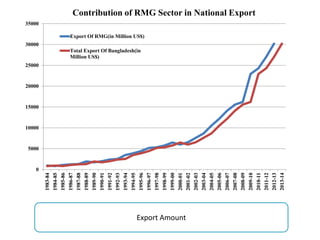

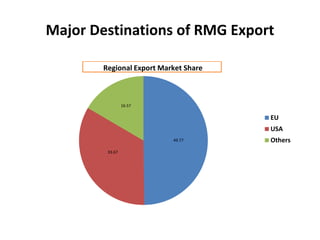

This document analyzes the export performance of Bangladesh's export processing zones. It finds that export processing zones have played a key role in rapidly increasing Bangladesh's exports, with the zones contributing around 17% of national exports on average. The ready-made garments sector in particular has been very successful, accounting for over 75% of export earnings and growing at over 15% annually. While the zones and garments sector face some challenges, Bangladesh has significant potential to further grow its exports if it addresses issues like infrastructure development and worker training.