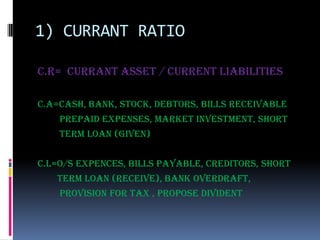

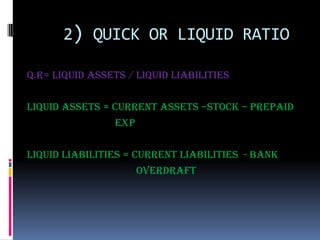

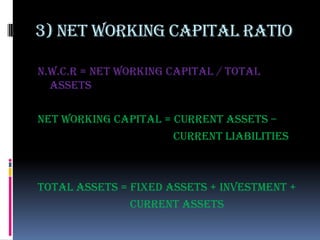

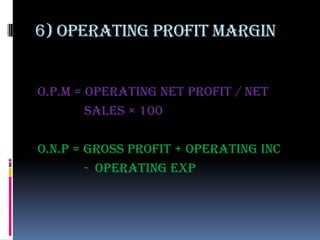

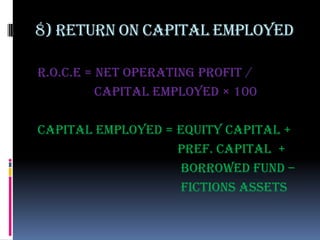

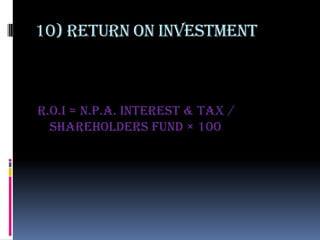

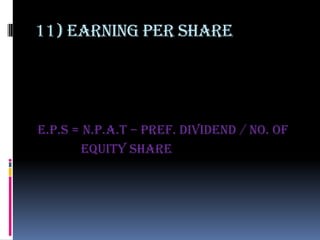

The document defines and provides the formulas for 11 common financial ratios used to analyze a company's performance and financial situation. These ratios include the current ratio, quick ratio, net working capital ratio, gross profit ratio, net profit ratio, operating profit margin, operating ratio, return on capital employed, return on equity shareholders, return on investment, and earnings per share. The formulas use various elements of a company's financial statements such as assets, liabilities, revenues, expenses, profits, and shareholder equity to calculate important performance metrics.