Mekdella Woreda Chimit Masonry Dam CBA

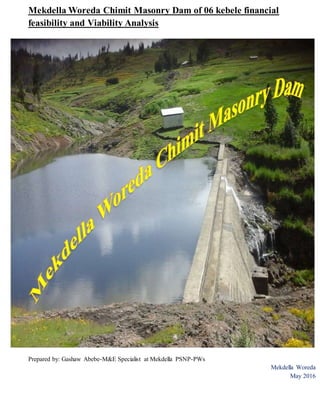

- 1. Mekdella Woreda Chimit Masonry Dam of 06 kebele financial feasibility and Viability Analysis Prepared by: Gashaw Abebe-M&E Specialist at Mekdella PSNP-PWs Mekdella Woreda May 2016

- 2. Chimit Masonry Dam financial feasibility and Viability Analysis Ever since 2011/12, in Mekdella Woreda Agriculture Development Office, under the support of PSNP capital budget various types of modern river diversion had been built which create enabling environment for smallholder farmers to improve agricultural products and productivities through commercial crop intervention in addition to stabilizing local markets. Profitability of irrigation schemes built before 2012/13 is earlier known since they are constructed rooted in none- intermittent local rivers; assessing financially viable, technically implementable and socially acceptable broadly emerging masonry dams before years of effort has been worthless (money, material, labor and time) is deemed important. To materialize it, therefore, a result of the study conducted on Chimit Masonry Dam built in 2015 in 06 kebele is explained bellow. Capital outlay from PSNP budget 1,019,703 Ethiopian Birr (ETB) had been utilized to construct the dam which can irrigate 48 ha of farm land to benefit 189 household heads. In this year,the dam is limited to cultivate onion, fenugreek, lentil, potato, etc only on 11 ha of farm land caused by el-nino crises resulted in reduction of volume of water. Taking the labor for farming practices as an implicit cost, in the first production year of 2015/16, as an operating cost, 205,306 ETB had been utilized to purchase selected seeds,fertilizer, pest and insecticide. This cost will significantly increase each year adding maintenance cost of the dam after two or three years. Cash inflow has shown a little decline in the first production year related to insufficient water reservation of the dam due to the prevailed drought. However,if the dam lasts long holding substantial amount of water in the upcoming years: more coverage of farm land will be irrigated; many farmers will get experience to participate; farmers will prefer to be engaged on producing high value crops and selling price will be improved and thus leading to surplus production. Based on this fact,keeping sustainable productivity of the dam, accounting profit-cost benefit analysis of Chimit Masonry Dam for the first five years is described here below using Payback Period, Net Present Value (NPV) and Internal Rate of Return (IRR). Note that all unites of money in this study is Ethiopian Birr (ETB) Activities Initial cost(0 Year) Year 1 Year 2 Year 3 Year 4 Year 5 T/Sum A) TotalCash outflow 1,019,703 205,306 250,410 302,920 375,169 450,960 2,604,468 B) Totalcash inflow 0 940,670 1,450,179 1,965,600 2,580,911 3,124,890 10,062,250 Net cash inflow(A-B) -1,019,703 735,364 1,199,769 1,662,680 2,205,742 2,673,930 7,457,782 NPV @ 12% -1,019,703 656,606.52 956,455.85 1,183,495.62 1,401,749 1,517,187.9 5,715,494.9 1. Payback Period Payback period uses to know how long it will take to earn back the money we invest on the project. Since the return from the project is expected to vary from year to year, we simply add up the expected returns for each succeeding year, until we arrive at the total cost of the project. In our case,the project would be completely paid for about 13 months in to the second year. Payback period = 𝑐𝑎𝑠ℎ 𝑜𝑢𝑡𝑓𝑙𝑜𝑤 𝑎𝑛𝑛𝑢𝑎𝑙 𝑐𝑎𝑠ℎ 𝑖𝑛𝑓𝑙𝑜𝑤 + = 𝑢𝑛𝑝𝑎𝑖𝑑 𝑐𝑎𝑠ℎ 𝑜𝑢𝑡 𝑓𝑙𝑜𝑤 𝑑𝑒𝑑𝑢𝑐𝑡𝑒𝑑 𝑓𝑟𝑜𝑚 𝑠𝑒𝑐𝑜𝑛𝑑 𝑦𝑒𝑎𝑟 𝑟𝑒𝑣𝑒𝑛𝑢𝑒 𝑠𝑒𝑐𝑜𝑛𝑑 𝑦𝑒𝑎𝑟 𝑐𝑎𝑠ℎ 𝑜𝑢𝑡𝑓𝑙𝑜𝑤 1+ 79,033 1,450,179 = 1.0545 years (Therefore,the dam will take 385 days = 1 year & 20 days to earn back the money). Using the payback period, we can only know the period it takes to recoup the original investment. However,it completely ignores the time value of money and the total project return. We therefore,use the Net Present Value (NPV) and Internal Rate of Return to solve this problem. These project evaluation methods allow us to consider time value of money. 2. Net present value (NPV) Basically, it allows us to know the present value in “to day’s birr” of the future net cash flow of a project. Then we can compare that amount with the amount of money needed to implement the project. If NPV is positive the project is acceptable to be implemented, if it is negative it could be rejected. Zero value projects are determined by the investor either to succeed or stop. Using this approach and the table illustrated above, NPV is calculated as follows: Net present value (NPV) = PVB – PVC Where,PVB = present value of benefit PVC = present value of cost 𝑁𝑃𝑉 = ∑ 𝐵𝑡 (1+𝑟) 𝑛 𝑖=0 − ∑ 𝐶𝑡 (1+𝑟) 𝑛 𝑖=0 Where,B = Benefits; C = Costs; r = discount rate; t = time period; n = number of time periods

- 3. NPV equals the summation from t = 0 (the initial start-up of the program) to t =n (the final year of the program) of [(Bt –Ct) / (1 + r) t]. 𝑁𝑃𝑉 = ∑ 𝐵𝑡 (1+𝑟) 𝑛 𝑖=0 − ∑ 𝐶𝑡 (1+𝑟) 𝑛 𝑖=0 NPV @ 12% = 5,715,494.9 -1,019,703 = 4,695,791.87 The project is financially viable since NPV is positive. 3. Internal Rate ofReturn(IRR) Essentially, IRR allows us to find the interest rate that is equivalent to the birr returns we expect from our project or the birr return should be higher than we have discounted the project. Once we know the rate, we can compare it to the rates we could earn by investing our money in our intended project or other investments. If IRR is less than the prevailing discount rate,the project will definitely be worthless. Therefore,it is to be acceptable,a project must be expected to earn an IRR that is as a minimum severalpercentages higher than the cost of investment, to implement the project for its risk, time and the trouble associated with it. IRR has the following method of calculation. IRR = ∑ 𝐵𝑡 (1+𝑟) 𝑛 𝑖=0 − ∑ 𝐶𝑡 (1+𝑟) 𝑛 𝑖=0 =0 Using rules of linear algebra, IRR can be computed as; 8,477,485 (1+𝐼𝑅𝑅) = 1,019,703 1,019,703(1+IRR) = 8,477,485 IRR= 8,477,485 1,019,703 -1= 7.3136805520823 IRR =731% Since by severalpercentages IRR is greater r (731% >12%) , this project is certainly acceptable to be implemented. In both methods, the project (Chimit Masonry Dam) is financially viable, technically implementable and socially acceptable. The following chart displays incremental change of net cash inflow and NPV each year. -1,500,000 -1,000,000 -500,000 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 Intial Year Year 1 Year 2 Year 3 Year 4 Year 5 Net cash inflow -1,019,703 735,364 1,199,769 1,662,680 2,205,742 2,673,930 NPV @12% -1,019,703 656,606.52 956,455.85 1,183,495.62 1,401,749 1,517,187.90 -1,019,703 735,364 1,199,769 1,662,680 2,205,742 2,673,930 -1,019,703 656,606.52 956,455.85 1,183,495.62 1,401,749 1,517,187.90 Mekdella Woreda Chimit Masonry Dam, diagramatic illustration of cost benefit analysis from 2015-2020 Net cash inflow NPV @12%