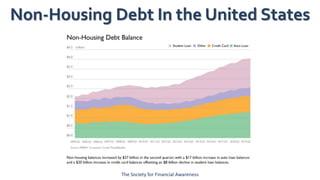

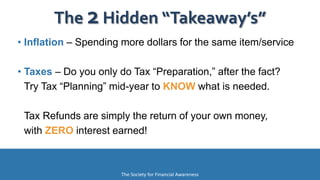

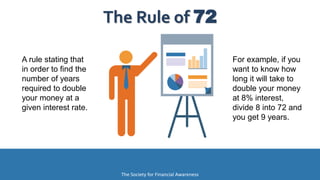

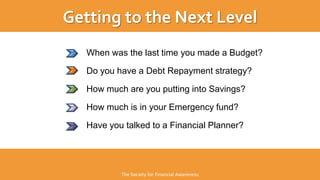

The document is a presentation from The Society for Financial Awareness (SOFA) providing an overview of getting financially fit. It discusses challenges like longer lifespans and insufficient savings for retirement. It emphasizes developing a budget, reducing debt through methods like snowball payment, building an emergency fund, and investing for the future in vehicles like 401ks and IRAs. The presentation aims to educate attendees on taking control of their finances through planning and commitment to financial goals.