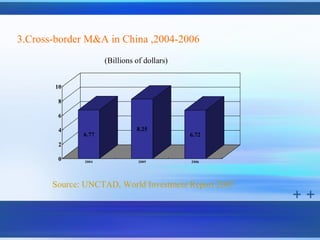

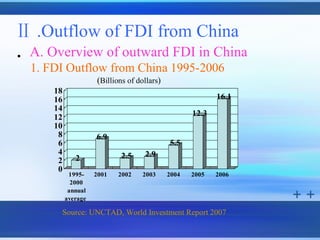

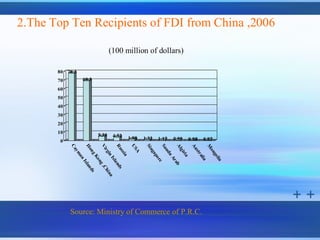

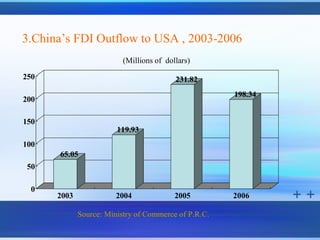

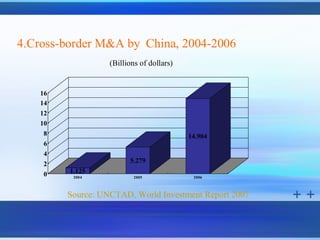

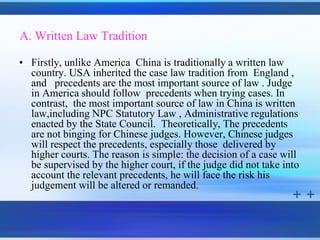

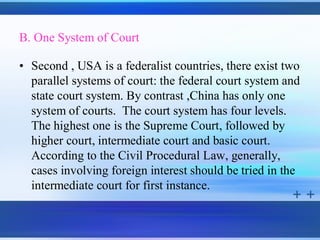

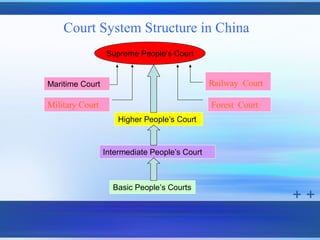

The document discusses the trends and policies surrounding foreign direct investment (FDI) in China, highlighting the historical context, recent reforms, and the emphasis on attracting high-quality investment. It notes the optimistic prospects for both inward and outward FDI due to China's large market potential and the government's proactive strategies such as the 'going global' initiative for Chinese enterprises. Additionally, it briefly contrasts the Chinese and American legal systems concerning FDI, indicating similarities in commercial law which may benefit U.S. investors.