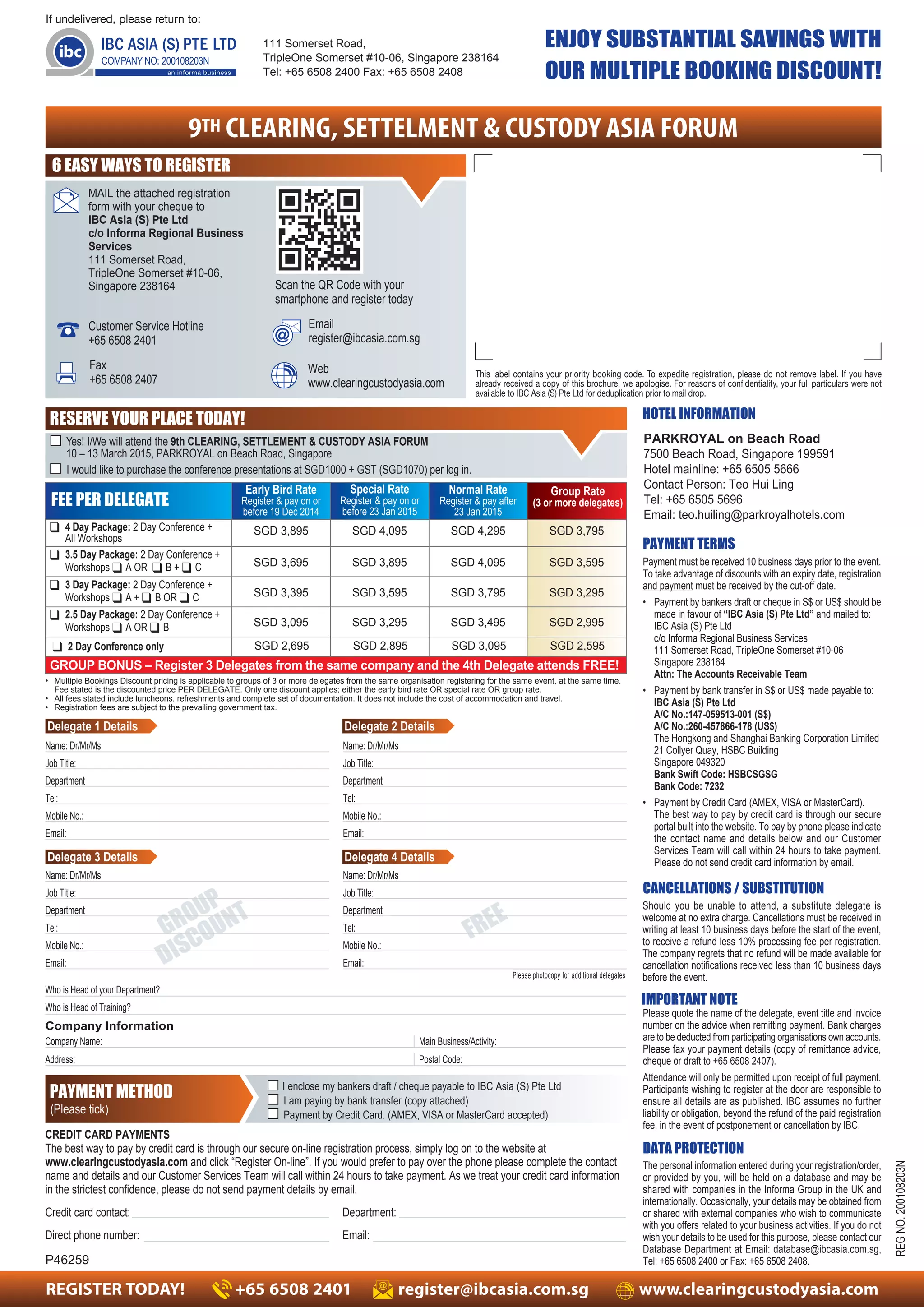

The 9th Clearing, Settlement & Custody Asia Forum took place from March 10-13, 2015, in Singapore, featuring industry leaders from various Asian countries discussing topics like post-trade processing, OTC regulations, and market developments. The event highlighted the importance of adapting to regional regulatory changes and improving operational infrastructure to enhance cross-border trading. Attendees participated in workshops focusing on market opportunities in Thailand and Vietnam, as well as a post-conference workshop on transforming collateral management.