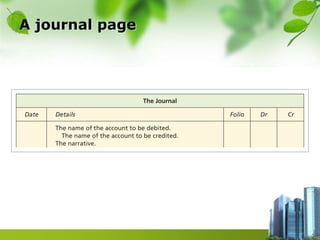

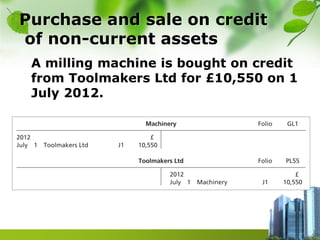

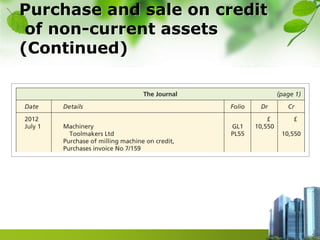

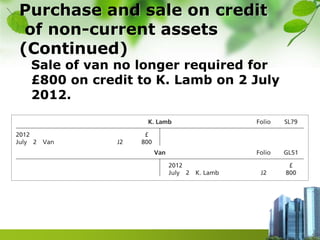

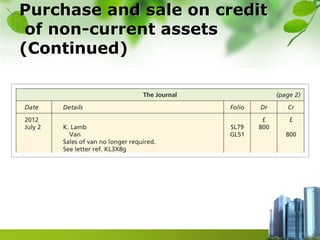

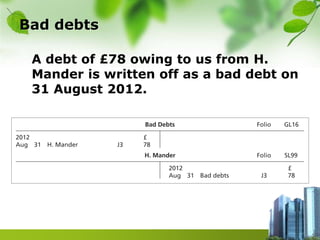

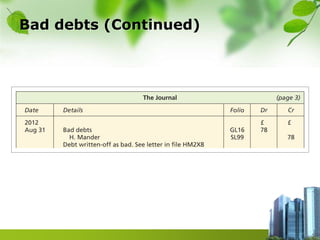

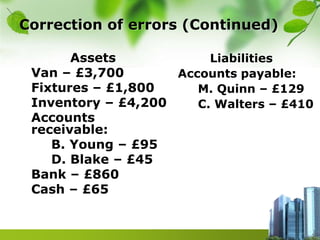

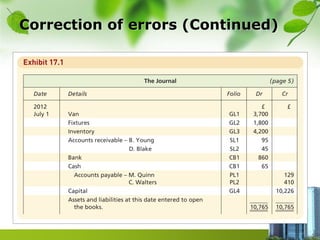

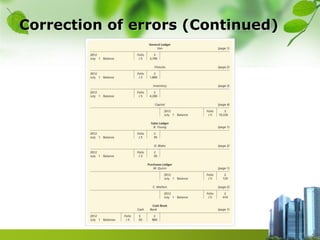

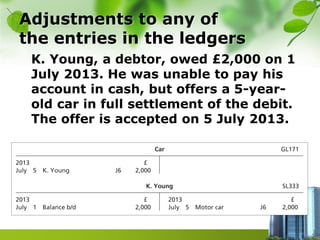

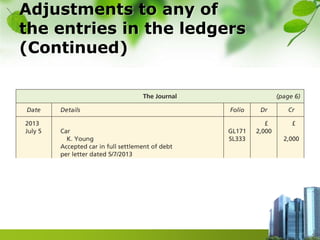

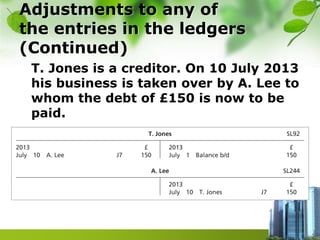

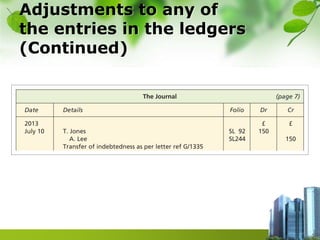

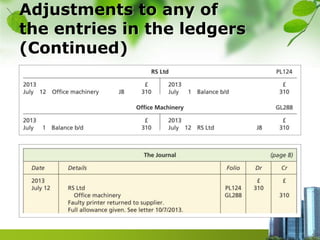

The document discusses the general journal in financial accounting, which records unusual transactions before they are posted in double entry accounts. It outlines the components of a journal entry and typical uses, such as recording purchases and sales of fixed assets, writing off bad debts, and making adjustments to ledger entries. The document includes examples of various transactions, including corrections of errors and adjustments related to accounts receivable and payable.