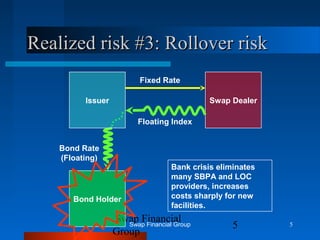

This document discusses the risks of interest rate swaps that became apparent during the financial crisis of 2008. It outlines four major risks: counterparty risk when financial institutions like Lehman Brothers and AIG faced difficulties; basis risk when bond rates increased due to problems in the banking sector; rollover risk as the crisis eliminated providers of liquidity facilities; and collateral posting risk as rates moved beyond historical norms. Charts show the increases in Treasury yields and swap spreads during this period. The conclusion recommends issuing fixed rate bonds and swapping to a floating rate to avoid risks associated with bank support.