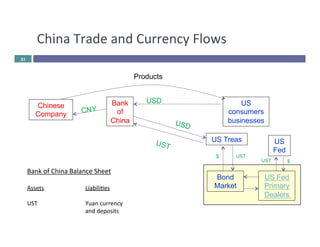

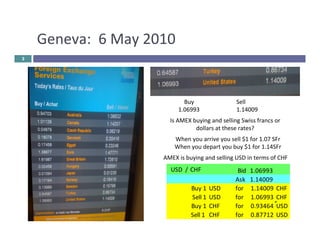

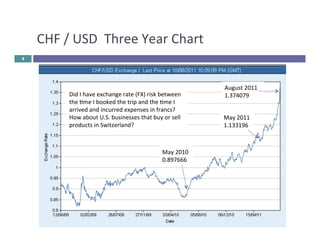

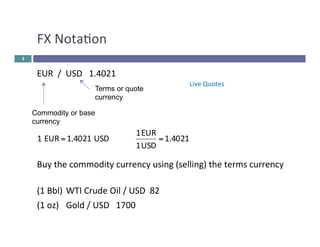

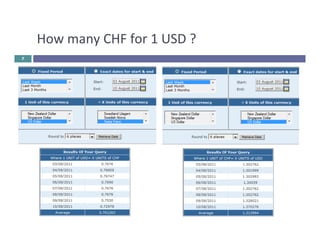

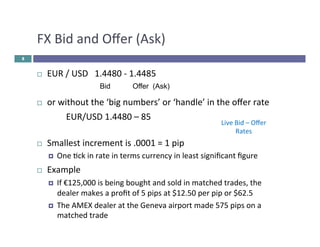

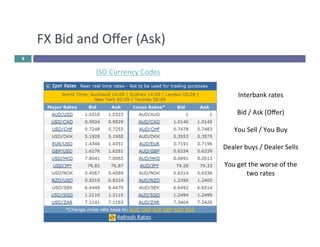

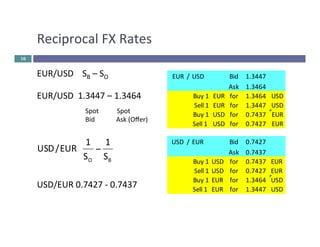

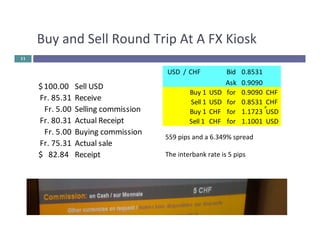

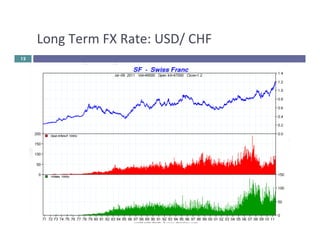

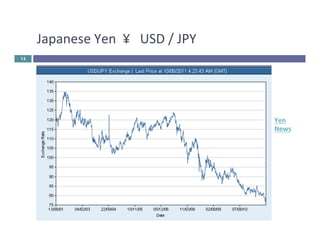

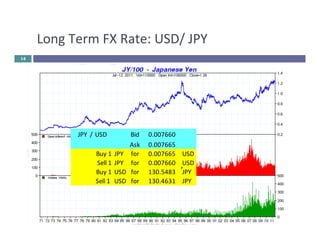

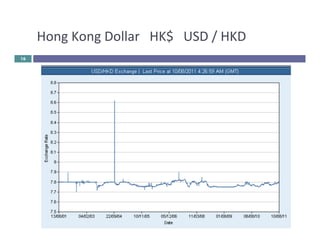

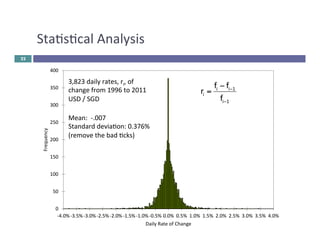

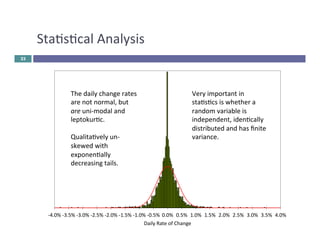

The document discusses foreign exchange rates, focusing on USD/CHF and EUR/USD transactions along with relevant concepts like bid-ask spread, currency exchange rates, and statistical analysis of currency fluctuations. It emphasizes the importance of managing foreign exchange risk for travelers and businesses operating in international markets. Additionally, it covers the effects of economic theories like purchasing power parity and the role of financial institutions in currency markets.

![Autocorrelaon

of

Change

Rates

24

1

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0

-‐0.1

-‐0.2

-‐0.3

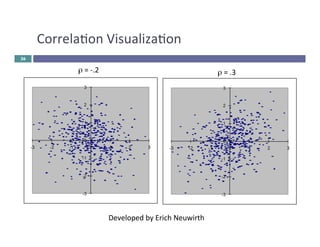

Independence

is

oren

checked

by

non-‐auto-‐

correlaon

of

rates

and

variance

of

rates.

Autocorrelaon

of

simple

rates

of

return

0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36

Autocorrelation

Lag

[Days]](https://image.slidesharecdn.com/fxrisk-140825212746-phpapp01/85/Fx-risk-24-320.jpg)

![Autocorrelaon

of

Change

Rate

Variance

25

1.0

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0.0

Autocorrelaon

of

de-‐trended

squared

rates

of

return

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36

Autocorrelation

Lag

[Days]](https://image.slidesharecdn.com/fxrisk-140825212746-phpapp01/85/Fx-risk-25-320.jpg)