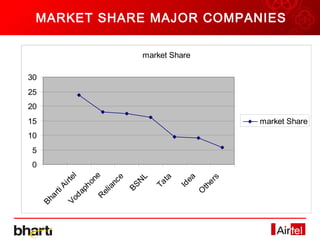

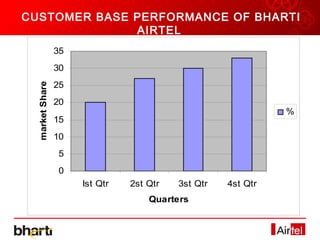

This document analyzes the telecom sector in India and the key player Bharti Tele Ventures Ltd. It provides an overview of the growth of the Indian telecom sector since 1994 and the various policy changes that liberalized the sector. It also summarizes the major service providers, key players, and the demand for telecom in India. Finally, it analyzes Bharti Airtel's market share performance, recent recognitions, and key focus areas, with the company's mission to be the most admired brand in India by 2010.