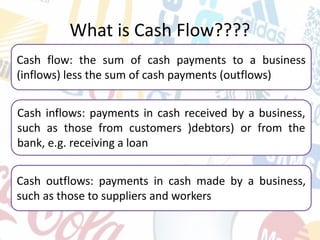

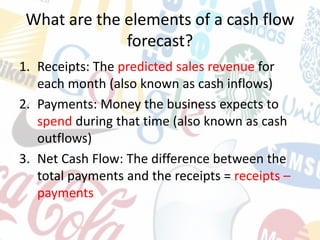

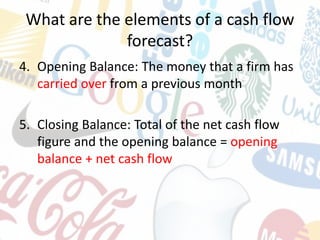

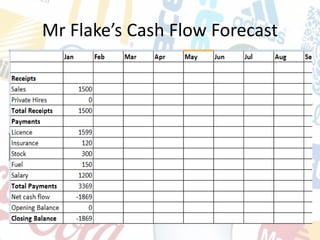

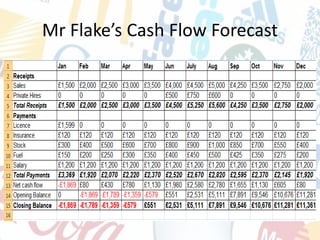

Cash flow forecasting predicts a business's future cash inflows and outflows. Cash flow forecasts are particularly important for new businesses, fast-growing businesses, and businesses with erratic sales to help plan for and manage cash needs. A cash flow forecast contains elements such as predicted monthly sales revenue (receipts), expected expenses (payments), the net difference between receipts and payments, an opening balance carried over from the previous month, and a closing balance. The document provides an example cash flow forecast for a business owner named Mr. Flake.