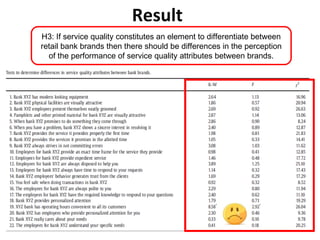

This document summarizes a study on the relationship between service quality, customer satisfaction, loyalty, and perceived value for retail banks in Mexico. The study tested three hypotheses: 1) service quality dimensions are directly related to customer satisfaction and loyalty; 2) service quality is directly related to perceived customer value; and 3) service quality differs between bank brands. The results supported the first hypothesis but rejected the second and third. The conclusion is that service quality may not be a real source of brand differentiation or superior customer value. Future research could improve the measurement of customer perceived value.