VRL Logistics is recommended as a buy with a maximum portfolio allocation of 3%. It is a leading player in surface logistics and parcel services in India. Goods transportation is its primary business.

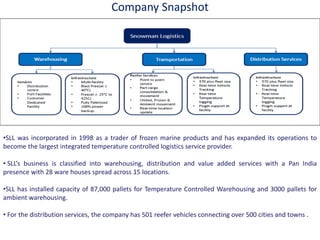

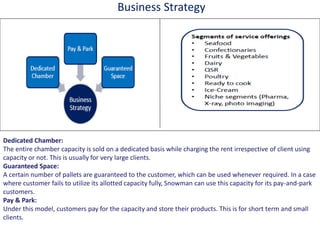

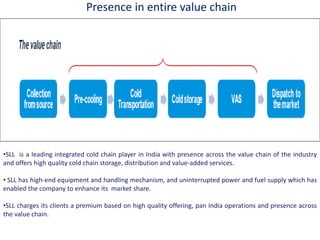

Snowman Logistics is recommended as a buy with a maximum portfolio allocation of 2%. It is the largest integrated temperature controlled logistics service provider in India with a pan-India presence.

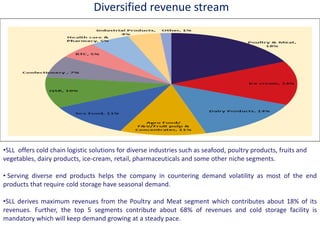

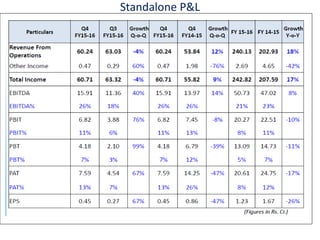

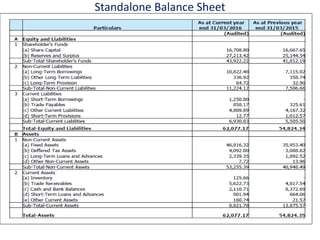

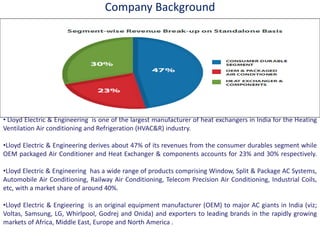

Lloyd Electric is recommended as a buy with a maximum portfolio allocation of 5%. It is a manufacturer of air conditioners and LCD TVs and is a contract manufacturer for MNCs in the consumer durables space.

![VRL Logistics Ltd - Investment Snapshot

(as on Jul 13, 2016)

Recommendation :- BUY

Maximum Portfolio Allocation :- 3%

Investment Phases & Buying Strategy

1st Phase (Now) of Accumulation :- 50%

Current Accumulation Range :- 310-320Rs

VRL is our special stock, which is a Good Investment under

current Market conditions. It has a presence in a space which

offers enormous potential and is also trading at reasonable

valuations which will deliver superior returns in the long run.

Core Investment Thesis :

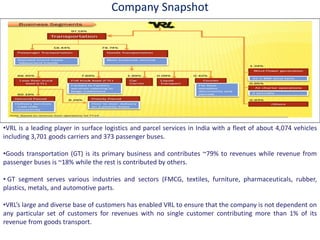

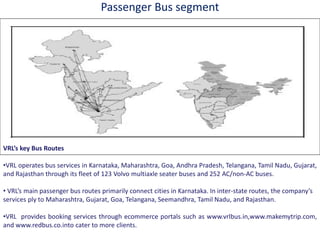

VRL is a leading player in surface logistics and parcel services in

India with a fleet of about 4,074 vehicles including 3,701 goods

carriers and 373 passenger buses. Goods transportation (GT) is

its primary business and contributes ~79% to revenues while

revenue from passenger buses is ~18% while the rest is

contributed by others.

Current Market Price – Rs.314.00

Current Dividend Yield – 1.28%

Bloomberg Code –VRLL. IN

BSE / NSE Code -539118/VRLLOG

Market Cap (In Rs. Cr) - 2862

Equity Share Capital [Cr]– 85.54

Face Value – Rs.10

52 Week High / Low – Rs.479.00/

Rs.251.80

Pro oter’s Holdi g – 69.57%

Other Holdings - 30.43%](https://image.slidesharecdn.com/5stocksbasedongstevent-160720164633/85/5-stocks-based-on-gst-event-3-320.jpg)

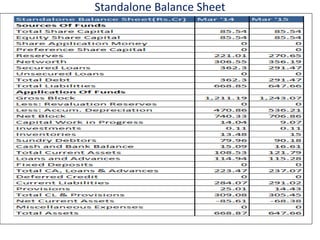

![Snowman Logistics Ltd– Investment Snapshot

(as on Jul 13, 2016)

Recommendation :- BUY

Maximum Portfolio Allocation :- 2%

Investment Phases & Buying Strategy

1st Phase (Now) of Accumulation :- 50%

Current Accumulation Range :- 80-85 Rs

Snowman Logistics is our special Stock which is a Good

Investment under current Market conditions. It has a presence

in a space which offers enormous potential and is a market

leader in the sector which will deliver multibagger returns in

the long run.

Core Investment Thesis :

The company is in the cold storage space and has a strong brand

which has been its strength. The company has good presence

Pan India. The company is also likely to benefit from fast growing

user industries which is likely to benefit the company. The

company has been consistently adding capacities which will drive

growth.

Current Market Price – Rs.82.00

Current Dividend Yield – 0.61%

Bloomberg / Reuters Code –SNLL. IN/

SNOW.NS

BSE / NSE Code – 538635/ SNOWMAN

Market Cap (In Rs. Cr) - 1368

Total Equity Shares [Mn]– 166.68

Face Value – Rs. 10

52 Week High / Low – Rs.46.00/

Rs.116.45

Pro oter’s Holdi g – 40.26%

FII - 2.73%

Mutual Funds - 5.30%

Other Holdings - 51.71%](https://image.slidesharecdn.com/5stocksbasedongstevent-160720164633/85/5-stocks-based-on-gst-event-13-320.jpg)

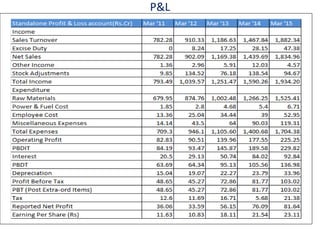

![Lloyd Electric & Engineering Ltd– Investment Snapshot

(as on Jul 13, 2016)

Recommendation :- BUY

Maximum Portfolio Allocation :- 5%

Investment Phases & Buying Strategy

1st Phase (Now) of Accumulation :- 50%

Current Accumulation Range :- 240-250 Rs

Lloyd Electric is our special stock, which is a value stock and is a

Good Investment under current Market conditions. It has a

presence in a space which offers enormous potential and is also

trading at reasonable valuations which will deliver superior

returns in the long run.

Core Investment Thesis :

The company is predominantly in the air conditioner and LCD TV

and has established its reputation which has been its strength.

The company is also the major contract manufacturer of A s for

MNC s which sheds light on their technical prowess. The

company is also likely to benefit from capacity expansion in the

AC space which will drive its growth.

Current Market Price – Rs.242.00

Current Dividend Yield – 0.54%

Bloomberg / Reuters Code –LEE. IN/

LEEG.NS

BSE / NSE Code – 517518/LLOYDELENG

Market Cap (In Rs. Cr) - 874

Total Equity Shares [Mn]– 35.20

Face Value – Rs. 10/-

52 Week High / Low – Rs.328.90/

Rs.175.10

Pro oter’s Holdi g – 49.98%

FII - 9.15%

Mutual Funds - 0.00%

Other Holdings - 40.87%](https://image.slidesharecdn.com/5stocksbasedongstevent-160720164633/85/5-stocks-based-on-gst-event-23-320.jpg)

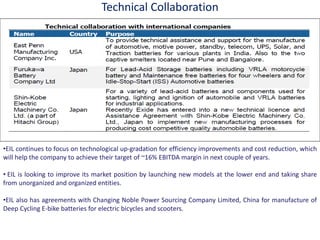

![Exide Industries Ltd– Investment Snapshot

(as on Jul 13, 2016)

Recommendation :- BUY

Maximum Portfolio Allocation :- 5%

Investment Phases & Buying Strategy

1st Phase (Now) of Accumulation :- 50%

Current Accumulation Range :- 180-190 Rs

Exide Industries is our special stock, which is a Good Investment

under current Market conditions. It has a presence in a space

which offers enormous potential and is also trading at

reasonable valuations which will deliver superior returns in the

long run.

Core Investment Thesis :

The company is largest lead acid storage battery manufacturer

and seller for automotive, industrial, and submarine applications

in India and abroad .The company is also likely to benefit from

sustainable leadership and strong pricing power which will drive

its growth.

Current Market Price – Rs.183

Current Dividend Yield – 1.32%

Bloomberg / Reuters Code –EXID. IN/

EXID.NS

BSE / NSE Code – 500086/EXIDEIND

Market Cap (In Rs. Cr) - 15491

Equity Share Capital [Cr]– 85

Face Value – Rs. 1

Pro oter’s Holdi g – 45.99%

FII - 15.59%

DII - 17.26%

Other Holdings - 21.16%](https://image.slidesharecdn.com/5stocksbasedongstevent-160720164633/85/5-stocks-based-on-gst-event-31-320.jpg)

![Inox Leisure Ltd - Investment Snapshot

(as on Jul 13, 2016)

Recommendation :- BUY

Maximum Portfolio Allocation :- 3%

Investment Phases & Buying Strategy

1st Phase (Now) of Accumulation :- 50%

Current Accumulation Range :- 235-245Rs

ILL is our special stock, which is a Good Investment under

current Market conditions. It has a presence in a space which

offers enormous potential and is also trading at reasonable

valuations which will deliver superior returns in the long run.

Core Investment Thesis :

ILL is I dia s second largest multiplex operator with 107576 seats

and 413 screens across 57 cities accounting for about 23% of the

multiplex screens in India, is scripting a blockbuster growth story

through a mix of organic and inorganic growth.

Current Market Price – Rs.242.00

Current Dividend Yield – NA

Bloomberg Code –INOL. IN

BSE / NSE Code -532706/INOXLEISUR

Market Cap (In Rs. Cr) - 2326

Equity Share Capital [Cr]– 96.16

Face Value – Rs.10

52 Week High / Low – Rs.275.90/

Rs.170.75

Pro oter’s Holdi g – 48.70%

Other Holdings - 51.30%](https://image.slidesharecdn.com/5stocksbasedongstevent-160720164633/85/5-stocks-based-on-gst-event-42-320.jpg)