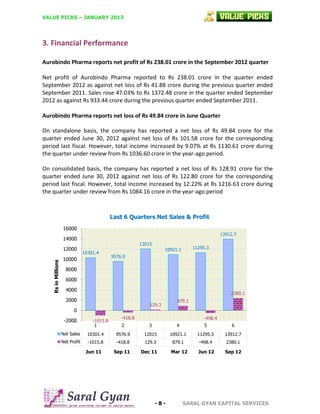

Aurobindo Pharma Ltd is an Indian pharmaceutical company with a market capitalization of Rs. 54543.9 million. The equity research report from Saral Gyan Capital Services provides an overview of the company, recent developments, financial performance, investment rationale, and risks. Key points include Aurobindo generating over 70% of its revenues from international markets, guidance for 15-20% revenue growth in the US market, and plans to aggressively file 25 ANDAs per year to drive future growth. The report recommends Aurobindo Pharma as a buy with a 12-18 month target price of Rs. 275 per share.