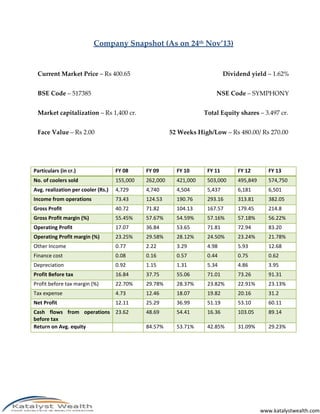

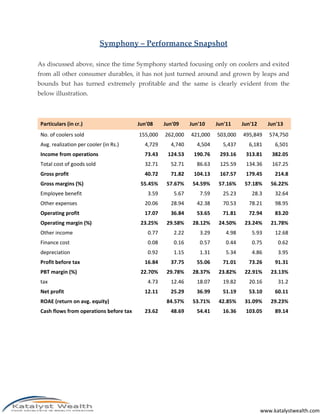

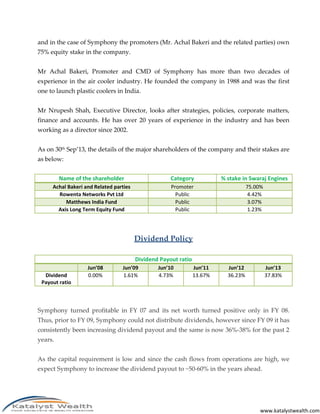

Symphony Ltd, a leading air cooler manufacturer in India, dominates the organized segment with a 50% market share and expects 25-30% annual growth due to increased demand for branded products and low competition. The company's successful turnaround from financial distress in 2002 to a profitable, debt-free entity is attributed to its focus on air coolers, innovation, and outsourcing manufacturing. Symphony's expansion into the industrial and commercial air-cooling market alongside growing consumer demand driven by rising temperatures and lower income households presents promising future growth opportunities.