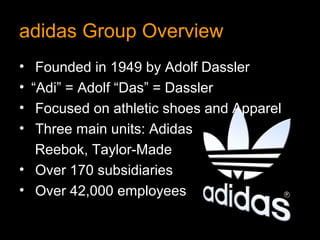

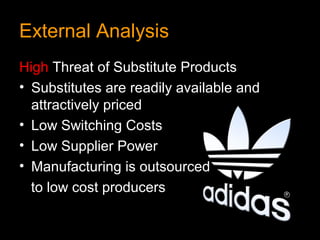

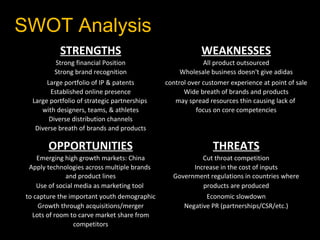

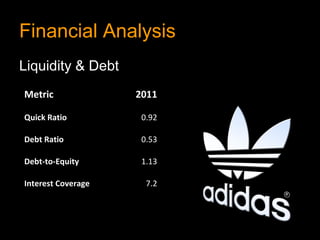

The document provides an overview and analysis of the adidas Group. It summarizes that adidas has 13% of the North American shoe market share compared to Nike's 43.1% and identifies gaining more market share in North America as a key strategic issue. It then reviews adidas' corporate culture and history, performs external and internal analyses of the company, and provides recommendations such as increasing marketing and R&D spending, focusing on corporate social responsibility, and potentially acquiring companies like Under Armour to gain market share.