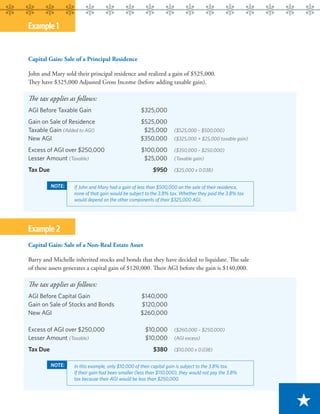

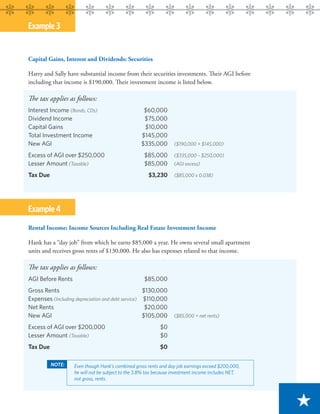

This document provides examples to help explain how the new 3.8% tax on investment income resulting from the Affordable Care Act would apply to different real estate transactions and income sources. The tax applies to individuals with adjusted gross income over $200,000 and joint filers over $250,000. It is imposed on unearned income including capital gains, dividends, interest, and net rental income. The examples illustrate how the tax is calculated for various capital gain scenarios, rental properties, and mixed income sources. An additional 0.9% tax also aims to fund Medicare but applies to earned income over the thresholds.