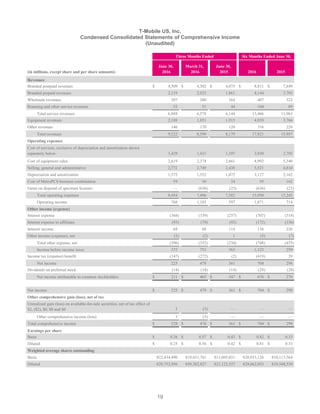

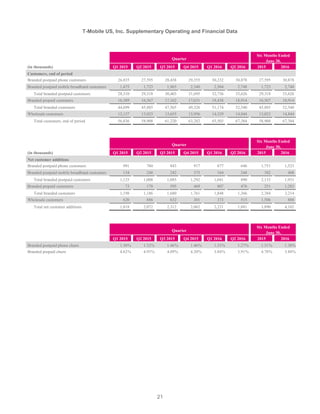

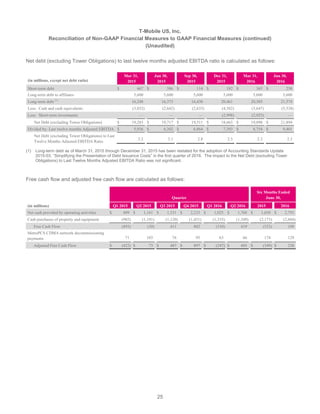

T-Mobile reported strong financial and customer growth results for the second quarter of 2016, with 1.9 million total net customer additions, record low branded postpaid phone churn of 1.27%, $225 million in net income, and 35.6% growth in adjusted EBITDA year-over-year. The company continued expanding and enhancing its 4G LTE network coverage and saw increased 4G LTE speeds, maintaining its position as the fastest nationwide 4G LTE network in the US. T-Mobile raised its full-year 2016 customer and financial guidance.