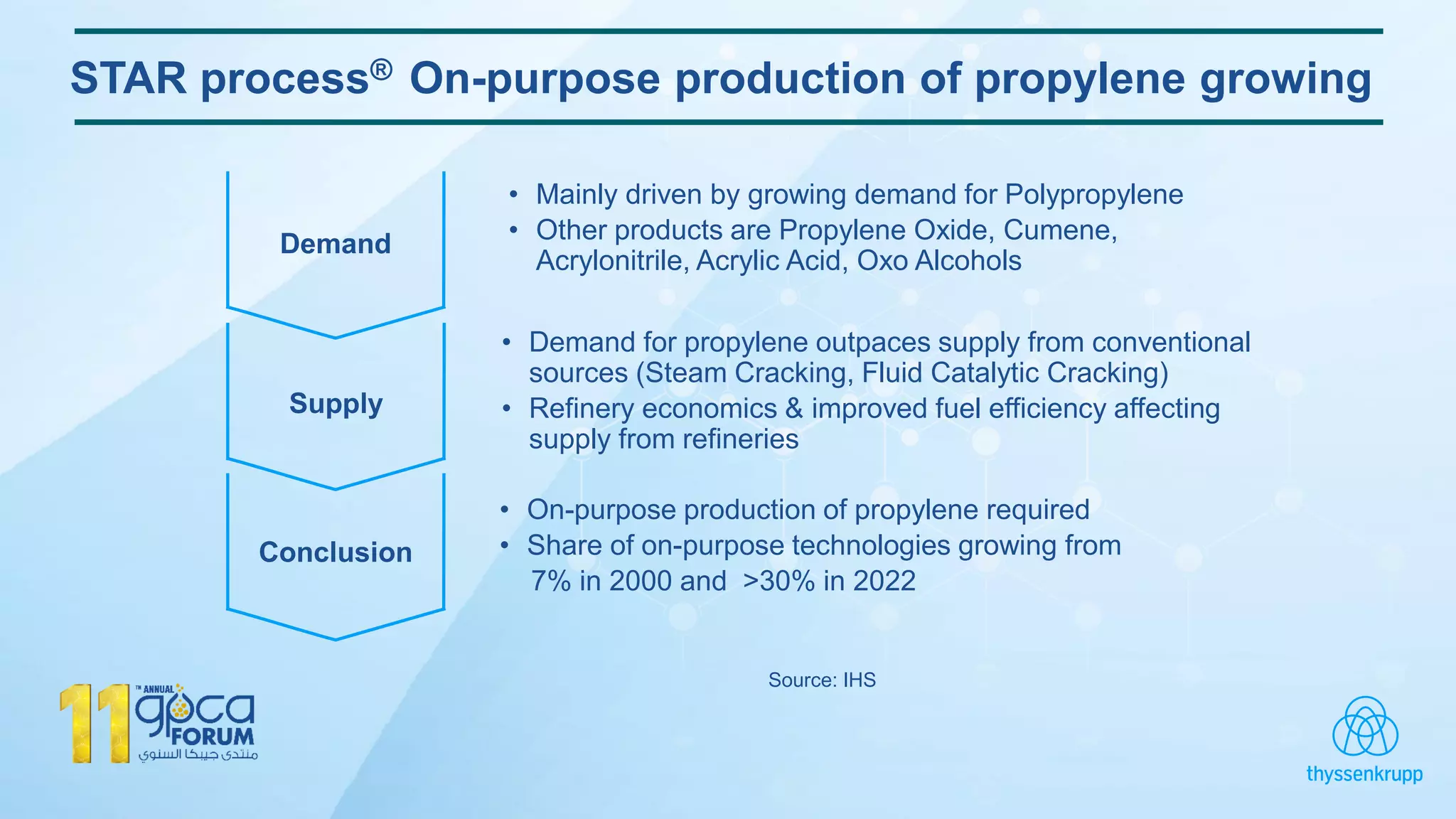

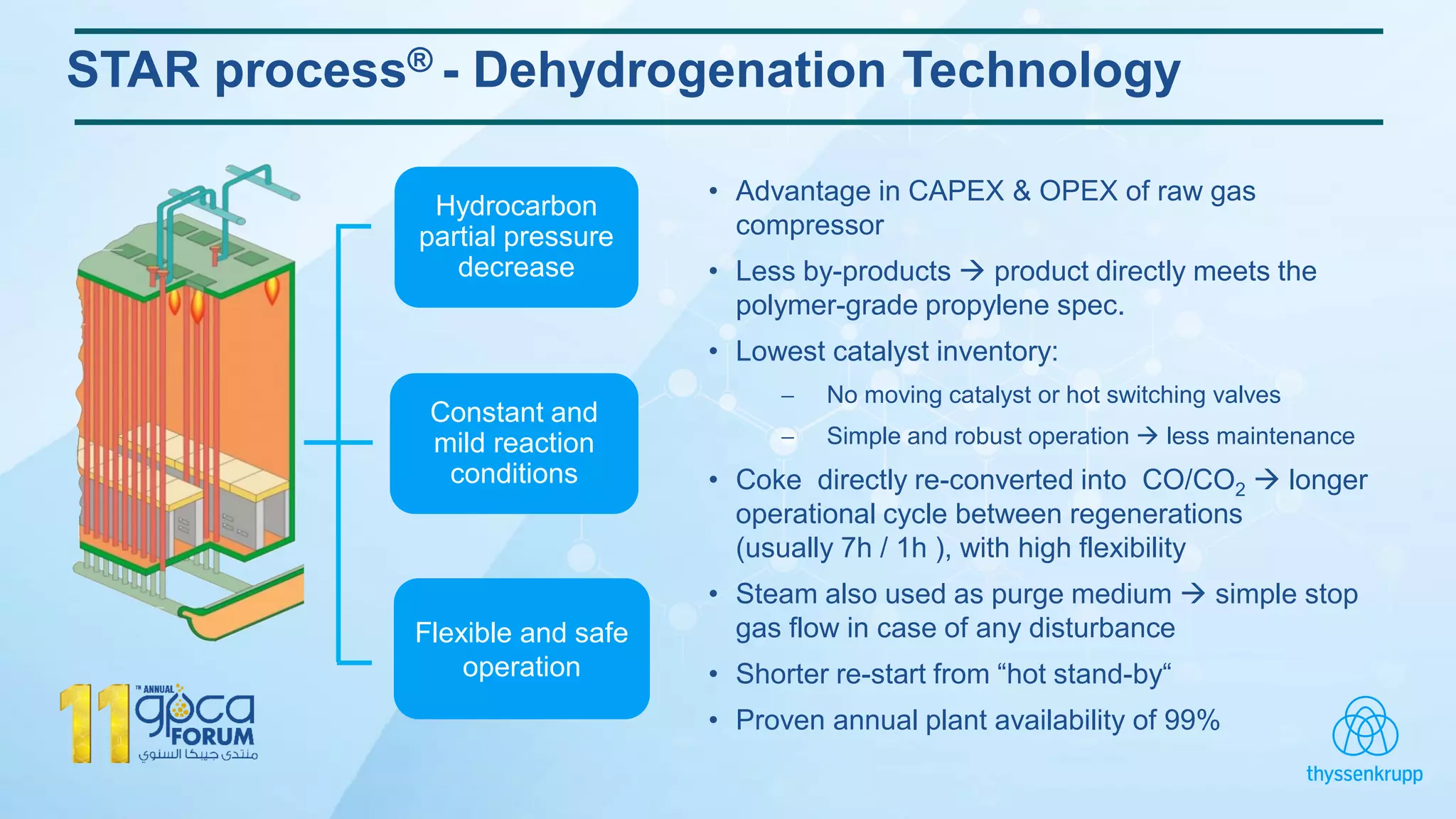

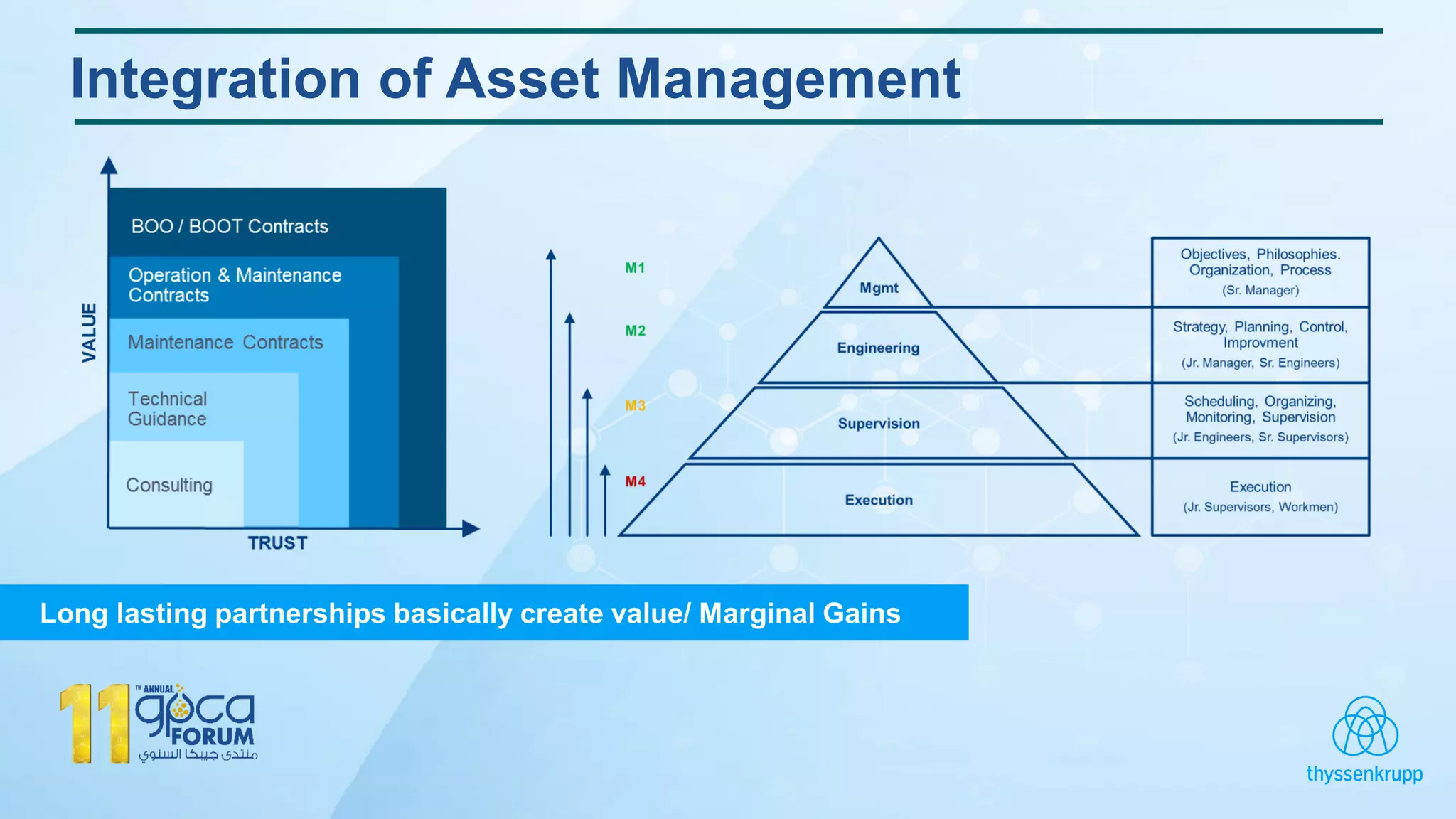

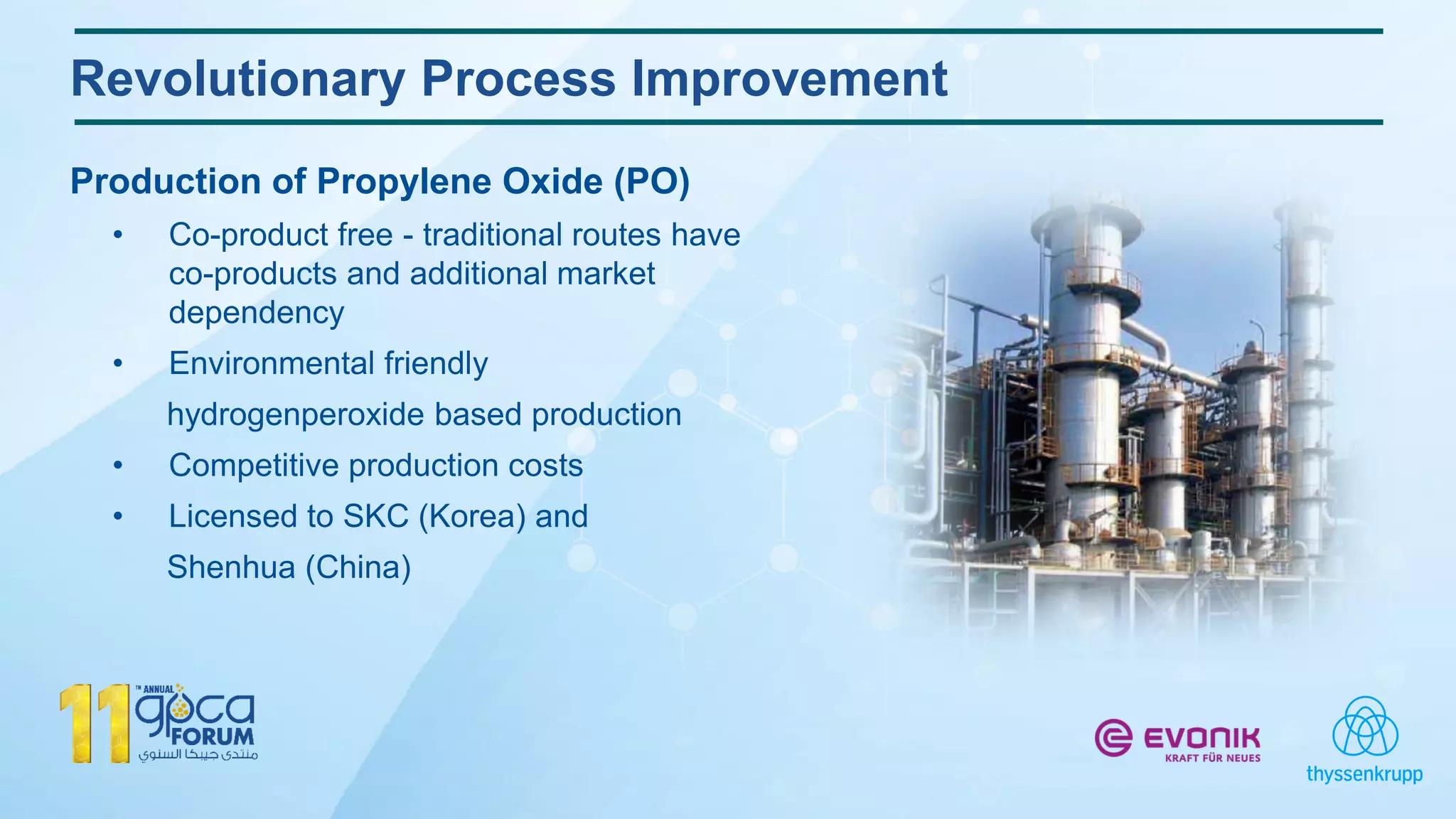

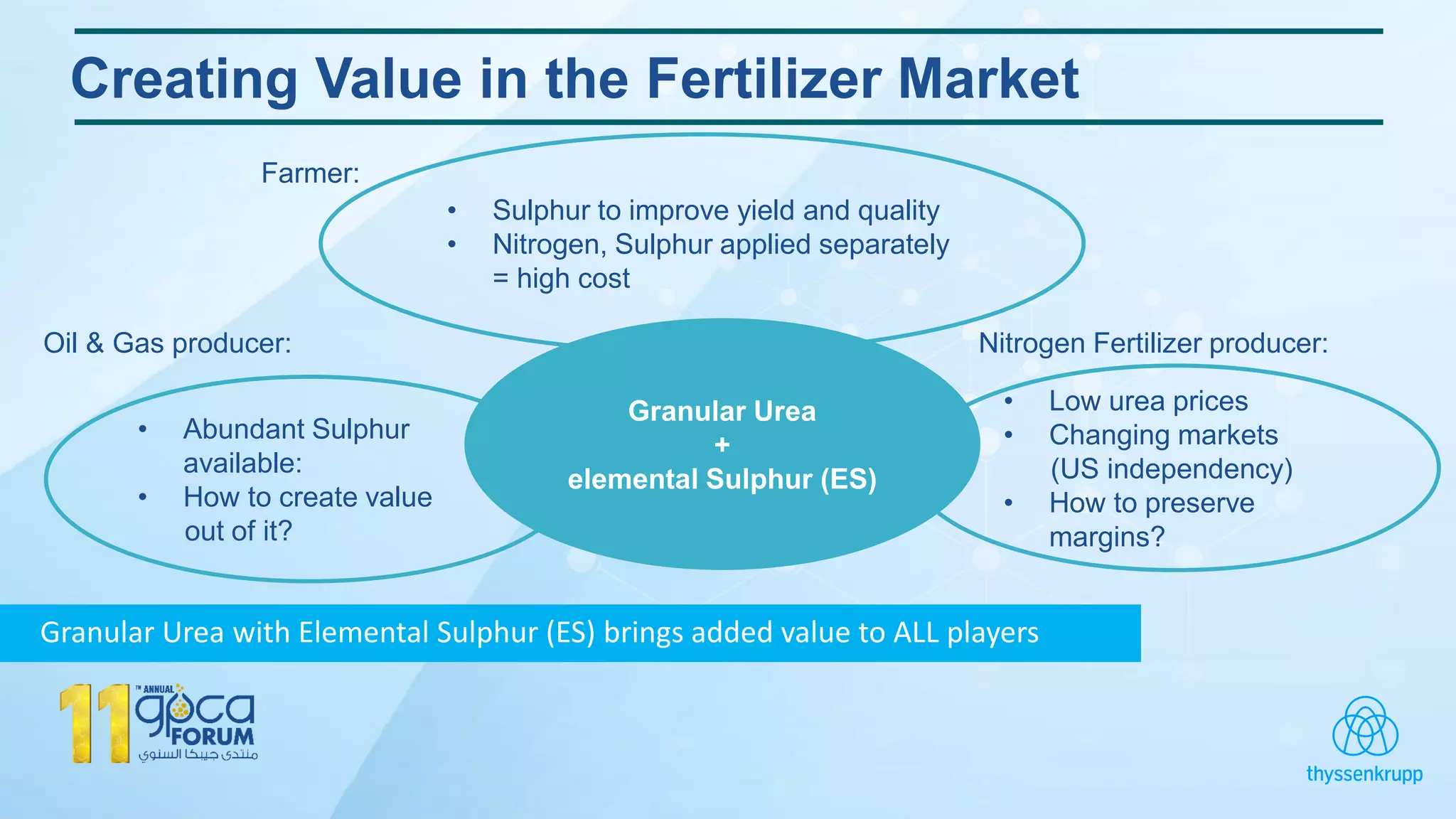

Boris van Thiel discusses how small incremental improvements, or marginal gains, can provide significant benefits. He outlines how thyssenkrupp achieves marginal gains through innovative technologies like their STAR process for propylene production and urea fertilizer production with elemental sulfur. Process improvements and asset management also provide marginal gains through initiatives like mechanical design changes that reduce energy use by 7%. These many small improvements, though only 1% individually, have large cumulative impacts when implemented across an organization.

![Granular Urea + ES: Market Situation

~ 10 MMt/a of sulphur needs addition to soil

~ 2 MMt/a covered by other sulphur applications

Urea Granulation Middle East Africa

Annual Production [MMt/a] 20 13

No of plants 24 14

No of producers 10 8

Elemental Sulphur

Annual Production [MMt/a] 12 1.6

No of plants 63 17

No of producers 44 17

Urea is used as carrier for sulphur Source: IHS Chemical Economics Handbook Sulphur

12.5 MMt S/

year world

wide deficit

by 2015](https://image.slidesharecdn.com/12b3b7d9-098a-48ac-b2ef-e4b47a210c38-170206172042/75/21-Boris-van-Thiel-18-2048.jpg)