The document outlines important themes in managerial accounting for the 2021 exam, emphasizing topics such as cost analysis, capital budgeting, and organizational architecture. It details key concepts like opportunity costs, cost variation, and budgeting techniques, providing a framework for understanding decision-making and performance measurement in organizations. Additionally, it covers various accounting methodologies and the principal-agent model in the context of responsibility accounting.

![Interest Rate Fundamentals

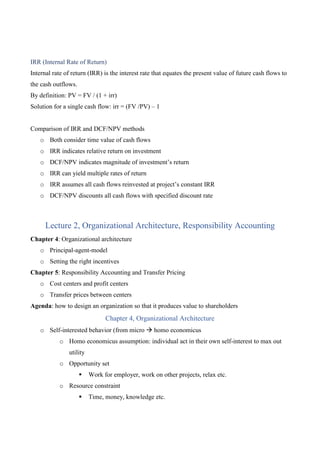

FV= future value

PV= present value

r= interest rate per period (usually per year)

n=periods form now (usually years)

Present value of a perpetuity (a stream of equal periodic payments for infinite

periods)

PV = FV r

Present value of an annuity (a stream of equal periodic payments for a fixed

number of years)

PV = (FV r ) { 1 – [1 (1 + r)n]}

Adjustment for Inflation

If inflation exists in the economy, then the discount rate should be adjusted for said inflation

1. Restate future cash flows into nominal DKK (after inflation)

2. Discount nominal cash flows with nominal interest rate

How to adjust for inflation in excel

https://www.youtube.com/watch?v=sWTZK_zzgn8&ab_channel=MumblingProfessor](https://image.slidesharecdn.com/2021managerialaccountingnotes-240719015314-f3dc099c/85/2021-Managerial-Accounting-notes-exam-prep-docx-13-320.jpg)