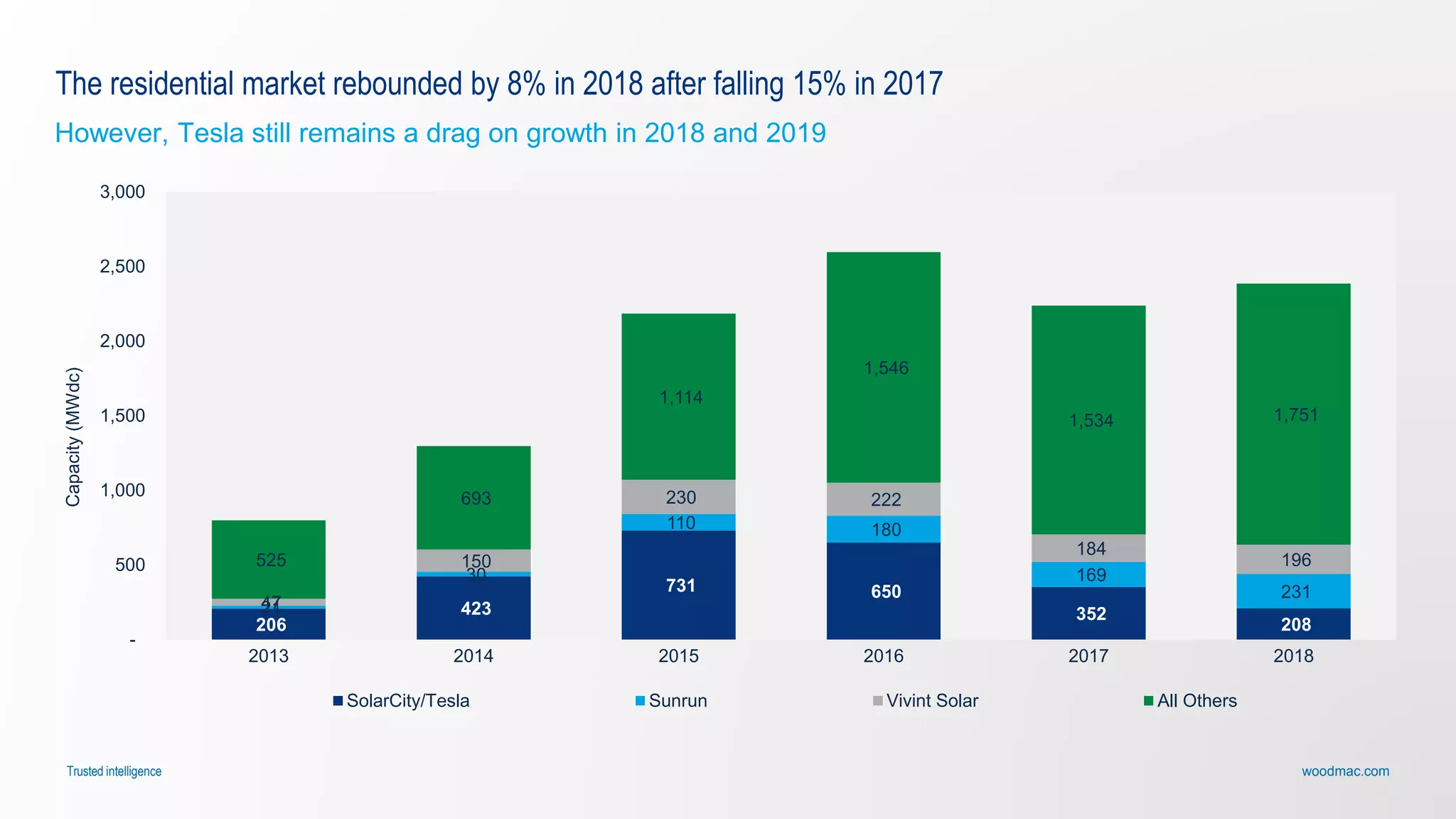

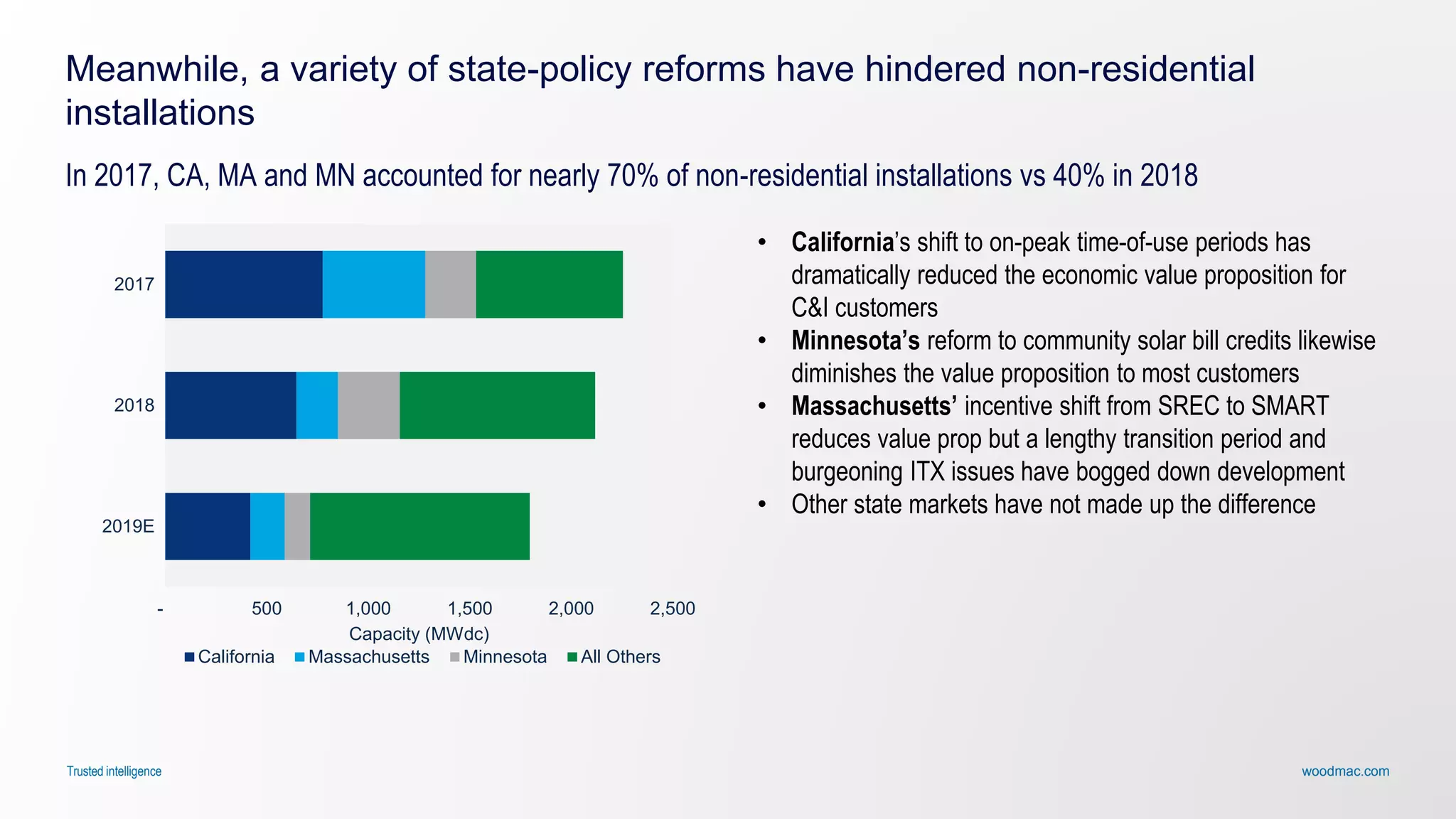

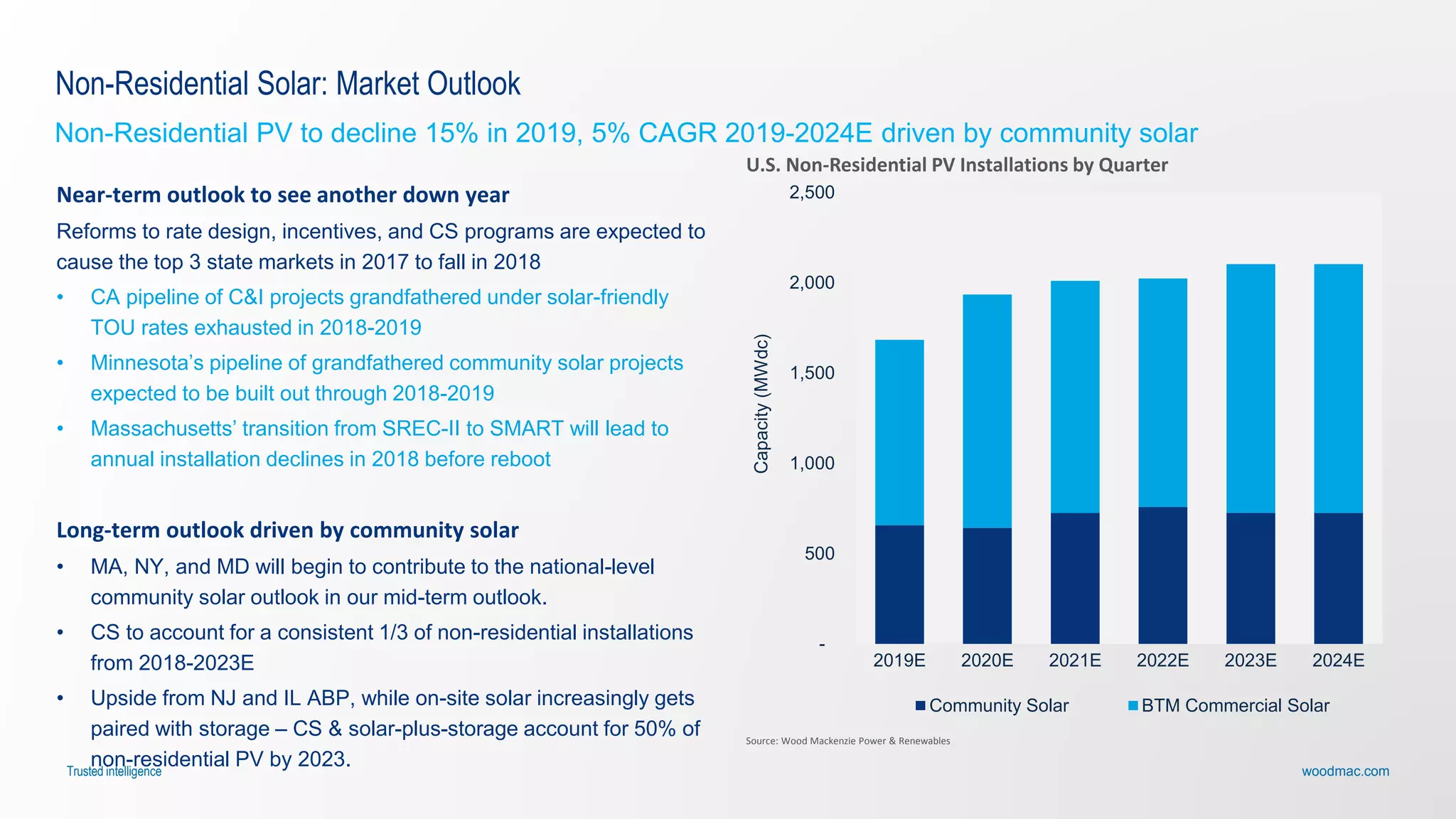

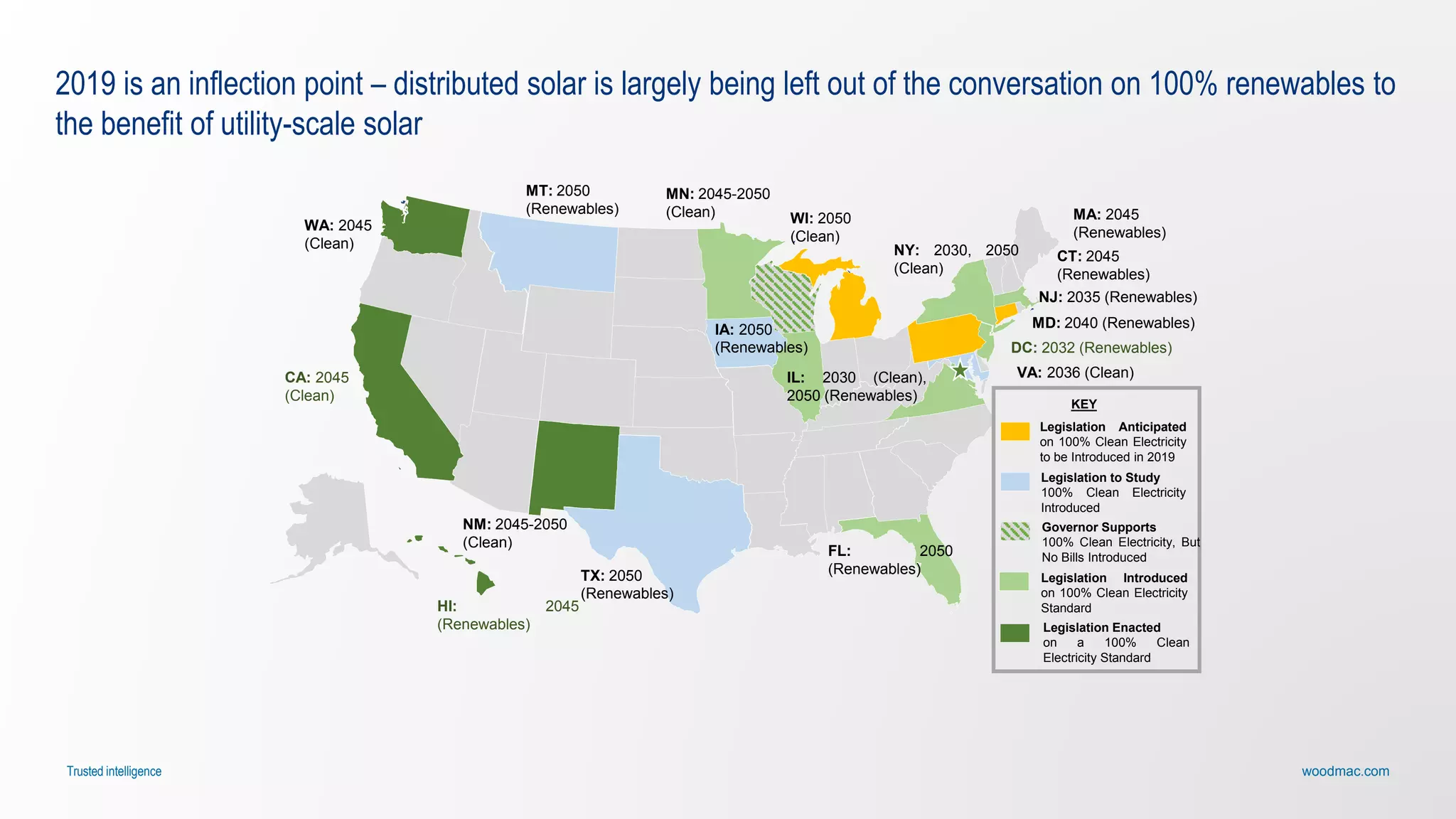

Wood Mackenzie is a research firm with expertise in renewable energy, electricity grids, and electric vehicles. This presentation summarizes the 2018 US solar market and provides an outlook for 2019-2021. The key points are: 1) The US solar market grew slowly in 2018 but utility-scale solar continues to be driven by economic factors rather than policies; 2) Residential solar rebounded in 2018 while non-residential installations declined due to policy changes in major states; 3) Significant policy changes in key states over the next few years will impact market growth as incentives change and the investment tax credit steps down.

![woodmac.comTrusted intelligence

Source: Wood Mackenzie Power and Renewables

Section 201 – Near term impact but long term recovery

Module tariffs have impacted utility solar but the market has proven astoundingly resilient

The White House announced on January 22nd that President Trump has

issued a 30 percent year-one tariff on imported c-Si solar cells and

modules.

• Tariffs: “Ad valorem” (percent-based) tariffs on imported c-Si cells and

modules will decline over a four year period, starting at 30% in year 1 and

declining by 5% per year to 15% in year 4.

• This will result in an average $0.10/W increase in year 1 prices to

modules, stepping down to a $0.04/W premium by year 4.

• Quotas: The first 2.5 gigawatts of imported c-Si cells are excluded from the

tariff in each of those four years.

• The safeguard measures (i.e. tariffs and quotas) took effect on February

7, 2018, which was 15 days from the date President Trump signed the

proclamation.

Final Decision on Section

201

Year 1 Year 2 Year 3 Year 4

Safeguard Tariff on Cells

and Modules

30% 25% 20% 15%

Cells Exempted from Tariff

(Quota)

2.5 GW 2.5 GW 2.5 GW 2.5 GW

-

7%[CELLRAN

GE]

6,198

[CELLRANGE]

-18%

7,786

[CELLRANGE]

8%

10,003

[CELLRANGE]

19%

10,383

[CELLRANGE]

8,655

8,638

9,287

0

2,000

4,000

6,000

8,000

10,000

12,000

2014 2016 2018 2020E 2022E 2024E

Annualinstalledcapacity(MWdc)

Q4-2017 Forecast Q1-2019 Forecast

Despite tariff impacts, the current 2018-

2022 forecast now exceeds Wood

Mackenzie’s pre-tariff forecast](https://image.slidesharecdn.com/solarsummitpresentation-2019statepolicycompass-190514175854/75/2019-State-Policy-Compass-29-2048.jpg)