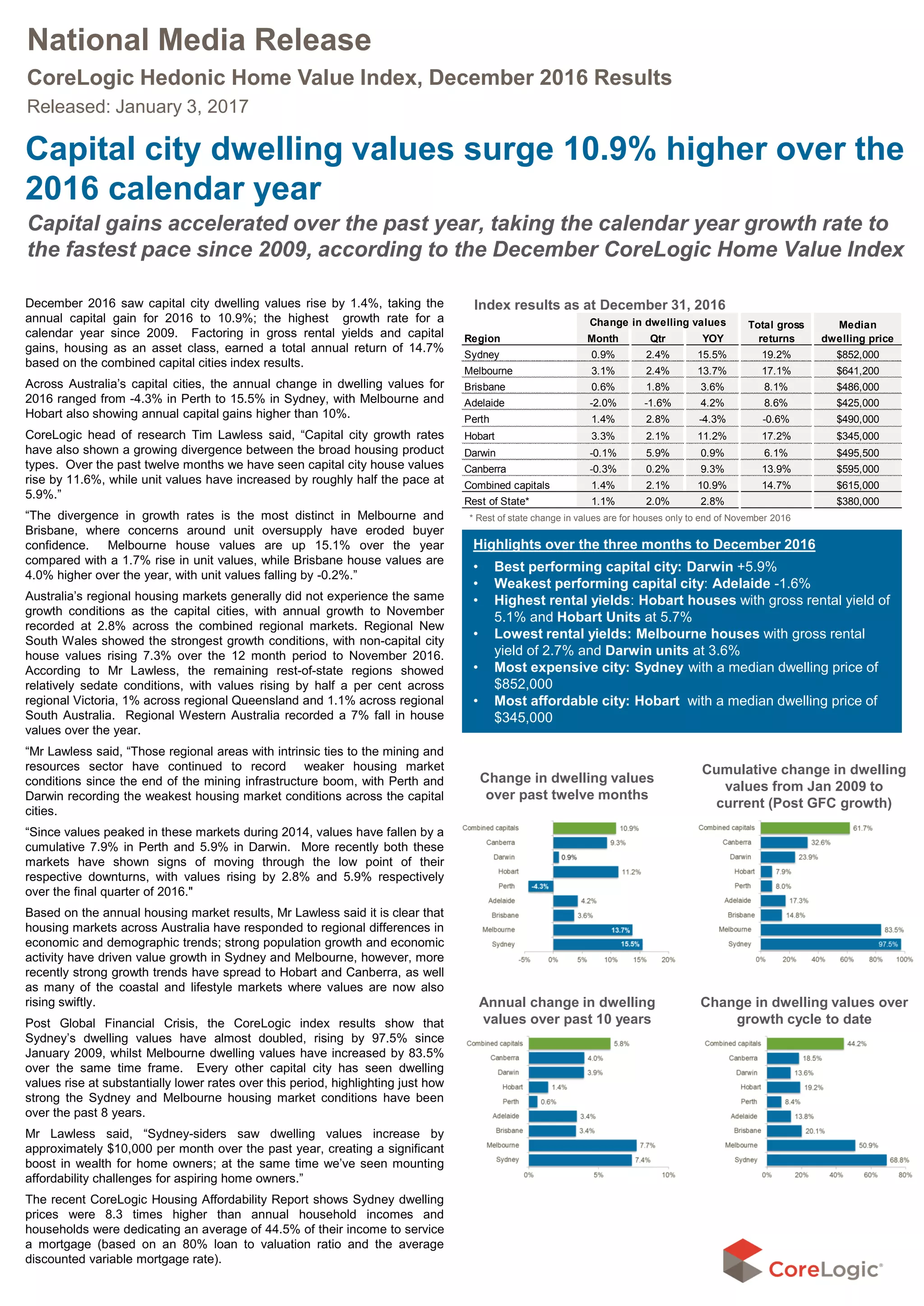

In December 2016, Australia's capital city dwelling values rose by 1.4%, with an annual growth rate of 10.9%, the highest since 2009, driven particularly by Sydney and Melbourne. The report highlights a divergence in growth rates between houses and units, as well as regional variations in housing market performance, with ongoing affordability challenges for buyers. The outlook for 2017 indicates potential headwinds such as rising mortgage rates and increased supply in the unit sector, which may temper growth rates moving forward.