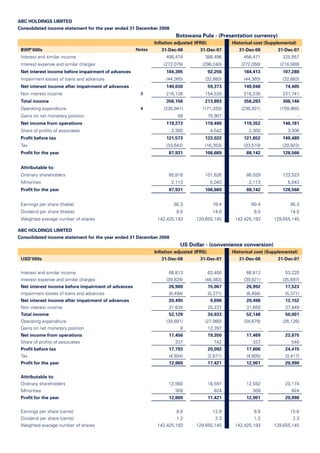

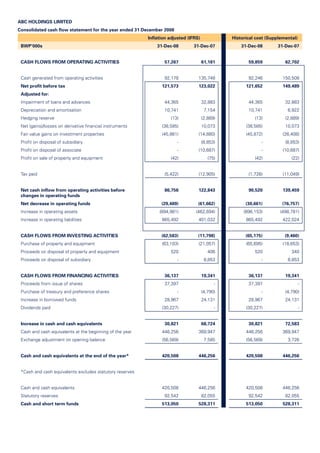

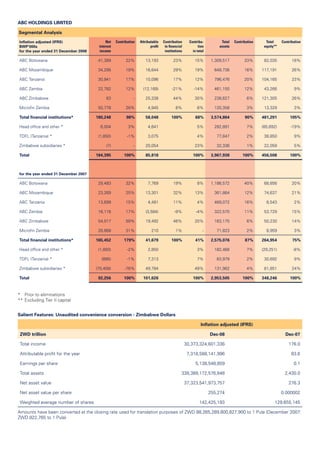

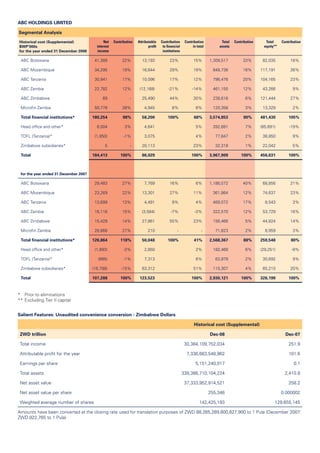

- ABC Holdings produced good results for the year ended 31 December 2008 considering the global financial turmoil, with attributable profits to shareholders of BWP85.8 million, a 16% decrease from the prior year.

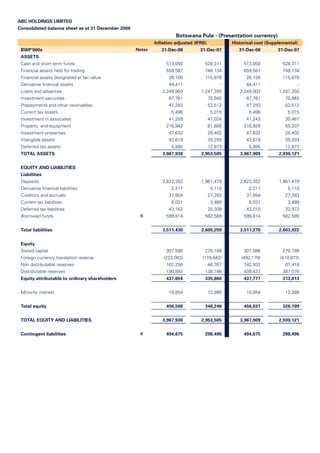

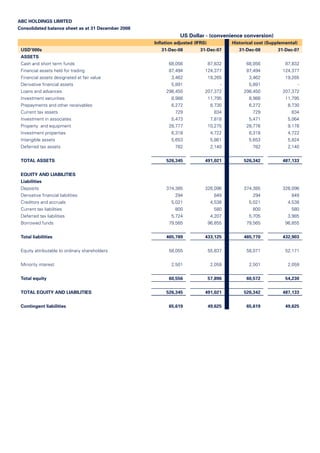

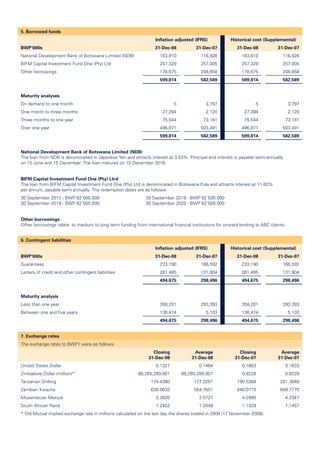

- The balance sheet grew by 35% to BWP3.97 billion, with loans increasing 80% to BWP2.2 billion and deposits up 40% to BWP2.8 billion. However, return on equity declined to 22% from 33% the prior year.

- Earnings per share decreased to 60.3 Thebe due to lower earnings and an increase in shares. Net asset value per share increased to BWP3.07 from BWP2.37 the prior year.