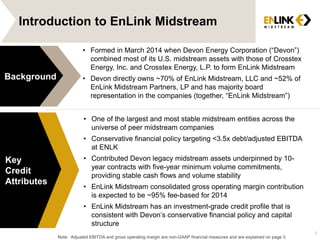

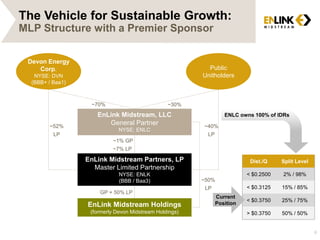

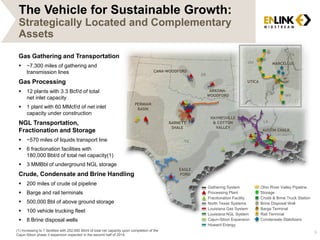

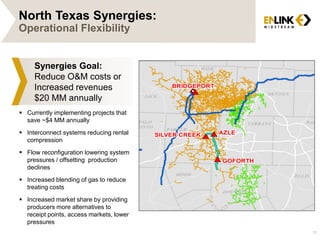

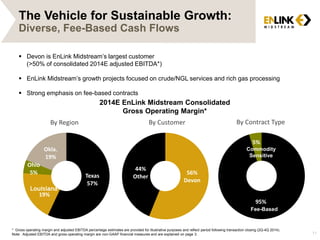

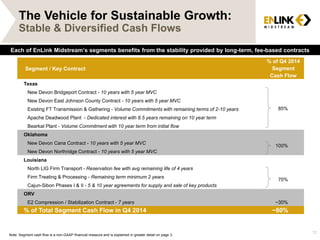

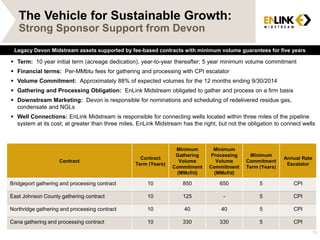

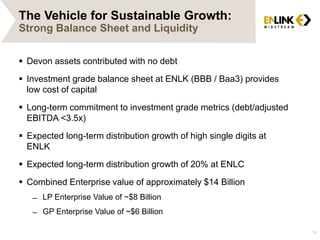

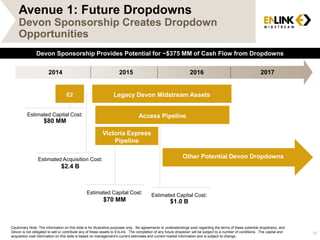

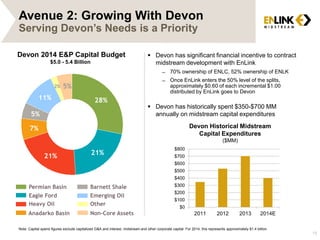

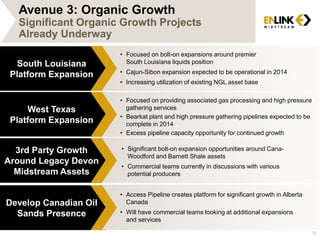

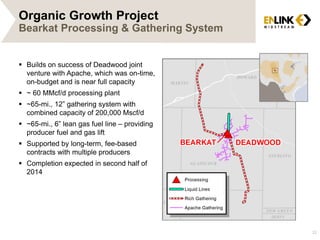

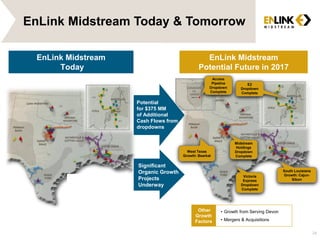

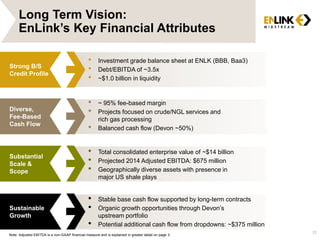

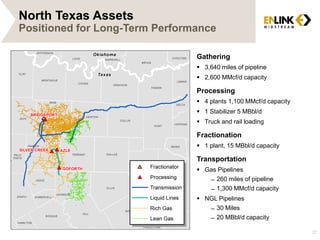

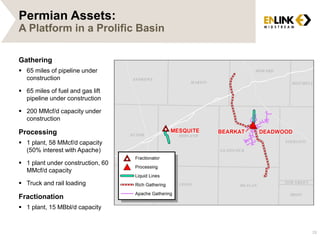

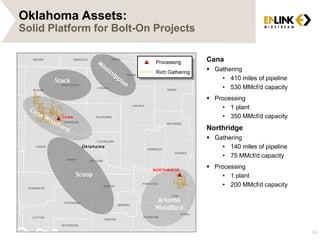

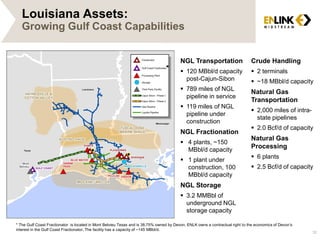

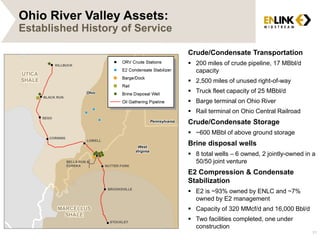

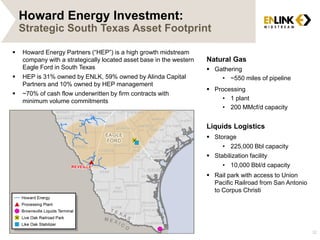

This document discusses EnLink Midstream's business and growth strategy. It begins with an introduction to EnLink Midstream, noting its scale, stable cash flows from long-term contracts, and investment-grade credit profile. It then outlines EnLink Midstream's strategically located assets and its management team's experience. The document discusses EnLink Midstream's focus on organic growth projects and potential dropdown opportunities from its sponsor Devon Energy, as well as pursuing acquisitions. It highlights several specific near-term expansion projects and regions for potential future growth.