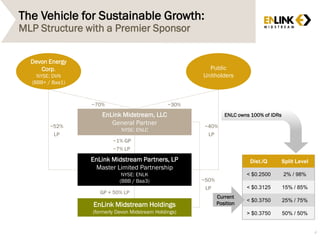

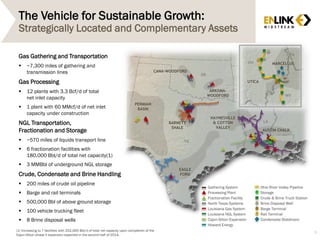

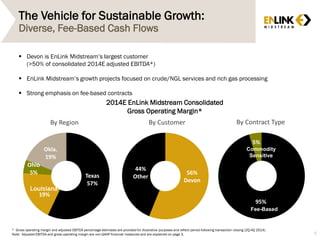

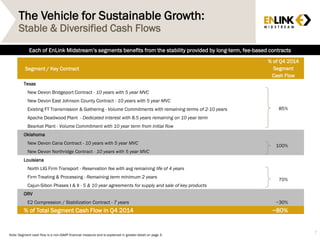

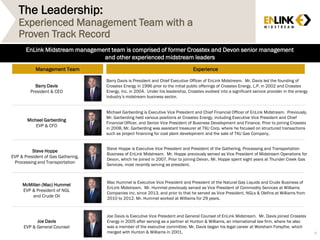

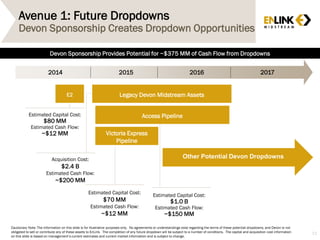

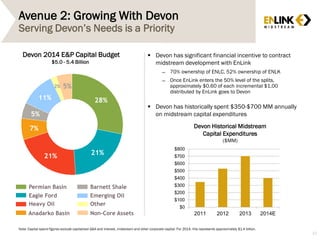

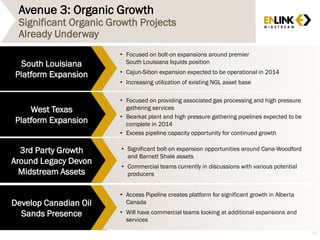

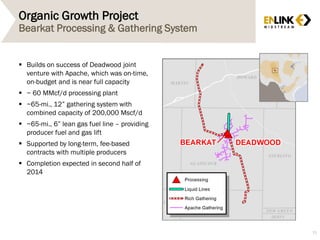

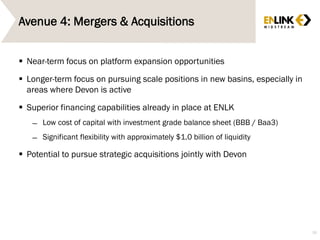

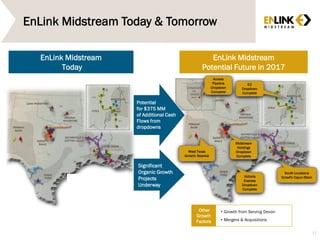

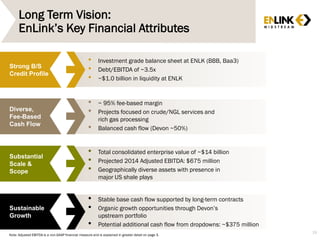

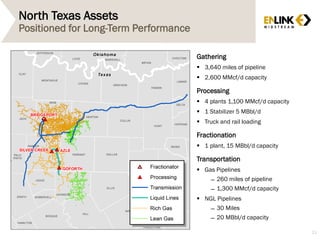

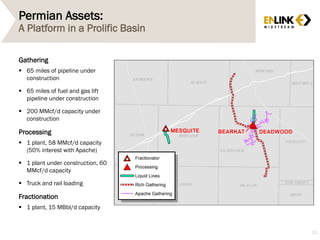

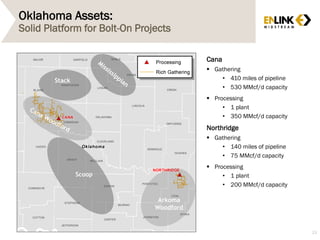

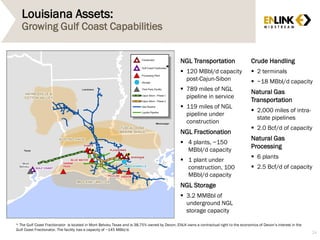

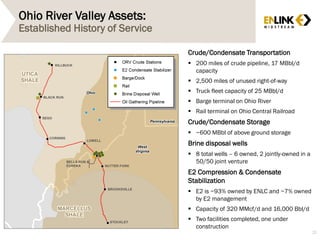

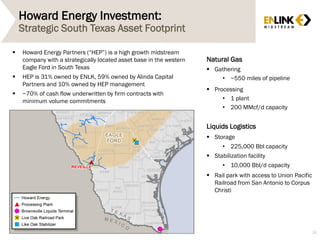

This presentation by Barry Davis, President and CEO of NAPTP, provides an overview of NAPTP and forward-looking statements. It discusses non-GAAP financial measures used by EnLink Midstream such as adjusted EBITDA, gross operating margin, and segment cash flows. It then summarizes EnLink Midstream's assets including gas gathering pipelines, processing plants, NGL transportation and fractionation facilities. Finally, it provides brief biographies of members of EnLink Midstream's management team.