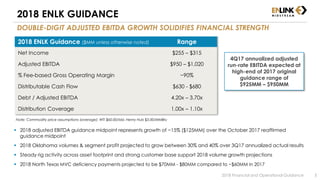

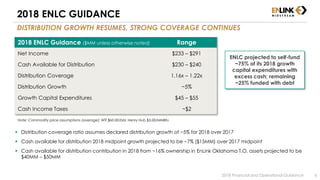

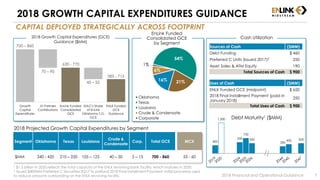

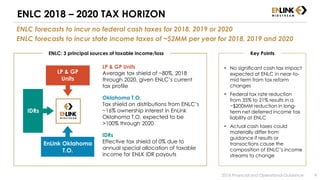

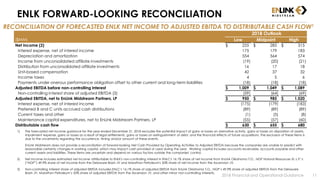

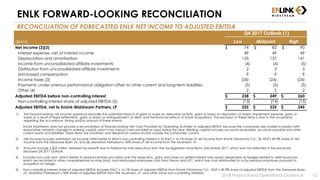

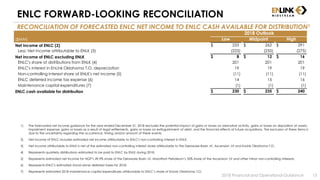

This document provides guidance for EnLink Midstream's 2018 financial and operational performance. It begins with forward-looking statements and risk factors that could impact projections. The guidance projects adjusted EBITDA, distributable cash flow, debt levels, distribution coverage, capital expenditures, and segment profit. Non-GAAP terms are defined, including adjusted EBITDA and distributable cash flow.