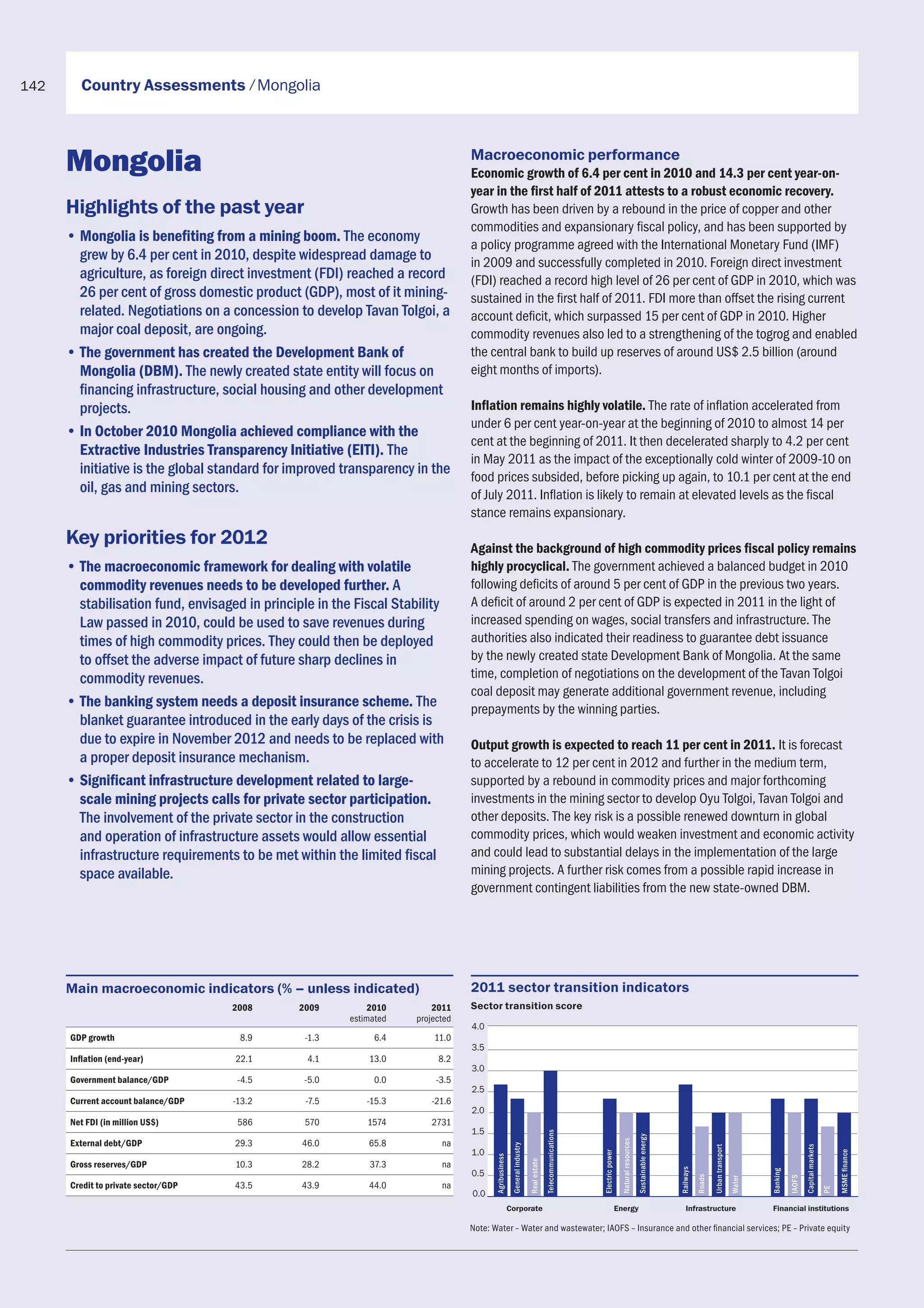

- Mongolia experienced strong economic growth of 6.4% in 2010 and growth is projected to reach 11% in 2011, driven by a mining boom and high commodity prices. Foreign direct investment reached a record 26% of GDP in 2010, mostly in mining.

- Inflation remains volatile and elevated, fluctuating between 4% and 14% in 2010-2011. Fiscal policy also remains procyclical and expansionary. The government achieved a balanced budget in 2010 but deficits are expected in 2011-2012.

- Key priorities include developing the macroeconomic framework to manage volatile commodity revenues, establishing a proper deposit insurance scheme to replace an expiring blanket guarantee, and encouraging private sector participation in mining-related infrastructure