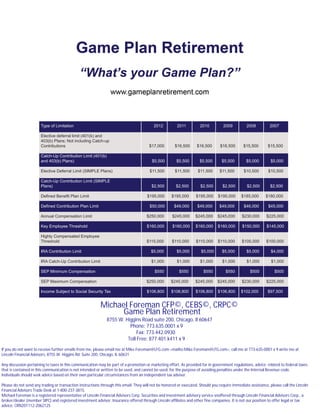

The document outlines contribution and compensation limits for various retirement plans from 2012 to 2007, including:

- 401(k) and 403(b) elective deferral limits ranging from $17,000 to $15,500 annually

- Catch-up contribution limits for 401(k), 403(b), and SIMPLE plans ranging from $5,500 to $2,500

- Defined benefit plan limit of $195,000, defined contribution plan limit ranging from $50,000 to $45,000

- Annual compensation limit ranging from $250,000 to $225,000 and key employee threshold ranging from $160,000 to $145,000

- IRA contribution limit of $5