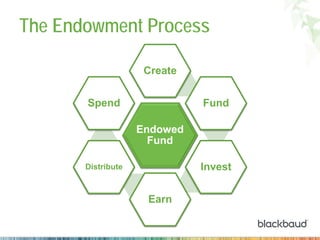

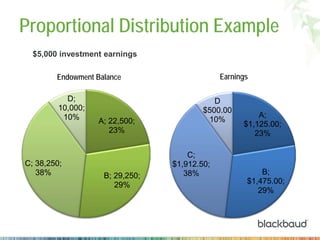

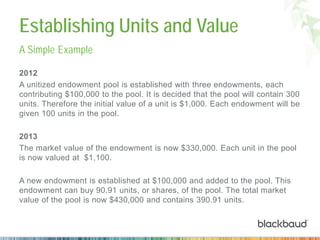

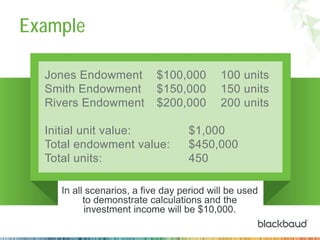

1) A unitized endowment pool allows multiple endowments to invest in the same pool of assets, with each endowment owning units in the pool. Units are valued monthly, so new endowments can purchase units based on the current value.

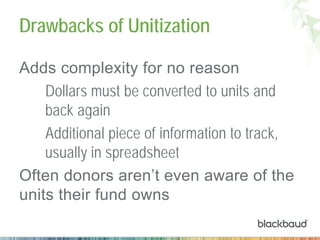

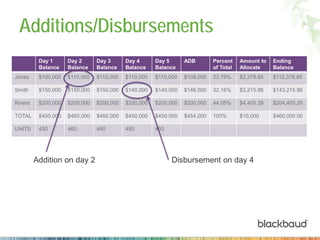

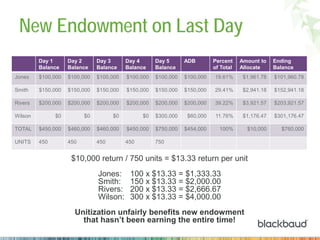

2) While unitization provides a simple way to distribute earnings proportionally, it becomes complex to manage when additions or disbursements occur, as the total units must be recalculated. New endowments purchasing units on the last day of the period may receive a disproportionate share of earnings.

3) Therefore, the document concludes that while unitization seems simple, managing the unit calculations for distributions, additions, and earnings allocation over time can